Tax authority split in major overhaul

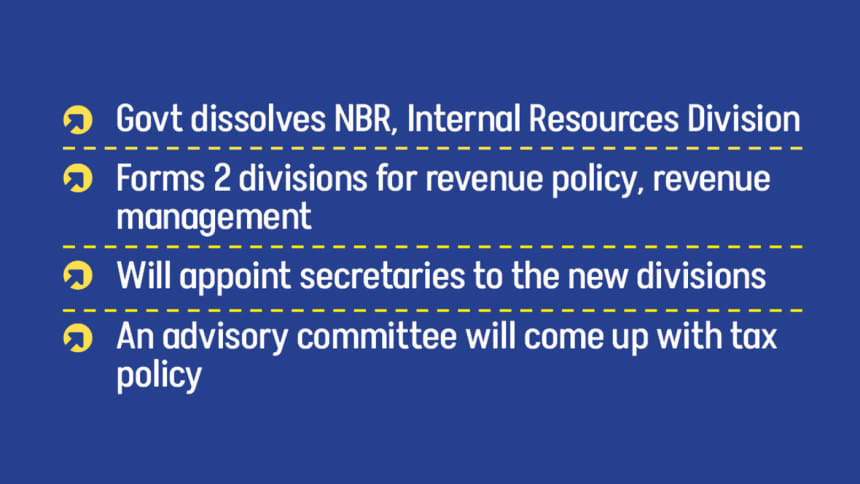

The interim government has replaced the five-decade-old tax authority with two new entities as part of sweeping reforms aimed at modernising tax administration and boosting revenue receipts.

The newly established Revenue Policy Division will be responsible for designing tax laws, setting rates, and managing international tax treaties while the Revenue Management Division will oversee enforcement, audits, and compliance for income tax, VAT and customs.

The restructuring, enacted through an ordinance late Monday, dissolved the Internal Resources Division and the National Board of Revenue (NBR), an agency established in 1972 to mobilise revenue for the newly independent nation. The new ordinance will take effect upon the issuance of a separate circular.

The move is widely seen as a response to long-standing calls from multilateral lenders and domestic experts to raise Bangladesh's chronically low tax base.

The reform is tied to a condition under a $4.7 billion loan programme from the International Monetary Fund, which requires the separation of tax policy and administration, an international best practice aimed at reducing conflicts of interest and improving governance.

Officials said the overhaul is critical as the country confronts mounting fiscal pressures, including a decline in foreign exchange reserves. The interim administration, led by Nobel laureate Muhammad Yunus, has framed the change as part of a broader effort to strengthen public finance and institutional efficiency.

"The NBR has consistently failed to meet its revenue targets," the Chief Adviser's Office said in a statement yesterday, adding that Bangladesh's tax-to-GDP ratio is approximately 7.4 percent, one of the lowest in Asia.

For context, the global average stands at 16.6 percent.

"To achieve the development aspirations of its people," Bangladesh must raise its tax-to-GDP ratio to at least 10 percent, according to the statement.

"Restructuring the NBR is critical to this goal. There is growing consensus that a single institution should not be responsible for both creating tax policy and enforcing it -- such an arrangement breeds conflicts of interest and promotes inefficiencies," the Chief Adviser's Office added.

However, the move has been met with strong resistance from within the tax bureaucracy. NBR officers and staff demonstrated in front of the agency's headquarters yesterday, demanding the repeal of the ordinance. Under the banner of the NBR Reform Unity Council, they also announced a three-day pen-down strike beginning today, though they pledged to exempt international passenger services, export operations, and budget-related activities.

Critics within the Customs and Income Tax cadres argue that the ordinance sidelines experienced tax professionals, transferring policy-making powers to officials from the general administration cadre. They claim the final ordinance includes only a minor revision from the draft version, slightly narrowing the policy division's scope.

They also argue that the Revenue Policy Division will oversee enforcement of tax laws and evaluate collection performance -- a provision that blurs the intended separation between policy and implementation.

Farid Uddin, member of a five-member advisory committee formed to make the reforms, criticised the ordinance for disregarding the committee's recommendations.

"This is an arbitrary move by the government. Although the NBR is a specialised institution, it has been led by officers from other cadres for over four decades. If their leadership had been truly effective, would the NBR be in such a crisis today?

"We keep talking about raising the tax-to-GDP ratio from 8–9 percent to 16 percent. But if that's the goal, why weren't the necessary reforms implemented over the past 40 years to get there?

"Although the government is separating policy and administrative functions, both divisions will continue to be led by the same group. So what has really changed? What difference will this make?" he questioned.

Not all tax professionals are critical of the reform. Mutasim Billah Faruqui, president of the BCS Taxation Association, welcomed the move. "We raised several concerns after receiving the draft ordinance, most of which have been addressed," he said. "There is still a tremendous amount of work ahead, but I believe this will help strengthen the professional standing and career prospects of tax cadre officers."

Kazi Mostafizur Rahman, president of the BCS Customs Association, declined requests for comment.

Finance Adviser Salehuddin Ahmed dismissed fears that the dissolution of the NBR would disrupt revenue collection. "Revenue collection rose 2 percent year-on-year in fiscal 2024–25," he told reporters yesterday. "A small division will be formed to frame tax policy. Officials' interests have been safeguarded."

Ahmed said consolidating both policy and execution under a single agency creates a conflict of interest. "Internationally, the two functions remain separate," he said. "Framing the policy requires people who understand the economy, statistics and GDP."

The decision comes amid long-standing complaints from the business community that tax policy in Bangladesh often prioritises revenue targets over fairness, growth, and long-term planning.

Economist Selim Raihan, executive director of the South Asian Network on Economic Modeling, also endorses the move. "This structure reflects international best practices. It could better align the revenue system with evolving economic realities," he said.

However, he warned that structural change alone would not be enough. "Corruption must be tackled. Rules must be clear and enforcement must be strict. Without modernising tax laws, the appeals process, and judicial framework, no structure -- however well-designed -- will work."

Raihan called for the formation of a committee comprising both the reform architects and experienced tax officials to resolve grievances. "This resistance is not new. Tax reform in Bangladesh has historically faced internal opposition. But constructive dialogue is the only way forward," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments