Distressed asset law in the making to tackle NPLs

The interim government is formulating a distressed asset management ordinance that could pave the way for a state-owned corporation to buy and trade troubled assets from banks and non-bank financial institutions (NBFIs).

The initiative comes as non-performing loans (NPLs) continue to weaken the stability of the financial sector.

Officials at the Ministry of Finance said they began work on the ordinance in October last year, with completion likely by June 2026.

The Financial Institutions Division (FID) has already prepared a draft, which is now with Bangladesh Bank (BB) for revision, top officials confirmed to The Daily Star.

Under the proposed act, private firms may also be allowed to set up asset management companies to trade distressed assets.

Distressed or troubled assets include loans or properties unlikely to be repaid in full, prompting banks or NBFIs to sell them at a discount to recover part of the money.

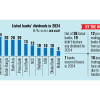

At the end of March this year, bad loans in the country's banking sector hit a record Tk 420,335 crore, accounting for 24.13 percent of total disbursed loans, according to Bangladesh Bank (BB) data.

However, officials estimate that total distressed assets, covering bad loans, defaulted loans, rescheduled loans, written-off loans and loans stuck in court, could be more than Tk 700,000 crore.

Apart from the banking sector, defaulted loans stood at Tk 25,089 crore at 35 non-bank financial institutions at the end of December last year, or 33.25 percent of their disbursed loans.

The idea of making a legal framework for troubled asset management is not new.

Rather, the idea dates back to the previous Awami League government, which in 2020 floated a plan to set up a state-run corporation to help banks clean up bad loans.

The FID drafted the Bangladesh Asset Management Corporation Act-2020 that year.

However, the plan was shelved following criticism, including from the International Monetary Fund (IMF), over the use of taxpayer funds and concerns about the poor performance of state enterprises.

Following the political changeover in August last year, distressed assets surged as the true state of the financial sector came to light.

The issue of troubled asset management came up at a recent government meeting on reform progress.

Central bank officials said they are working on the draft and will soon send it back to the finance ministry. A World Bank team is also offering advice on it.

As of March this year, defaulted loans at state-owned banks stood at Tk 146,407 crore, or 46 percent of their disbursed loans.

At private banks, the figure was Tk 264,195 crore, or 20.16 percent. Foreign banks reported Tk 3,239 crore in bad loans, 4.83 percent of their total, while defaulted loans at specialised banks reached Tk 6,494 crore, or 14.47 percent.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development and former chief economist at the Bangladesh Bank, said, "The interim government should take strict action to arrest the high amount of bad loans."

He added that while the government has announced many reform plans for the financial sector, progress so far has been disappointing.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments