No cut in corporate tax for non-listed firms

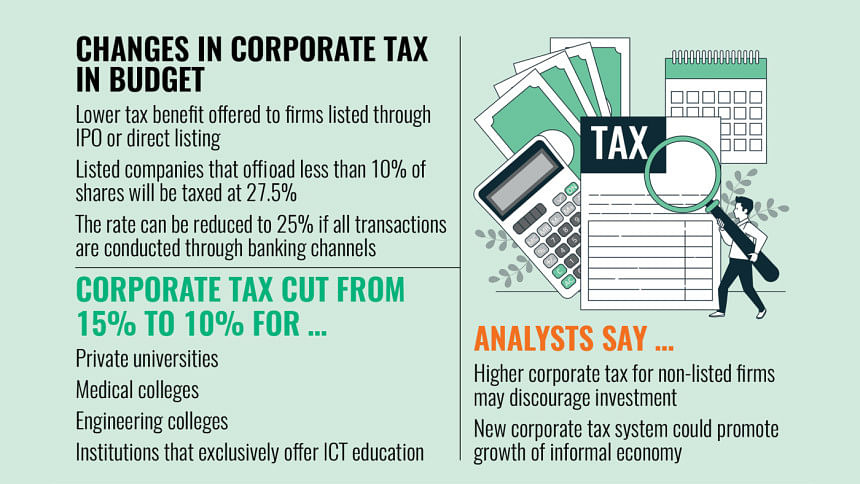

The interim government has kept the corporate tax rate for non-listed firms unchanged at 27.5 percent for fiscal year 2025-26, despite repeated demands from entrepreneurs and business chambers to reduce the tax, especially for those transacting through banking channels.

Currently, non-listed companies are taxed at 27.5 percent, but the rate drops to 25 percent if they conduct all transactions via banking channels.

This conditional benefit was previously welcomed by entrepreneurs and analysts, as it was seen as a measure to incentivise the formalisation of the economy.

However, the government has omitted the benefit and made it a flat 27.5 percent from the next fiscal year.

If the government wants higher investment, it will have to ensure a preferable environment where corporate tax is also a tool for attracting investors, said Kamran T Rahman, president of the Metropolitan Chamber of Commerce and Industry (MCCI).

When investors invest, they consider the regional corporate tax rate, and if they find that the rate is lower in other regional competitors, then there is no reason for them to invest in Bangladesh, he said.

The corporate tax rate in Bangladesh is "certainly" high, which is one of the factors discouraging investors from investing in the country, he said.

The corporate tax rate is 22 percent in Vietnam, 20 percent in Thailand, and 17 percent in Singapore. The average corporate tax rate in Asian countries is 21 percent.

Although the cost of labour is low in Bangladesh, efficiency is also low, for which labour might not draw them here, said Rahman.

To ensure that there are enough decent jobs in the country for youths, the government should focus on ensuring higher investment, be it foreign or domestic, he added.

In its budget proposal, the government had earlier recommended a 22.5 percent corporate tax rate for listed companies that have offloaded at least 10 percent of shares through an initial public offering (IPO).

The rate could go down to 20 percent if all financial transactions were processed through banking channels.

Now, the 20 percent rate will be applicable for companies that have offloaded at least 10 percent of shares through direct listing, according to a press release from the finance ministry.

However, companies listed via direct listing or IPOs that have offloaded less than 10 percent of shares, such as Berger Paints and Walton Hi-Tech Industries, will not qualify for the reduced rate and will instead face the 27.5 percent tax.

But the rate may be reduced to 25 percent if all transactions are conducted through formal banking channels, the press release said.

Snehasish Barua, managing director of SMAC Advisory Services, said listed companies that offloaded or were going to offload over 10 percent of shares to avail the tax benefit would end up being deprived.

It is "discriminatory" for them, as their rate will go up to 25 percent from 20 percent, he said.

Meanwhile, the interim government has reduced the corporate tax rate from 15 percent to 10 percent for private universities, medical colleges, engineering colleges, and institutions exclusively offering ICT education.

Previously, a finance bill unveiled on June 2 had proposed maintaining the 15 percent corporate tax rate for these institutions.

In a separate measure, the government has reduced the withholding tax on property transfers.

Additionally, the advance tax on imports of refined petroleum products has been slashed from 7.5 percent to 2 percent.

A top official of a non-listed firm said the withdrawal of the benefit for the use of banking channels would discourage the formalisation of the economy, which would have a long-term effect on the mindset of investors.

It is another example of frequent policy changes, he said.

It is a tough task, but many companies plan to follow the condition. However, backtracking from the policy and scrapping the condition will encourage the growth of the informal economy, which already prevails to a large extent, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments