Bangladesh an attractive destination for business

Bangladesh has continued to be an attractive destination for Japanese companies to do business due to its lower production cost and labour wage compared to those of 19 countries in Asia and Oceania.

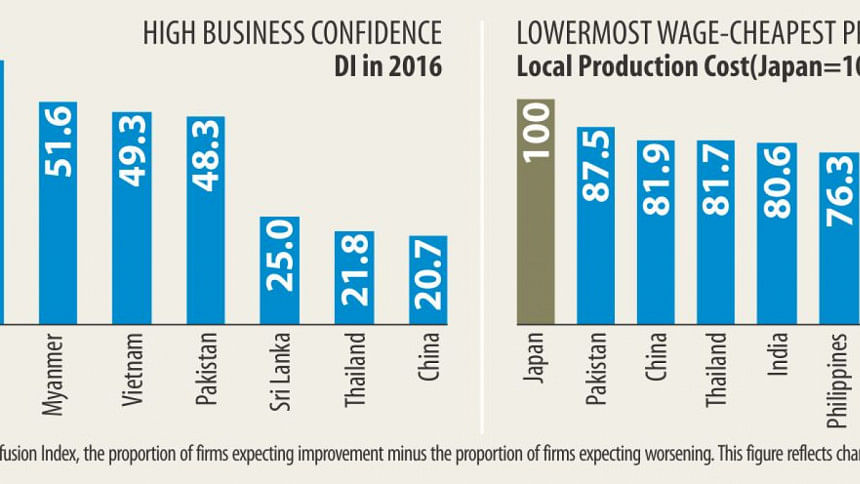

In comparison to Japan, the cost of production in Bangladesh is less than half, (49.5 percent), while it is 81.9 percent in China, 73 percent in Vietnam and 80.6 percent in India, according to the latest survey of Japan External Trade Organisation (JETRO).

“Like before, Bangladesh is found to be the most economical in terms of worker's wage both in manufacturing and non-manufacturing sectors which are less than one-fourth of China and half of India respectively,” said the survey.

The survey on business conditions of Japanese companies in Asia and Oceania for fiscal year 2014-15 was based on inputs from chief executive officers of 9,590 Japanese companies in 20 countries in the region and was conducted in October and November last year.

The survey questions were focused on operating profit forecasts, business confidence of CEOs, expansion plan, cost of local production, management concerns, procurement sources and export destination, expectation for economic integration and wages.

Bangladesh is far ahead of Vietnam, Sri Lanka, Thailand, and Pakistan on the cost indicator and is in a better position than Sri Lanka, Pakistan, Indonesia, Cambodia, India, the Philippines, and China on the labour wage indicator.

However, 69 percent of the CEOs identified the trend of rising wage as the highest concern of management.

The survey said although the Japanese firms in Bangladesh are struggling with operating profits, the good news is business confidence of the Japanese CEOs ranks the highest at 63.3 points, meaning their business performance in Bangladesh will improve in 2016.

It is only 20.7 points and 21.8 points in China and Thailand respectively, indicating that the expectancy of business performance of Japanese firms in the two countries is poor and might not pick up, it added.

Bangladesh was ranked fifth when the Japanese CEOs were asked whether they would expand their operations in the country in future.

More than 67 percent respondents said they would like to expand their footprint in Bangladesh in the next one or two years, thanks to high growth potentials, reduction of cost, reviewing production and distribution network and an easy-to-secure labour force.

Japanese firms, however, showed modest downward trend in the last four to five years in Bangladesh and other countries such as China, Myanmar, Vietnam, India and Thailand.

“Especially since 2013, the downward trend of Bangladesh and China is much severe whereas expectancy for expansion is getting higher in Myanmar,” said the survey.

About the opportunities to export to Japan, the survey said the sky is the limit.

The Japanese-affiliated firms in Bangladesh export 67 percent of their products back to Japan.

“However, the achievement could be many-fold if Bangladesh can connect itself with Asia through free trade agreements,” said the survey.

An official of the JETRO Dhaka said Bangladesh should take steps to sign trade deals with ASEAN, where Japanese companies based in India, Indonesia, the Philippines, Vietnam or Cambodia export significantly.

If there is preferential trade deals, more Japanese companies will come to Bangladesh and export intermediary goods to their plants in the ASEAN countries for producing finished products, he said.

“Time has come for Bangladesh to take the regional connectivity issue seriously,” said the official.

In 2014-15, Bangladesh received $915.22 million for its exports to Japan, according to the commerce ministry.

Exports to Japan have been on the rise due to the relaxation of rules of origin for products from the least-developed countries.

“Considering export destination of Japanese-affiliated firms in Asia and Oceania region, export from Bangladesh to ASEAN countries is simply 'insignificant', whereas export rate to Japan shows the highest export ratio (71%),” said the survey.

It said compared to the average, Bangladesh is found in a volatile position because of the problems related to quality of employees, competitors, local procurement, and quality control.

More than 57 percent CEOs think quality of employees are not up to the mark in Bangladesh; 50 percent CEOs would like to think more on quality control.

Moreover, 56.3 percent CEOs flagged customs clearance as complicated and 70.6 percent consider local procurement as a big problem.

The survey revealed that 70.6 percent CEOs say in establishing business local procurement is a big matter. Only 22.5 percent Japanese firms operating in Bangladesh procure raw materials and parts locally.

“Huge import dependency on China and less on ASEAN countries have become a matter of concern for CEOs, indicating non-development of supporting industries and an absence of connectivity with ASEAN nations.”

Like the previous year, Bangladesh, compared to other neighbouring countries, is in a stressed situation when it comes to making profits.

The country was ranked one of the lowest profit makers, and it lagged behind Pakistan, China, and the Philippines.

The recommendations of the JETRO survey include reducing cost related to start-ups, as Japanese companies are comparatively fresh and young.

It also called for creating environment to help companies cut down operational cost, introducing more investor-friendly policy analysing those of the competitors, and undertaking pro-active initiatives to address and eliminate impediments to doing business.

It said environment should be created to develop supporting industries in order to increase local procurement.

There are 230 Japanese companies doing business in Bangladesh.

JETRO is the official investment and trade promotion organisation of the government of Japan, and has been conducting the survey since 1987.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments