Energy pricing dilemma and the culture of subsidy

Proper price and market structure is the key for ensuring the uninterrupted quality supply of any product. If an appropriate commercial framework of business is not in place, market distortion, price fluctuations and supply disruptions are bound to happen. The energy market in Bangladesh is no exception.

International Gas Union (IGU) in its survey of wholesale gas price found that 43 percent of the total 3480 bcm gas consumed in 2013 in the world was based on Gas on Gas (GOG) competition. Forty two countries in the world have this price mechanism in one form or other spread over all regions except Africa, but mainly dominated by North America and part of Europe. The other dominant price mechanism (19 percent) mainly used in the Far East is Oil Price Escalation (OPE). Most of the long term LNG contracts in Japan, Korea, India, China, and Taiwan use this formula. Regulated price mechanism comprising 33 percent of the consumption are divided into three segments – Cost of Service (12 percent), Social and Political (14 percent) and Below Cost (7 percent). A small portion of the gas is supplied at no cost, Net Back or Bilateral Monopoly contract basis.

A company named EnergyQuest did a review of governmental intervention in domestic wholesale gas market in three North American (USA, Canada, Mexico), three OECD (Holland, Norway, UK) and 14 non-OECD countries (Russia, China, India, Algeria, Egypt, Oman, Qatar, UAE, Indonesia, Malaysia, Thailand, Argentina, Brazil and Peru). Together these countries produced 74 percent of the world gas in 2011. The free market pricing allowed the explosion of Shale gas in USA driving the price down. The liberalised OECD market has a higher price than USA but lower than Asia despite a strong tie with OPE. These two markets have minimum government intervention. Majority of the non-OECD countries fall under the three categories of government administered Regulated Price structure and the following was the conclusion of the report about these countries:

“Most of the non-OECD countries have government interventions aimed at controlling wholesale gas prices. While these policies may produce low headline prices, they artificially stimulate demand and tend to restrict supply, leading to gas shortages and imports of gas from other countries at high prices. There is little incentive for energy efficiency and often governments must decide on the allocation of scarce gas to particular industries, picking winners on political grounds. These policies are often associated with government ownership or control of downstream industries and controls on exports to avoid leakage of the subsidies provided by regulated gas prices. Many of these countries are experiencing upward pressure on domestic gas prices, in some cases to import parity. However, it is typically politically difficult to increase prices once they are regulated.”

Regulated pricing has the same history in every country that produced/used gas. The study done by the market report mentioned here did not include Bangladesh but the conclusion made in the study is a scenario we are experiencing right now in the gas sector. The phenomenon started in 2010 in the electricity sector when imported oil based power production started. The electricity is getting closer to the import parity price which would be about Tk 8/kWh.

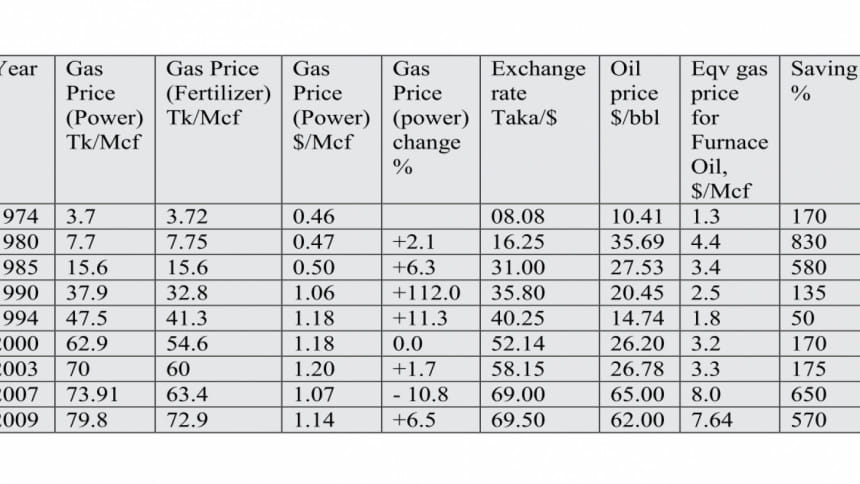

The price of gas in 1974 for both power and fertilizer was Taka 3.7/Mcf. The price of oil was USD 10.41/bbl and the dollar-taka exchange rate was taka 8.08. In terms of energy parity, 1000 cubic ft (1 Mcf) of gas is equivalent to 0.1765 bbl of oil. Using all these numbers it can be concluded that the price of gas in Bangladesh was about USD 0.46/Mcf for the power sector and in terms of equivalent price for oil this was USD 1.83/Mcf. For generating electricity, the alternate or replacement fuel for gas is furnace oil or heating oil where no other fuel is available. Assuming the cost of furnace oil being 70 percent of crude price, the alternate fuel price is USD 1.28/Mcf - a net saving of over 170 percent. The following table gives these numbers for the subsequent years until 2009 when the last tariff was fixed.

In the early seventies, gas became the focus of international oil companies due to the sudden increase in oil price. Bangladesh started feeling the pain of increasing oil import bills and decided to switch to fuel. Chittagong steel mill, re-rolling mills, several power plants started switching from the early eighties. By 1990, most of the power plants and other industries completely converted to gas in the eastern part of the country. When the use of gas during 1970-80 was only 0.3 tcf, it jumped to 1 tcf during 1980-90. Today, the yearly consumption is 1 tcf. Due to lack of vision and understanding of economics, Bangladesh lost the opportunity to raise the gas price to the level of price of the fuel it was replacing. Instead, it supplied it at 1/6 of the replaced fuel price (1985 oil price is indeed the average for the decade) and hence the beginning of subsidy. It definitely reduced the import bill but at what cost? Within a decade the generation efficiency plummeted to 25 percent, some of the fertilizer factories were using 1.5 to 2 times more gas than a more efficient newer plants, the domestic sector was using gas for drying clothes and even room heating! The slide could not be checked even by doubling the real price of gas in 1990 from the 1985 rate (see table). By looking at the table, it can be seen that the gas price has remained virtually constant since 1990 in nominal dollar terms without considering inflation. The average generation efficiency has now increased to 30 percent due to the introduction of 1200 MW of combined cycle (50 percent efficiency) IPP power plants.

The case of gas price for electricity generation was picked up for comparison because that sector is the most heavily subsidised and the highest gas user (about 50 percent) in Bangladesh. Despite the system loss (pilferage and technical), the subsidy in electricity tariff along with the gas subsidy did not allow to save any money for even maintaining a reasonable service, let alone adding new generation. Gas was not a tradable commodity yet. Unlike oil, the local price was not dictated by international price yet. The gas price is typically determined by its opportunity cost. The four most common ways of determining local gas price is by- a) cost of service b) border price c) long run marginal cost (LRMC) and d) alternate fuel cost. The cost based pricing includes the actual cost of providing the service (exploration, development and production, transmission and distribution) and a reasonable profit so that the companies can reinvest for future service and expansion. This is based on financial analysis. Because gas is not traded internationally, the 'border' price of export is another way of finding its true economic value. LRMC is the cost of supplying a unit of energy (i.e. 1 Mcf of gas) if the consumption is sustained indefinitely in the future.

The alternate fuel approach has already been discussed for electricity generation. Today we can see that when one dollar gas is producing electricity at Tk 2.3/kWh, furnace oil used plants are producing the same unit at Tk 16. The domestic gas is supplied at Tk 450/two burner/month at an estimated use of 85 m3/month. The imported LNG at USD 15/Mcf will cost Tk 3700/month/two burner just for the molecules. Even a limited supply of two bottles of LPG will cost at least Tk 2500 every month. CNG gas is supplied at Tk 30/m3 whereas even at today's international market price of 65 USD/b (55 USD/b crude oil), gasoline will cost Tk 65/liter. The gas based captive power (generated locally by individual industry) produces electricity at Tk 2.4/kWh whereas the industrial supply from Grid is Tk 7/kWh. These comparisons show the dismal situation for competitive fuel in a regulated market based on social and political consideration. No practical or commercial solution is possible in such disparate market either from public or private sector.

Kerosene and diesel has always been subsidized in Bangladesh like many other developing countries. The kerosene use has been minimum and mostly by the poor but always kept at par diesel price to avoid adulteration. Diesel has been under blanket subsidy in the name of agriculture use although the usage of the fuel in irrigation is no more than 30 percent. Petrol has always been kept at above market price as a means of cross subsidy. In the time of high oil price government has provided as high as Tk 7000 as subsidy in a year for keeping the fuel price low. The pressure on the government exchequer increased when the country started importing additional furnace oil of over 2 million tons to feed the oil based power plants. Currently due to oil price drop, BPC is making money from all its products. As a result, people are asking for reduction of oil price without realising that it would not benefit the general public as much. Profit by reducing the diesel price will be gobbled by the transport owners as there has not been a single incident of fare reduction in the history of Bangladesh. In the agriculture sector, the extra money will go into the pockets of irrigation pump operators. Octane/petrol can play its role as a way of cross subsidy. Reduction in the furnace oil will definitely benefit the general public indirectly as it will offset the pressure of power tariff hike and that should be done. All extra profit must be earmarked and kept aside for future subsidy ensured by BERC. The larger question is whether Bangladesh should switch to market based oil pricing? In principle it should be done and now is the best time to do it when all prices will go down. The biggest challenge remains to administer a transport fare formula that would adjust predictably according to the change in its fuel component. The arbitrary and captive nature of the transport sector must be regulated before commencing a market based oil pricing formula. A pre-determined safeguard for the consumers for a very high oil price must be in place as well.

Price control, subsidy and energy security

The most expensive energy is no energy. In almost every instance, price control has created shortage, rewarded wastage, and sometime promoted environmental damage. In 2005-6, Bangladesh faced a short term diesel crisis. Hundreds of farmers were looking for diesel even at Tk 40/litre when the regulated price was only Tk 30/litre. A massive bailout by government through public borrowing saved the country from a major supply disruption.

Short term subsidies are easy to formulate and also easy to withdraw. If the country has a long history of subsidy, it is very difficult to phase it out. Strong resistance from the civil society, trade unions is put up to protect the poor. It requires tremendous political will to take tough decision that results adverse short term effect. The so called 'price shock' due to energy subsidy withdrawal is very much like going 'cold turkey' when quitting smoking. The sweating and suffering is really bad in the short run but very good for the long haul. The people who get used to cheap energy cannot be blamed when they react violently to major energy price increase. If the goal of price control is to help the families who cannot afford the market price of energy, the help should be provided directly, effectively and for a specified time period. Any universal subsidy program is not sustainable.

Many countries have successfully managed to phase out subsidies by targeted compensation. Srilanka in 1979 tripled kerosene price by introducing a kerosene-stamp program that allowed low income households to receive 6 litres of free kerosene per month. The quota was not increased during subsequent increase in demand although the overall consumption decreased by 25 percent. The financial gain was far more than the administrative cost of identifying the families and supplying the quota. Vouchers or cash compensation is another way of helping the targeted section and removing overall subsidy. The difficulty is in identifying the targeted group. The first task is to define them clearly that may actually turn to be the most difficult job for Bangladesh. Does the government really know the people who are getting the benefit of the present subsidies in the country? Whom do they really want to target? Once this is done, a method can be devised to help them directly. If a decision is made, energy related questions can be included in the census or during the enlistment of voters. Once the data base is complete, implementing any policy would not be that difficult.

Apart from targeted compensation, another way of removing subsidy is transparent rate making through public awareness campaign. If consumers understand every aspect of the cost involved in a product, they are more likely to accept the changes as long as it is clear and rational. Public trust in a political government is the key of success for such approach. This approach was very successful in Indonesia and Nigeria recently.

In a mixed economy like Bangladesh, energy price perhaps cannot be left at the mercy of market only at this stage. The parity with market price has to be brought in gradually. Phased removal of subsidy, allowing price variation within an adjustable range related to benchmark price (until market price can be introduced) and introduction of a powerful and competent regulator have the best chance of ensuring energy security in Bangladesh.

The writer is Professor, Petroleum Engineering Department, BUET & Former Advisor, Caretaker Government.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments