When Politics Stifles Economic Growth

THE significance of political factors on economic performance is well established in the theoretical and empirical literature. Channels of political impact on the economy are many. Political instability takes a toll on economic growth through lower investment and subdued economic activities. Higher inflation has also been associated with political flux. On many occasions, political volatility had shortened government tenures which in turn hampered implementation of economic policies. Fragile politics has been a major constraint for economic development in many countries of Sub-Saharan Africa, the Western Europe and the Middle East. The experience of these countries reinforces that political factors be accorded an important place in the discussion of economic progress of countries.

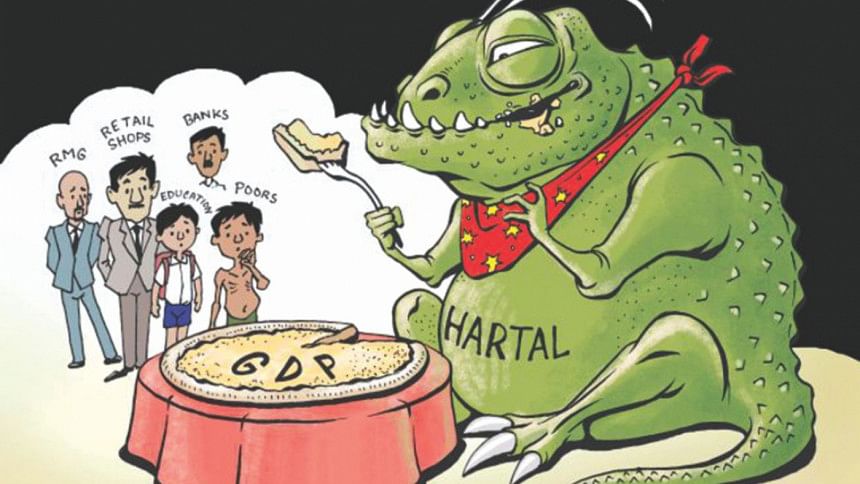

It's been barely a year since we rebooted the engine of economic activities after being hit by political violence for several months in 2014. It seems that the general elections held in January 2014 gave only a temporary breathing space for the country. Hartals and oborodhs are back in full force. The country once again observes venom and vindictiveness of confrontational politics. There is no sign of respite even after so many days. Life has come to a standstill in many respects. Education is disrupted, communication is interrupted, business has shrunk and safety of lives has reduced. Some losses are insurmountable while some are irrecoverable. Leaving aside the bigger picture of socio-political outcome of this stalemate, a mere short term view of economic outlook makes one wary of the future growth prospect.

The pace of economic growth slowed down in FY2014 due to political disturbances. A relatively calm situation following the national elections of January 2014 showed a glimmer of hope for picking up the growth momentum. The national budget targeted a 7.2 percent growth of Gross Domestic Product (GDP) while experts and donors revised their growth projections upward. However, current political turmoil is going to cast shadow on such expectations.

The first area of concern is the impact on investment situation. Inadequate investment has been a perennial problem in the country due to which economic activities cannot be expanded, productivity cannot be spurred, and growth cannot be augmented. Thus growth is somewhat hamstrung in recent years even after having much applauded macroeconomic stability for quite some time. Bangladesh's growth has been impressive in the past decades and the economy exhibited many promises despite several shortcomings. The country managed to increase its growth by 1 percent per decade during the last three decades. Good performance of agriculture, industry and service sectors have contributed to the acceleration of growth. Economists termed Bangladesh's progress as 'development surprise' since it advanced notwithstanding various unfavourable circumstances including poor governance and weak infrastructure. Growth has also been less volatile and shown strong resilience during periods of political volatility, natural disasters and global financial crisis. As a result, not only has the per capita income increased, spectacular achievement has been made in social fronts as well. Progress in poverty reduction, lower maternal and child mortality, increased life expectancy and higher enrolment are some of the examples of such proclaims. The country is also a forerunner in achieving a number of Millennium Development Goals. However, growth is now revolving around 6 percent and increasing this growth by another 1 percent in the current decade seems challenging.

Investment thrives in countries having good fiscal policies, improved infrastructure and skilled human resource. In addition to macro-financial variables, stability and predictability play critical role to boost business confidence. In a risky and uncertain situation investors hesitate since it is not about only the net present value, but also the future expected return. It is about future economic decisions and policies as well. If future looks murky, nobody would make an investment decision. The Sixth Five Year Plan (FY2011-FY2015) targeted an investment rate at 32.5 percent of GDP by FY2015, but the country could attain only 28.7 percent by FY2014.

Revenue generation is another area that is affected by political turbulence. During July-January FY2015 revenue collection grew at 16.8 percent, much lower than the targeted growth of 24.2 percent. This implies that during February-June FY2015 revenue collection has to grow by 31.5 percent which seems extremely difficult since losses suffered by most businesses will not be recovered by then. Net foreign aid disbursement during July-December FY2015 is also lower than that of the previous year. Slowdown in resource mobilisation leads the government to make bank borrowing for meeting up development and non-development expenditures which increases the interest burden of the government. Non-development expenditures are likely to increase during political disturbances as the government has to deploy more resources for maintaining the law and order situation.

Disruption in the supply chain of agricultural and industrial products affects both producers and consumers. Agricultural products are perishable and cannot be transported to cities safely due to which farmers have to sell their products at a throwaway price. As a result prices have gone up resulting in the possibility of higher inflation. The mean average inflation in January 2015 touched 6.87 percent while the target is to maintain it at 6.5 percent by June of FY2015.

While everyone is a victim of current political strife in one way or the other, some have been the worst casualty. The poorest section such as day labourers, rickshaw pullers and workers of the transport sector, shops and restaurants whose livelihood depends on their daily incomes faces a harsher situation. Unfortunately, they do not receive any assistance to make up for their losses. The government supports the export oriented readymade garments sector through cash subsidy, loan rescheduling and reduction of tax at source. Renewed claims for more incentives have been voiced. Given that resource mobilisation effort is limited and the government has to address competing priorities, such demand needs economic rationalisation through profound scrutiny. Instead of pouring money to those sectors which already enjoy stimulus for several years the government should give more attention towards poor workers, farmers, producers for domestic markets and small businesses with little or no capital to get back to the cycle of economic activities.

Financial incentive is, however, only a temporary and partial solution to a problem which is political in nature. After many turns and twists during the last four decades, the economy is on the cusp of change with so much potential. Political parties have to decide whether they would like to shepherd the economy towards materializing those possibilities or not.

The writer is currently a Visiting Scholar at the Earth Institute, Columbia University, New York.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments