Tk 2.26 lakh crore lost to tax evasion in FY23

Bangladesh lost an estimated Tk 226,236 crore in potential revenue to tax evasion and avoidance in the 2022-23 fiscal year, largely due to rampant corruption and a weak but complex system, according to a study by the Centre for Policy Dialogue (CPD).

The sum, if recovered, could fund the construction of about seven metro rail lines, each costing as much as the revised budget for Metro Rail Line-6 from Uttara to Kamalapur, which now stands at Tk 33,472 crore.

"Had the NBR managed to plug the Tk 2.26 lakh crore lost annually to tax evasion, it could have come significantly closer to meeting its revenue targets," CPD Research Director Khondaker Golam Moazzem said at the unveiling of the report at its Dhaka office yesterday.

"We've been talking about digitalisation for years, but what's missing is the will to act, both from the tax administration and the business community," he added.

Corporate tax evasion alone accounted for roughly half of the total loss -- about Tk 113,118 crore -- according to the study, which reveals a concerning trend of rising tax evasion since 2011. The estimated loss was Tk 96,503 crore in 2012 and surged to Tk 133,673 crore by 2015.

CPD, in partnership with Christian Aid in Bangladesh, unveiled the findings of the study at a media briefing session titled "Corporate Income Tax Reform for Graduating Bangladesh: The Justice Perspective".

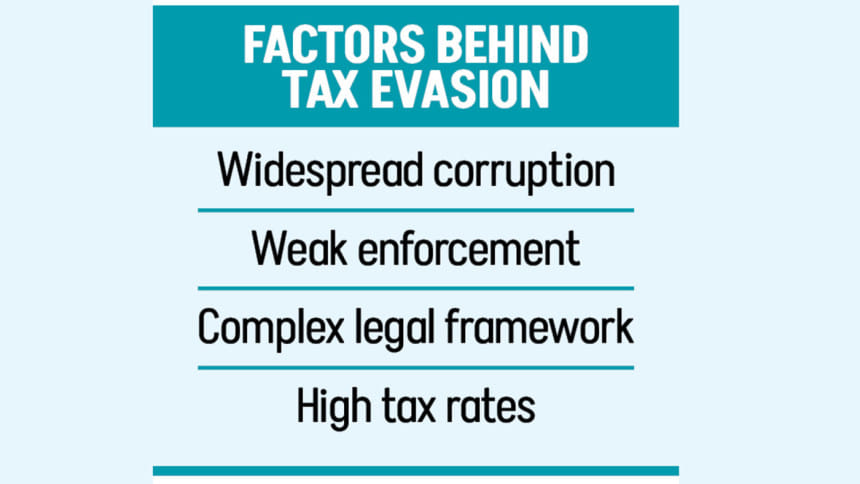

Alongside corruption, the CPD identified a host of structural issues fuelling tax evasion, including high tax rates, weak enforcement, and a labyrinthine legal framework that complicates compliance.

"From a tax justice perspective, high levels of tax evasion undermine compliance by discouraging honest taxpayers and increasing the burden on those who follow the law," the CPD said in the report.

Speaking to The Daily Star following the event, Moazzem pointed to the NBR's regulatory failure and flawed financial reporting as key enablers of rampant tax evasion.

"Digital integration of financial transactions across the country is no longer a choice—it's a necessity," he said. "We need a unified system that ensures every transaction is traceable and verifiable."

To tackle these challenges in the period after Bangladesh's expected graduation from the Least Developed Country bracket, the CPD recommended a multi-pronged approach: strengthening institutions, upgrading digital infrastructure, and bringing comprehensive reforms to tax policy.

It also stressed the importance of aligning with global tax agreements and fostering cooperation with other countries to ensure a fair and transparent tax regime.

Additionally, it called for a gradual reform of the corporate income tax (CIT) structure to ensure that the statutory rate for both export-oriented and non-export sectors does not fall below 15 percent—bringing Bangladesh in line with the global minimum tax commitment.

As part of this effort, the CPD proposed raising the current CIT rate for export-oriented industries, including the ready-made garment (RMG) sector, from 12 percent to 15 percent.

45% FIRMS REPORT BRIBERY

Nearly half of the firms surveyed in the study alleged that they were asked for bribes by officials while seeking tax-related services in FY23. The think tank said it surveyed 103 publicly listed firms in Dhaka and Chattogram.

It indicates a lack of transparency and corruption within the tax administration, said Tamim Ahmed, senior research associate at the CPD.

In addition, 40 percent of the surveyed companies reported facing problems while adjusting their tax refunds.

The study said 82 percent of the firms that took part in the survey believed the current tax rates imposed on them were unfair. They identified it as one of their major challenges in paying taxes.

A lack of accountability among tax officials, widespread corruption, and the absence of a fully digital tax submission system were flagged as other key concerns.

For example, 79 percent of the surveyed firms said there was a lack of accountability among tax officials. And 72 percent blamed widespread corruption in the tax administration. In addition, 65 percent of the businesses reported persistent disputes with tax officials over the calculation of their payable tax amounts.

Such practices create an intangible burden that often outweighs the tax itself, making the overall tax environment unfair, Tamim said, citing businesses.

He added that there is also a prevailing sense of distrust among the surveyed businesses regarding whether the taxes they pay will be utilised in ways that benefit them.

INCENTIVE, EXPENDITURE

At the briefing, Moazzem criticised the existing tax expenditure and incentives policies.

Investment should never be driven by blanket tax incentives, which are meant for targeted support—not for subsidising profit-making businesses or politically linked firms, he said.

"Bangladesh's tax incentive structure is deeply entangled with political interests. It's time to break away from this and introduce merit-based, time-bound incentives.

"Each year, over Tk 71,000 crore is spent on tax expenditures in the corporate sector. But where's the accountability? Who benefits, and at what cost to our health, education, and social protection sectors?" he asked.

Bangladesh cannot afford to graduate from the LDC status with such a weak tax base, Moazzem said. "The post-graduation reality will demand much more than we are currently prepared to deliver."

LOW TAX-GDP RATIO

To strengthen fiscal capacity and ensure economic resilience after its graduation from the LDC bracket, Bangladesh should target a tax-to-GDP ratio of at least 15 percent, the CPD recommended.

It noted that all countries that transitioned out of LDC status, except for Equatorial Guinea, maintained considerably higher tax-to-GDP ratios—ranging from 15 to 23 percent—far above Bangladesh's current level, which remains below 10 percent.

To close this gap, the NBR must significantly expand its corporate tax net, the CPD said, urging it to raise the proportion of tax-paying firms to at least 59 percent of registered companies—up from the current estimate of just 9 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments