Banks see sluggish deposit growth as high inflation weighs on savers

Banks have registered sluggish growth in deposits throughout the current fiscal year as elevated inflation and an economic slowdown have squeezed the scope for many to save, even though the interest rate has risen.

Also, a falling appetite for loans from the private sector, political uncertainties, and affluent people switching to investing in treasury bills and bonds have further diminished deposit growth, said several bankers.

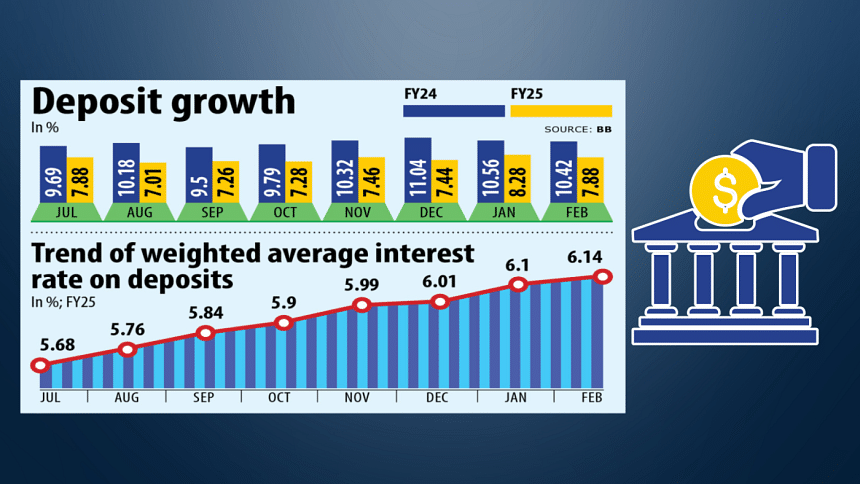

Banks recorded Tk 17.93 lakh crore in deposits at the end of February, which was 7.88 percent higher year-on-year.

On the other hand, the weighted average interest rate on deposits rose to 6.14 percent in February, over 1 percentage point higher than that a year ago, according to data by Bangladesh Bank (BB).

However, the overall growth of deposits in banks was lower in this year's February than the 10.42 percent year-on-year growth in the same month in 2024.

The average growth of deposits in banks was 7.68 percent in eight months of this fiscal year of 2024-25, from 10.28 percent a year ago.

"Because of high inflation, people have to spend more to buy the same amount of goods. This has strained the savings capacity of many people," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank (MTB) PLC.

Official data released this week showed that consumer price inflation eased to 9.17 percent in April, down from 9.35 percent in March, but remained above the 9 percent mark.

Bangladesh has been grappling with inflation above 9 percent for more than two years consecutively, severely eroding people's purchasing power at a time when the economy is suffering from a slowdown for the second consecutive year.

The economy recorded a 4.22 percent expansion in fiscal year 2023-24, the lowest since the pandemic.

By the end of last month, the World Bank trimmed its projection for Bangladesh's economy further to 3.3 percent for the current fiscal year, which will be the lowest in the last couple of decades.

"The overall economy has slowed down. Imports of capital machinery have fallen due to a lack of investment demand," said Rahman.

Besides, a significant amount of funds has been shifted to investment in treasury bills and bonds to benefit from increased yields. Many people have also bought US dollars to profit from the depreciation of the taka, he said.

A senior official of BRAC Bank said the contractionary monetary policy maintained by the BB could be another reason for sluggish deposit growth.

A chief of the treasury at another private bank said banks record a good flow of deposits when there is demand for credit in the economy.

"But we see very low appetite for loans," he said, adding that private credit growth stood at 6.82 percent year-on-year in February.

"It is the lowest in 18 years…The deposit growth that you see is because of the payment of salaries and the disbursement of some credit to private borrowers," he said.

He said that because of low demand for credit, most banks were investing in treasury bills and bonds.

"Businesses that were connected with the previous Awami League government are not as active now as they were in the past. Interest among the private sector to invest is low because of political uncertainty," said the official.

"It appears that businesses will gain direction after the declaration of the election schedule, and demand will pick up," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments