Smaller in size, larger in intent

Finance Adviser Salehuddin Ahmed has offered both empathy and arithmetic in his budget speech, laying out a vision that puts people, not just projects, at the heart of economic policy.

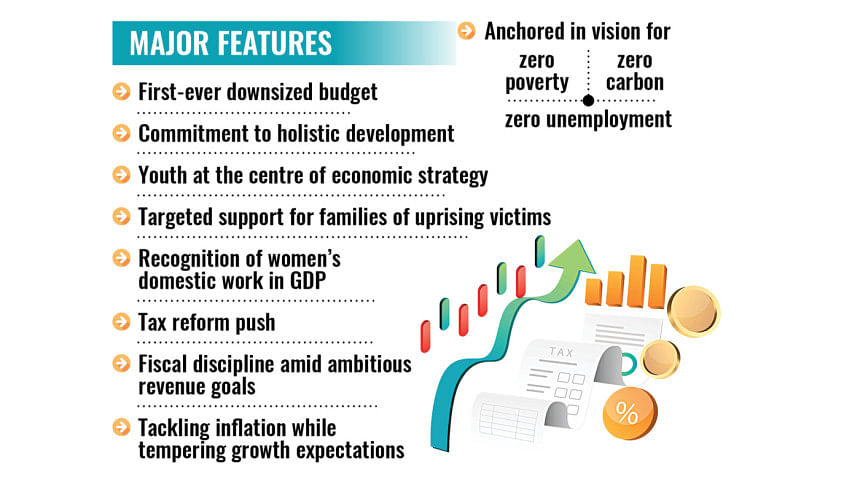

The first budget from the interim government is smaller in size but larger in intent. It's a symbolic break from bloated spending and inflated promises. Gone is the language of sky-high growth. In its place, Ahmed pushed for what he called "holistic development".

He spoke of the families of the July Mass Uprising -- of the martyrs, the injured, and those left behind. He described mothers unable to afford protein, farmers stranded by flash floods, and migrant workers searching for dignity abroad. He acknowledged the invisible labour of women whose unpaid work sustains households but goes uncounted in the national economy. The adviser also looked ahead, highlighting telemedicine, tech-adapted teaching, and a banking system on the mend.

In a clear shift from the past, the FY26 budget prioritises people over infrastructure. "Instead of highlighting the traditional physical infrastructure development, we have given priority to the people," he said. Ahmed underscored the importance of safeguarding fundamental rights and ensuring access to a dignified life. Without these, he warned, "any state becomes ineffective, and the foundation of a society is weakened."

The budget reflects a broader national ambition: to build a society free from poverty and unemployment, and committed to a zero-carbon future -- an echo of Chief Adviser Muhammad Yunus's "three-zero" vision.

The government has placed youth almost at the centre of its economic vision, rolling out initiatives focused on skills training and entrepreneurship. The finance adviser said the aim is to harness the energy and potential of young people to build a more self-reliant workforce. However, analysts argue that the budgetary allocations fall short of what's needed to meaningfully address the scale of youth unemployment.

Empathy for a wider society shapes the budget's tone, but beneath it lies a sober economic reality. In a year clouded by inflation fatigue, fragile policymaking, and the structural hangover of the past disgraced regime, Ahmed presented a budget grounded in restraint. And the people-first framing masks the harder constraints underpinning the budget: ballooning debt.

GDP growth is projected at 3.97 percent this fiscal year. While growth may pick up to 6.5 percent in the medium term ahead, the adviser warned that inflation, driven by the Russia-Ukraine war, remains tough to control. Still, tighter policies have brought it down to 9.05 percent in May from a peak of 11.66 percent last July.

FISCAL DISCIPLINE

The budget balances social spending with bold tax reforms, but its success depends on improbable revenue gains, a gamble that could backfire amid global economic headwinds.

The most significant structural reform comes from the elimination of corporate tax exemptions, a clear departure from the previous government's tendency to perpetually extend such benefits. This move, coupled with sweeping reductions in import duties across hundreds of items, suggests a genuine effort to broaden the tax base and improve competitiveness.

The success of these measures depends on two precarious assumptions: first, that removing exemptions will not trigger backlash from the business community; and second, that customs revenue losses will be offset by increased compliance. Historical precedent is not encouraging; the tax-to-GDP ratio has stagnated around 8 percent for years, well below regional peers.

The tax measures could lay the groundwork for a more rational system, but only if future governments resist pressure to reintroduce exemptions.

With the National Board of Revenue collecting just Tk 362,000 crore last fiscal year, the new target of Tk 499,000 crore for the upcoming year seems overly ambitious. So far, the NBR has raised only Tk 289,000 crore in the first 10 months of the current fiscal year.

The fundamental tension lies in how expenditures will be funded. With the budget deficit projected at 3.6 percent of GDP and likely to expand if revenue falls short, Bangladesh risks either compromising its development spending or accumulating more expensive debt. The lack of concrete plans to improve tax administration efficiency suggests the government may be relying on domestic borrowing, which could crowd out private investment and push interest rates higher.

Ultimately, Bangladesh's economic trajectory will depend less on budget proposals than on whether it can break its chronic cycle of weak revenue mobilisation and stopgap financing. Without deeper reforms in tax administration and public expenditure management, even the most well-intentioned fiscal plans will remain aspirational.

The adviser insisted that measures are already in motion to expand the tax base, phase out exemptions, and modernise revenue systems.

One of the more contentious elements of the budget is the decision to impose an additional 7.5 percent tax on publicly traded companies that have issued less than 10 percent of their shares through a public offer. Critics argue the move is not only punitive but also discriminatory, especially in a market already struggling with low investor confidence.

Equally counterintuitive is the withdrawal of the reduced tax rate previously granted to companies conducting transactions through formal banking channels. At a time when the government is promoting financial transparency and digital payments, this measure undermines efforts to build a cashless economy.

Salaried taxpayers, too, are feeling the squeeze. While the hike in the tax-free threshold at the entry level offers some relief, the broader restructuring of tax slabs may ultimately place a greater burden on the middle class. That runs counter to the concept of equity and erodes disposable income in an already inflationary environment.

DEMOCRATIC TRANSITION

Macroeconomic stability was one pillar of the budget, and the other was democratic transition.

In one of the most politically resonant moments of his speech, Ahmed underscored the interim government's commitment to restoring electoral integrity. "One of our goals is to reestablish people's voting rights through a free and fair election and to hand over power to a democratic government," he said, adding that the country's electoral system had been "completely tampered with" over the past decade and a half.

The timing of the message was significant: the budget was unveiled on the same day Chief Adviser Muhammad Yunus resumed dialogue with political parties.

Ahmed said electoral reform had been given the "highest priority." The voter list has been updated, and new technology is being deployed to bolster transparency.

Ahmed's speech reflected a careful balancing act between calls for equity and stabilisation. This is a budget that tries to do more with less and do it differently. Whether it can deliver, amid bureaucratic bottlenecks, shaky institutions, and electoral uncertainty, will depend less on what is written in budget documents and more on what the government can implement in the months leading up to the national election.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments