A year of firefighting for businesses

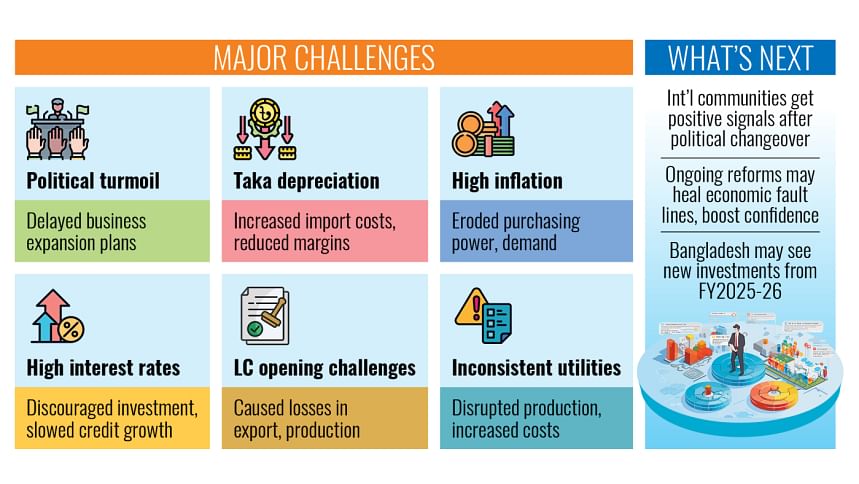

The year began with a national election, saw a mass uprising midway and subsequently progressed through a deteriorated law and order situation. These all had adverse implications for businesses.

Similar to previous occasions, the heated political atmosphere surrounding the national elections put business expansion plans on hold for months, both before and after the polls.

Then came the nationwide student-led protests in July, culminating in a fierce anti-government campaign, violence, army deployment, curfew and government ouster in early August.

The political changeover left a huge vacuum in law and order, exposing manufacturing lines to arson, vandalism and ransacking.

Apart from these challenges, the turbulent business climate throughout the year struggled with inconsistent gas and power supplies, red-hot inflation, a US dollar crisis in raw material imports and weakening of the local currency Taka.

Lately, labour unrest and high-interest rates on bank loans further complicated the business environment.

In 2024, there were also external shocks on the global supply chain, such as the prolonged Russia-Ukraine war, conflict in the Middle East and the Red Sea crisis. On the home front, multiple floods submerged vast swathes of the southern and north-eastern regions.

"If compared, the year 2024 was no less difficult than the coronavirus pandemic," said Ahsan Khan Chowdhury, chairman and chief executive officer of Pran-RFL Group.

Echoing similar sentiments, Zaved Akhtar, managing director of Unilever Bangladesh, said that 2024 has been a very difficult year for business communities.

The key cause for that was soaring prices of food and non-food essentials, according to Akhtar, who is also president of the Foreign Investors' Chamber of Commerce and Industry (FICCI).

STUBBORNLY HIGH INFLATION

Not only among the business communities, but also among the general public, stubbornly high inflation made it almost impossible to turn a corner without bumping into woes due to price pressures.

The inflation rate hovered around the double-digit mark all year round in 2024. It increased to 11.38 percent in November, registering its highest rise in four months.

Business communities translated the price pressures into eroded purchasing power of people and a severe blow to demand.

For instance, megapacks of fast-moving consumer goods (FMCG) took up less space on grocery shelves as many shoppers turned to mini-packs of food and toiletries instead.

This means consumers were losing ground in their protracted war against inflation.

Zaved Akhtar, managing director of Unilever Bangladesh, said their monthly FMCG sales declined 5 percent in recent months.

For the spiralling prices, Asif Ibrahim, former president of the Dhaka Chamber of Commerce and Industry (DCCI), blamed rising food prices and disruptions to the global commodity supply chain.

To tame the inflationary curve, the Bangladesh Bank continued its contractionary monetary policy, which, to some extent, was discouraging for fresh investment and business expansion.

THE FALLING TAKA

Throughout 2024, the local currency Taka continued to lose its value against the US dollar.

"The Taka depreciation increased the cost of imports and affected business margins," Ibrahim said.

He added that import-related credit activities were impacted by the nonperforming loan crisis and the general liquidity of the banking sector, which resulted in a drop in letters of credit (LCs) for the import of capital machinery and essential raw materials for industry.

Ibrahim said the private sector investment faced several economic challenges in 2024, with the low import of capital machinery reflecting slowed investment throughout the year.

According to official data, LC settlements for capital machinery imports declined 41 percent while LC openings for the same dropped 21 percent from July to October.

"The decrease in capital machinery imports clearly indicates that fresh investment will not arrive in the coming days," said Anwar-ul Alam Chowdhury Parvez, president of the Bangladesh Chamber of Industries.

LC OPENING HASSLE

Businessmen faced problems in opening LCs due to a shortage of US dollars even though the forex crunch had slightly improved compared to last year.

The challenge in opening LCs in 2024 has caused businesses to face considerable losses, said Pran-RFL Group Chairman Ahsan Khan Chowdhury.

"If investors cannot open LCs properly, it has a huge impact on exports and production levels," he added.

In such a situation, the attention of businessmen is impaired and production fails, which impacts exports and the economy, he said.

However, he said the government should not be blamed for this, rather businessmen also have a responsibility here as they can also supply the required US dollars using export earnings.

INCONSISTENT POWER, GAS SUPPLIES

Throughout 2024, production was severely affected by the gas and electricity crisis, said Muhammad Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA).

"We were only getting three to five PSI [pounds per square inch] of gas during the day whereas we needed 15 to 40 PSI," he added.

Hatem further said that the government's decision to increase gas prices from Tk 11.95 to Tk 31.50 per cubic metre led to higher production costs.

However, he noted that the recent political shift is encouraging and a significant conquest for the business community.

According to the business leader, the new chairman of the National Board of Revenue is showing positive approaches to improve the business climate.

LABOUR UNREST EXPOSED LAW AND ORDER VACUUM

Soon after the formation of the interim government, major industrial belts on Dhaka's outskirts heated up with agitating labourers.

They abandoned the production lines, took to the streets and chanted slogans for pay hikes and other benefits.

This impacted apparel exports and the pharmaceutical industry in particular.

According to Pran-RFL Group Chairman Chowdhury, about 10 percent of business and trade were lost in 2024 due to political instability and labour agitation.

Meanwhile, FICCI President Akhtar said improving law and order and energy security remain the biggest concerns in the immediate term for existing investors.

"Unless we have a full grip on the situation, existing investors will be jittery," Akhter said.

This issue needs to be addressed quickly as existing investors act as the country's ambassadors and have a strong impact on the confidence of incoming investors, he added.

According to central bank data, during the January-June period of 2024, Bangladesh received just $712.44 million in foreign direct investment compared to $728.63 million during the corresponding months of 2023.

Akhter also said investors are taking a wait-and-see approach before making investment decisions.

The footfall of foreign guests, a proxy of foreign investment and exports, also speaks of a topsy-turvy business climate in 2024.

Md Shakawath Hossain, chief executive officer of Unique Hotel and Resorts PLC, said the hotel business was dull throughout the outgoing year.

After sluggish booking for months, he said the presence of foreigners at their two luxury hotels slightly improved in October but saw a fresh downturn in November.

"Business recovery totally depends on the current political and economic situation in the country," Hossain said.

HIGH INTEREST RATES ELEVATED COST OF BUSINESS

Contractionary measures, like raising interest rates, were adopted to curb inflation, but the long-term project financing interest rate from banks rose to about 14 percent, which resulted in a slowdown in the growth of private sector credit, said former DCCI president Ibrahim.

According to him, the private sector credit growth rate had already dropped by 9.8 percent by mid-year.

Pran-RFL Group Chairman Chowdhury said that anyone wishing to invest in or conduct a business should bear in mind the high bank interest.

"I think we will get rid of the current difficult situation with time," he commented.

Ferdous Ara Begum, chief executive officer of Business Initiative Leading Development (BUILD), said high loan interest rates, a lack of established law and order and unclear guidelines have made investors hesitant and foreign investors have chosen to wait-and-see.

She said the government is also giving projects under the Annual Development Programme higher priority than others, and that some projects have been shelved. This indicates that there might be a wait for fresh investment until the budget for fiscal year 2025-26 is placed.

However, she said Bangladesh has been able to send a signal to the international world that the country has fought against oligarchies, and transparency and accountability will be the main thrust of the government.

"Several reform commissions and committees have been formed, and they are currently turning in their reports that expose the real facts, which can be viewed as encouraging," she added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments