BB suspends Binimoy over irregularities

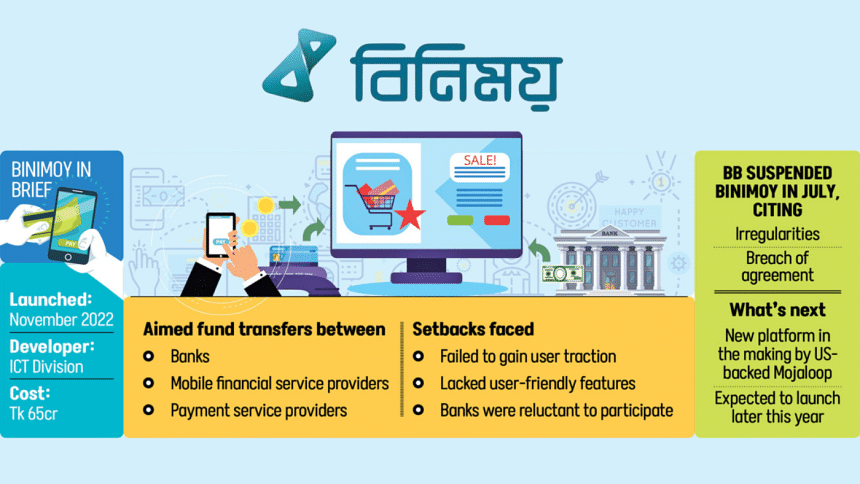

The Bangladesh Bank (BB) has scrapped the interoperable digital transaction platform Binimoy, citing irregularities and a breach of contract.

Binimoy was launched in November 2022 to facilitate fund transfers across banks, mobile financial service (MFS) providers, and payment service providers (PSPs).

During the previous Awami League government, it was developed by the Innovation Design and Entrepreneurship Academy (IDEA) under the ICT Division at a cost of Tk 65 crore. The goal was to support efforts to reduce the country's heavy dependency on cash.

But there had been allegations of political patronage and irregularities against Binimoy since the launching.

According to the central bank, it was pressured into signing the agreement that led to Binimoy's launch and did not receive the operational and maintenance fees it was promised for months.

"We suspended the services of the platform as we were forced to introduce it," said Areif Hossain Khan, executive director and spokesperson of the central bank.

Khan, who leads the central bank's Payment Systems Department and looked after Binimoy's operations, said senior officials from the previous government had handed them a ready-made setup and insisted they sign an agreement without a chance to properly examine its terms.

"There were irregularities from the very beginning. In fact, the agreement itself was signed with those irregularities in place," he said. "The central bank had no involvement whatsoever in preparing the document."

He added that the platform was difficult to run under such risky and unsupported conditions.

"They clearly breached the agreement and failed to provide us with the necessary support. On our lawyer's advice, we discontinued their services through a legal process."

Although the original deal, signed in 2019, stipulated that the central bank would run the platform in exchange for government funding, the BB says it has received no payments for the past seven to eight months.

The central bank said a new interoperable digital transaction platform is being developed in partnership with Mojaloop, a US-based open-source initiative backed by the Gates Foundation. It hopes to launch the new system this year.

"The work is progressing. They have extensive documentation requirements," said Khan. "First, they ask for one document, then another. We are providing everything as quickly as possible and hope to finalise an agreement soon."

According to industry insiders, Binimoy, which was modelled after India's Unified Payments Interface (UPI), failed to attract users due to its lack of user-friendly features, limited promotional efforts, and banks' reluctance to engage with the system.

Until its suspension, the platform had been used by eight banks, three MFS providers and two PSPs.

The banks are Sonali Bank, BRAC Bank, UCB Bank, Eastern Bank, Mutual Trust Bank, Pubali Bank, Al-Arafah Bank, and Midland Bank, while the MFS providers are bKash, Rocket, and mCash.

Although Binimoy failed to gain popularity, industry experts say an effective interoperable platform is vital for the country's digital payments ecosystem.

While users can now receive remittances and pay utility bills, peer-to-peer transfers across MFS providers are not widely available.

"If the government and the central bank can set a user-friendly interoperable digital transaction platform, then a payment revamp will happen. It could bring many benefits; it should be introduced," said Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank.

"This is very important for our payments, especially for those who make small payments. For them, these charges really matter," added Rahman, also a former chairman of the Association of Bankers, Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments