No immediate tax relief despite inflation woes

There will be no tax relief for individuals in low- and middle-income brackets, at least in the next fiscal year, even though high inflation has significantly eroded their purchasing power over the last couple of years.

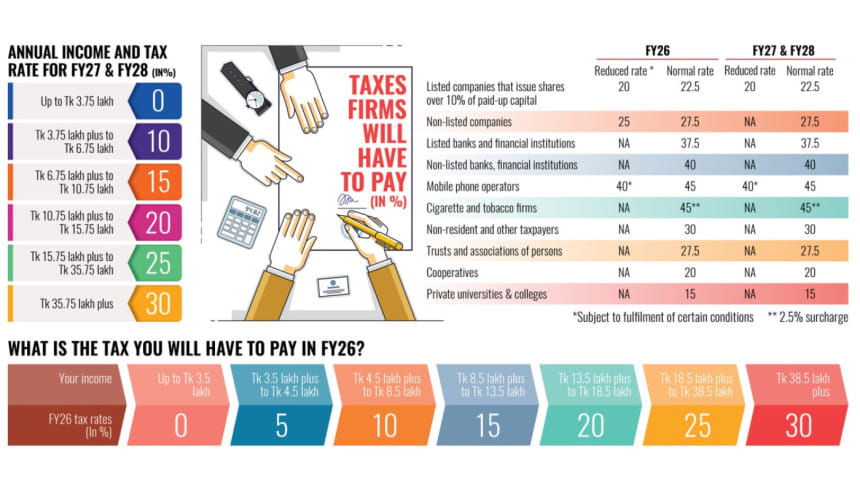

Tax rates on income will remain the same as in fiscal 2024-25. The tax-free income ceiling has not been raised, meaning every individual earning above Tk 350,000 must pay income tax.

And the overall tax bill will rise further if VAT, an indirect tax paid by consumers, is taken into account. From plastic tableware to kitchen items to home appliances, taxpayers will have to pay more VAT amid high inflation that now hovers around 9 percent.

It'll cost more to build homes or buy refrigerators and locally made mobile phones, or do online shopping, leaving little breathing space for taxpayers.

However, they will get some respite from tax burden in fiscal 2026-27 when the tax-free threshold will go up to Tk 375,000, according to the budget proposal.

Besides, a first-time taxpayer may benefit from the minimum tax of Tk 1,000, instead of Tk 5,000, in FY27 given the taxable annual income is between Tk 375,000 and Tk 675,000.

Many taxpayers have voiced frustration that they'll have to wait for more than a year to get the much-needed relief from tax burden.

Mahmudul Hasan Suman, who works at a private organisation in the capital, said, "We are grappling with the rising prices of commodities. If we could get this tax-free benefit right now, it would have provided us with some sort of cushion."

Tax rates on income will remain the same as fiscal 2024-25. The tax-free income ceiling has not been raised, meaning every individual earning above Tk 350,000 must pay income tax.

Seeking anonymity, a government official based in Satkhira, said, "As a government employee with a fixed income, I'm already feeling the pinch of soaring inflation. It's disappointing that the raise in the tax-free income limit will not come into effect until fiscal 2026-27."

Towfiqul Islam Khan, a senior research fellow at the Centre for Policy Dialogue (CPD), said the raise starting from fiscal 2026-27 is unlikely to benefit taxpayers who need some relief now. There were no explanations about it in the budget proposal.

Snehasish Barua, managing director of SMAC Advisory Services, said that instead of cracking down on tax evaders, the proposed Finance Ordinance 2025 unfairly burdens compliant taxpayers with steep taxes amid high inflation.

But there is good news as well.

The rules on mandatory submission of proof of tax return will be eased from fiscal 2025-26. Taxpayers will not need to show the proof for getting 33 services, including purchase of savings certificates worth above Tk 5 lakh. Only a copy of the Taxpayer Identification Number (TIN) certificate will be needed for getting 12 services.

However, the plan to phase out exemptions and tax benefits enjoyed by the various sectors will cause worries to many businesses.

Another matter of concern for them is the proposal for hiking corporate tax rate for non-listed companies to 27.5 percent from the existing 25 percent.

At present, non-listed firms are eligible for a reduced rate of 25 percent if they meet two conditions: they must use banking channels for receiving all their income and also for every expenditure above Tk 5 lakh. Otherwise, the rate is 27.5 percent.

From the next fiscal year, these conditions will no longer apply, and the flat rate of 27.5 percent will be applicable to all non-listed firms.

The corporate tax rate for merchant banks will be reduced to 27.5 percent from 37.5 percent. However, corporate tax rates for other entities, including mobile operators, cigarette companies, and private universities, will remain unchanged.

The income tax rate for those in the highest income bracket is likely to be reverted to 30 percent in fiscal 2025-26 as part of the government's prospective tax plan.

IMPACT OF INDIRECT TAX

The new budgetary measures will affect households directly as the National Board of Revenue collects nearly 65 percent of the revenue from indirect taxes like VAT.

For example, though plastic items have become an integral part of households, the government has doubled the VAT rate on plastic tableware, kitchenware, and also hygiene products and toiletries to 15 percent from 7.5 percent.

Besides, a 10 percent supplementary duty has been imposed on over-the-top (OTT) platform services for fiscal 2025-26, increasing costs at the users' end.

The move comes as the popularity of OTT platforms is growing, driven by increased smartphone penetration, availability of internet, and rising demand for localised contents.

On the other hand, source tax on broadband services will be reduced to 5 percent from 10 percent.

There will also be VAT exemptions on environment-friendly items such as plates and cutlery made of clay, and plant-based materials with biodegradable components.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments