Economy slowing, negative revenue growth shows the sign

For Bangladesh, it is no longer the question of whether the economy is destined for a hard landing or a glide to a flat state; rather the question now is how deep the descent will be.

To fathom the crisis, let's take a look at the country's tax collection.

Roughly speaking, the collection turned negative in the first half of the current fiscal year (FY) 2024-25, which is a first since at least the pandemic era -- when markets shuttered, manufacturing units came to a grinding halt, supply chains collapsed, and life and livelihood endured unprecedented shockwaves.

But those days were long over.

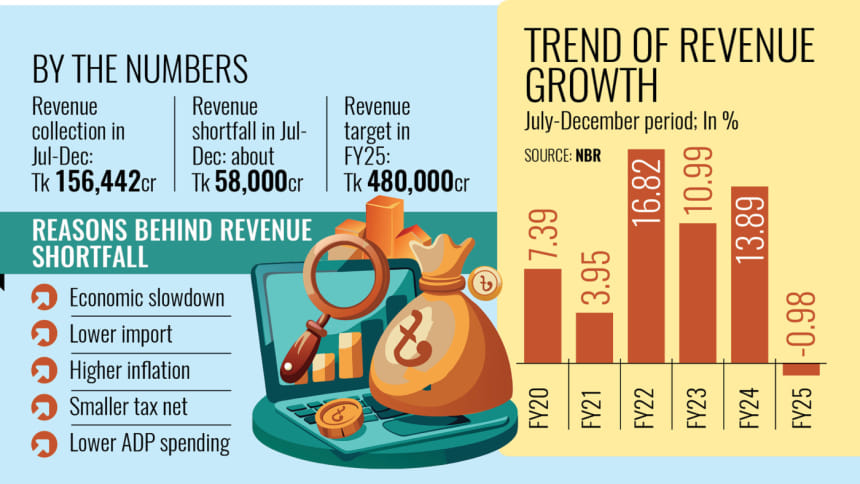

Yet, in the July-December period of FY25, taxmen collected Tk 156,442 crore -- 0.98 percent down year-on-year, according to National Board of Revenue (NBR) data.

This negative growth in revenue collection itself is not the disease, according to economists and businesspeople. Rather, it is a symptom of a slowing economy and growing cracks on the macro frontier.

In FY25, major macro indicators like the growth of the gross domestic product (GDP) tumbled, high inflation continued its rampage without showing signs of stopping anytime soon, the exchange rate remained volatile, and development spending hit a four-year low.

All these fairly indicate a single message: the economy is slowing down, it is hurting and will continue to do so due to a lot of factors, including revenue mobilisation, according to economists.

They said NBR's struggle to mobilise revenue and meet targets is nothing new, but these newly emerged economic cracks have added to the collection inefficiency.

In the last 13 years, the revenue board has been consistent in failing to meet its collection targets.

Despite a 6.66 percent collection growth in December, the revenue administration's collection still fell short of its target by Tk 58,000 crore or 25 percent in the first half of FY25, with its end goal set at Tk 480,000 crore for the year.

Taxmen and policy analysts point the finger at the political and economic shakeup stemming from the ouster of the Awami League government following a mass uprising on August 5 last year.

"The lower revenue growth is closely linked to the current economic slowdown, which also expedites the NBR's inefficiencies," said MA Razzaque, research director of the Policy Research Institute (PRI) of Bangladesh, a local think tank.

Prolonged inefficiencies, reduced imports, higher exemptions and inflationary pressure also contributed to the overall shortfall, the economist added.

The World Bank slashed its forecast for Bangladesh's economic growth by 1.7 percentage points to 4 percent for FY25 due to "significant uncertainties following recent political turmoil" and "data unavailability".

But Razzaque said the country's actual GDP growth this year could be lower than the World Bank projection.

The country's US dollar stocks have been depleting fast since 2022, prompting the authorities to tighten the belt and restrict imports.

As per the BPM-6 method by the International Monetary Fund (IMF), Bangladesh forex reserves now hover around $20 billion, according to the latest Bangladesh Bank data.

Furthermore, the country's total imports decreased from $90 billion in 2021 to $70 billion in 2023.

"So, the NBR is not going to get enough tariffs from imports," Razzaque added.

Besides, inflationary pressure is also hurting revenue growth as people have been slashing their consumption for a couple of years.

Echoing similar views, Anwar-ul Alam Chowdhury (Parvez), president of the Bangladesh Chamber of Industries (BCI), said lower imports contributed to lower revenue collection.

"The reduction of the overall import volume has contributed to the lower revenue growth and lack of business expansion," he said.

Besides, sluggish implementation of the development budget, officially known as the annual development programme (ADP), is another reason for the lacklustre revenue collection.

The NBR is not getting value-added tax (VAT) and supplementary duties (SDs) from construction works, according to the business leader.

"The projects automatically generate revenue for the NBR," he said.

The implementation of the Annual Development Programme (ADP) in the first six months of fiscal year 2024-25 was down 19 percent year-on-year.

Development spending in the July-December period amounted to Tk 50,002 crore, according to the Implementation Monitoring and Evaluation Division (IMED) under the planning ministry.

"There is an interrelation between the reduction of development spending and lower manufacturing growth," said Parvez.

For example, he said, if there is an ongoing project, there would be demand for construction items and services.

When government spending slows, it badly hits production, including cement, rod and brick manufacturing, causing lower revenue collection, explained Parvez, also a former president of the Bangladesh Garment Manufacturers and Exporters Association.

He also criticised NBR for failing to expand the tax net.

"We don't see any major progress in expanding the tax net. Rather, the NBR is burdening existing taxpayers," he said.

Seeking anonymity, an NBR official acknowledged that the negative collection growth occurred due to the economic slowdown.

"We are facing hurdles in collecting revenue amid the government's lower public spending, higher inflation and slow private sector credit growth," the official said.

Prof Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), suggested exploring more diversified sectors for revenue generation, properly implementing the wealth tax, and expanding the tax net.

"The NBR should not take any ad-hoc decisions for tax hikes without consultation stakeholders," he said, referring to the revenue board's recent withdrawal of hiked VAT and SD on nine goods and services.

"It should be well researched and meticulously planned," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments