How 'e' is e-Commerce today?

If you build it, they will come.” This mantra of the late 1990's e-Commerce 'boom' in the US seems to have caught on in Bangladesh lately. If, however, we looked closely at the US phenomenon, we would see that while it served a few players well back then, it failed to deliver on the promise for most of them.

Are we heading towards a similar set of predicaments here in Bangladesh? Or can we extract critical learnings from experiences of others and at least not make the same mistakes? To be sure, we will make our own mistakes, and that is not necessarily bad. My favorite film director, Woody Allen, once said, “if you're not failing every now and then, it's a sign you're not doing anything innovative.” But the not-so-hidden message in that quote is that you avoid making the mistakes others made, and you learn from your own mistakes.

Let's look at what we know so far about the e-Commerce market in Bangladesh. Newspaper reports have quoted the Bangladesh Bank Governor saying we currently have a Tk200 crore e-Commerce market in Bangladesh. Our independent study of the e-Commerce market validates that claim to a large extent. However, this pi Strategy Consulting study finds that much of this e-Commerce activity is not necessarily what constitutes true e-Commerce transactions. Typically, an e-Commerce transaction, by definition, requires the actual transaction (where funds are transferred from the buyer to the seller) to take place electronically. Most of the transactions that are categorized as e-Commerce in Bangladesh involve cash-on-delivery, which, strictly speaking, cannot be considered an electronic transaction, even if other parts in the value chain, such as product listing or marketing, is done electronically.

In order to get a bird's eye view of the demand side of our e-Commerce market, pi Strategy Consulting polled a few hundred people last month. The intent of this study was not to conduct an in-depth assessment of the market using statistically significant sample size or robust sampling techniques. Rather, the purpose of this study was to build, test and refine a series of hypotheses within a very short time. Subsequent stages of our study will delve deeper into various dimensions of the e-Commerce market. However, some interesting insights emerged even from this cursory look at the market.

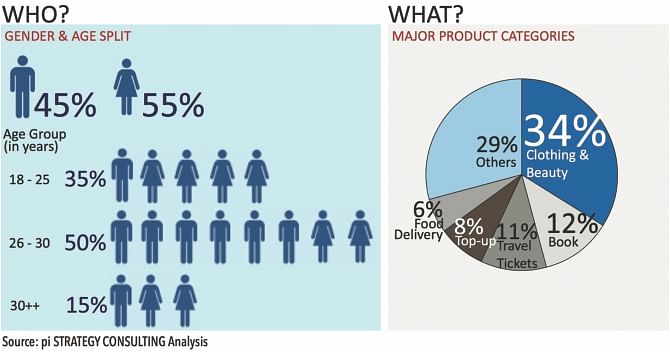

About half of those polled have used e-Commerce at least once in the preceding three months. Of those who are e-Commerce users, over 80% are less than 30 years old, and more than half of them are female. Most of them are either young professionals (44%) or university students (33%). Over 90% of them are based in Dhaka. One-third of them earn Tk30,000 or more per month.

Most of the products sold through e-Commerce in Bangladesh today are clothing and beauty products (34%). Other prevailing product categories include: books (12%), travel tickets (11%), airtime top-up (8%), and food delivery (6%). A majority of the e-Commerce users have spent between Tk500 and Tk3,000 over the previous three months. A small segment of them (just under 10%) spend nearly Tk10,000 per month. As indicated earlier, the overwhelming majority (over 80%) uses cash-on-delivery as a payment method.

The pi Strategy Consulting study points to a number of underlying issues related to e-Commerce in Bangladesh. This market is still at a relatively early stage in development. It cannot be considered a mass market phenomenon just yet – it is largely Dhaka-centric and it caters to a small segment of the population. There's clearly an inherent barrier towards greater adoption – you need a computing device and internet access to use e-Commerce. Given the rapid growth of internet-enabled mobile phones, that situation is likely to change fast. The e-Commerce market has been growing very rapidly over the last couple of years, especially since it began with a low baseline. However, the most critical hurdle for growth remains trust with online payment mechanisms. And trust needs time to build.

So, what lessons can we draw from global experiences as well as early experimentations at home? We should start by identifying a specific problem a large enough customer segment faces, and develop solutions to most effectively solve that problem. This is no different from any new product or service design. Nor should this be. A new e-Commerce portal or service is no different from any new business. Moreover, we should engage with that specific customer base closely and continuously to co-create that solution. We may think we know what a customer wants. We can only be sure once we ask enough of them. And when we collaborate with them to co-design solutions, everyone wins. It's time we engage them to solve the trust problem with online payments and make e-Commerce truly electronic.

The mantra of the 1990's should perhaps be adapted to say “if you build it with the help of your customers, they will come”.

The writer is Managing Partner at pi Strategy Consulting. He thanks Sudip Chowdhury and Syed Saleh Ahmed for their research contributions on this article.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments