Stocks drop 1.6% amid global tensions

The stock market in Bangladesh plunged by over 1.6 percent yesterday, mainly due to investor apprehensions over news of the US joining Israel in bombing Iran.

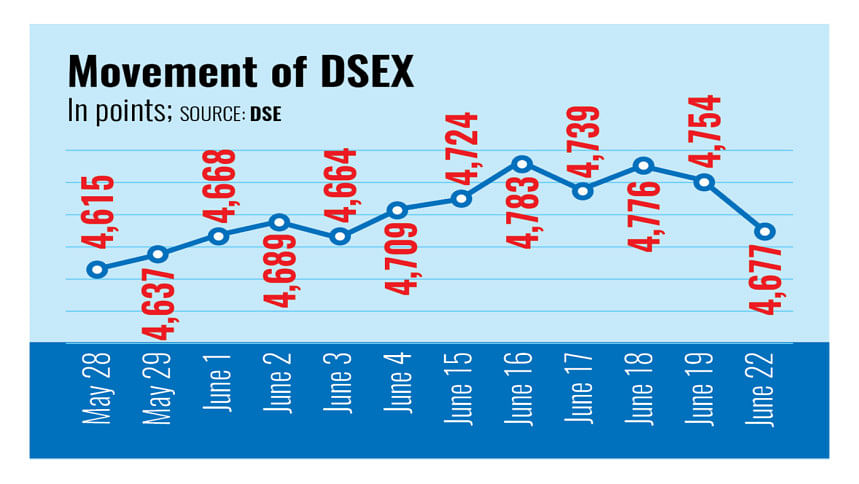

The DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), plummeted 76 points to 4,677 from the preceding day.

The DS30, the index that tracks blue-chip companies, fell 24 points, or 1.34 percent, to 1,758.

The DSES, the stock index of shariah-based companies, eroded by 2 percent to 1,016.

Due to the banking sector's high interest rates and the poor performance of listed firms in recent quarters amid macroeconomic challenges, stocks were on a downward trend, which ultimately frustrated investors.

Now, frustrated investors are apprehensive of global tensions as the US bombed three atomic sites in Iran, said Md Moniruzzaman, managing director and chief executive officer of Prime Bank Securities Ltd.

"Although the war is not impacting us yet, it has many elements that can affect the whole world. Especially if oil prices rise further, it will impact the Bangladesh economy," he said.

Another stock market analyst said Bangladesh's stock market does not usually react to global developments, whether positive or negative.

However, this time, people fear that the war could escalate, which would impact the economy of Bangladesh, he said.

So, the market index dropped significantly, he added.

Turnover at the DSE dropped 11 percent to Tk 271 crore. Among the stocks traded, 16 advanced, 365 declined, and 16 remained unchanged.

Shares of Taufika Foods and Lovello Ice-cream PLC were traded the most, amounting to Tk 19 crore, followed by Beach Hatchery Ltd (Tk 9 crore).

The food & allied sector dominated the turnover chart, accounting for 18.44 percent of the total.

In its daily market update, UCB Stock Brokerage said all sectors closed negative yesterday. Of them, paper & printing, non-bank financial institutions (NBFIs), and ceramics were the top three sectors that closed in negative territory.

All the sectors with large market capitalisation — which refers to the total value of a company's outstanding shares — posted negative performance, BRAC EPL Stock Brokerage said in its market update.

NBFIs experienced the highest loss of 3.17 percent, followed by food & allied (2.30 percent), engineering (2.29 percent), telecommunication (1.62 percent), fuel & power (1.51 percent), pharmaceuticals (1.22 percent), and banking (1.13 percent), respectively.

In the Chittagong Stock Exchange, the CSE All Share Price Index (CASPI), the premier index of the port city bourse, edged down by 171.46 points, or 1.29 percent, to close at 13,099.41.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments