‘Most difficult time in 34 years’

Consumer confidence in Bangladesh is at a low level, while investor confidence is negative both domestically and internationally, said a former president of the Metropolitan Chamber of Commerce and Industry (MCCI) yesterday.

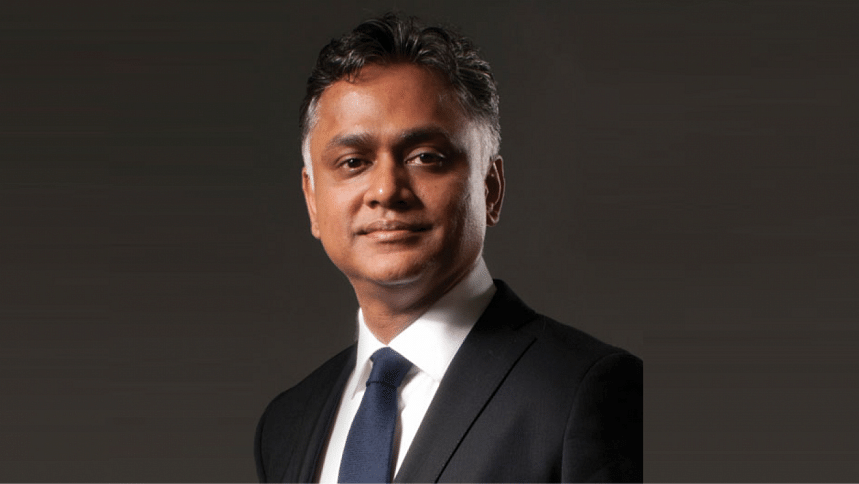

"The economy is under severe stress. I have been doing business for 34 years, and this is the most difficult year I have faced in my life in Bangladesh," said the former MCCI president, Syed Nasim Manzur.

He was addressing a symposium titled "White Paper and Thereafter: Economic Management, Reforms, and National Budget" at the Bangabandhu International Conference Centre (BICC).

The symposium was organised by a committee that prepared a white paper on the state of Bangladesh's economy in association with the Citizen's Platform for SDGs, Bangladesh.

"I have no other passport and no intention of going elsewhere, but our business is under stress. We feel a lack of confidence and support," said Manzur.

"We have a misconception that there is no other country apart from Bangladesh for investment. However, our foreign investors are telling us to consider investing in Indonesia due to the ease and cost of doing business there," he said.

He highlighted three key challenges—the increase in the minimum wage without a corresponding rise in productivity, the rising cost of energy, and the soaring cost of finance.

"If Bangladesh Bank keeps raising the interest rate to 25 percent to control inflation, businesses will shut down because they need affordable financing.

Without an optimal balance in these three areas, businesses will not survive," said Manzur.

He criticised the government for repeatedly increasing tax rates, as it is perceived as an easy way to raise revenue.

Some compliant businesses are paying higher taxes and interest to cover the gaps left by those who evade taxes and repay loans, he said.

He called for reforms to expand the tax net, emphasising the need for political will to consolidate all business promotion services under a single entity.

Consumers are under immense pressure due to high inflation, while investor confidence remains extremely low, said Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry.

The government was discussing ways to boost investor confidence, but then it suddenly raised VAT without any consultation, he said. "This provides very little confidence, and the credibility of the country is now in question," he said.

He warned that without the restoration of credibility, foreign direct investment (FDI) would not come.

"Why isn't the government expanding the tax net to increase revenue? Instead, it puts pressure on existing taxpayers while nearly half of government expenditures go toward overhead costs," said Akhtar.

"I pay taxes and request the government to provide a clear roadmap on how it plans to reduce overhead costs in the next budget," he said.

He questioned the government's commitment to tackling corruption, noting that corruption increases business costs. "The country is in a very different and difficult economic situation, so the same playbook won't work anymore," he said.

Michal Krejza, head of development cooperation of the European Union delegation to Bangladesh, stressed the need to strengthen the competition commission to ensure market functionality.

"The commission should play a vital role in investigations and its core activities," he said.

He also emphasised the importance of developing the capital market to attract foreign investments.

Regarding statistics, Krejza called for the Bangladesh Bureau of Statistics to operate independently of the Ministry of Planning to ensure timely, transparent, and accurate data publication.

Bangladesh's exports have grown tenfold over the past decade. To sustain this momentum post-LDC graduation, the country must improve labour protections, he said.

This includes aligning the Bangladesh Labour Act and the Export Processing Zones Act with international standards, he added.

Chowdhury Ashik Mahmud Bin Harun, chairman of the Bangladesh Investment Development Authority (BIDA), stated that the interim government plans to focus on developing five special economic zones instead of 100.

This would be done by ensuring essential resources such as gas, electricity, water, roads, and other infrastructure, he said.

Ashik noted that the government was working to merge all facilities and services under a single platform to streamline operations.

Kazi Iqbal, research director of the Bangladesh Institute of Development Studies (BIDS), suggested increasing the budget for technical and vocational training.

He also recommended streamlining skills development programmes across various ministries to avoid duplication.

Iqbal proposed allocating more funds for female hostels and daycare centres.

Prof. M Abu Eusuf, executive director of the Research and Policy Integration for Development, emphasised the need for clear directions and provisions in the upcoming budget for evidence-based mechanisms to impose taxes, VAT, or duties.

He recommended investments in launching automated compliance and enforcement systems, establishing a tax exemption review mechanism, and adopting advanced analytics and surveillance tools.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments