3-month turmoil costs nation $2.2b

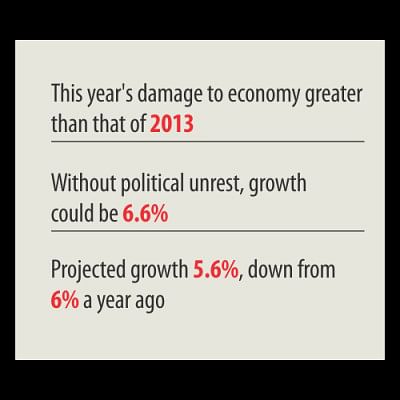

Political unrest this year has caused greater damage to Bangladesh's economy than that in 2013 when the nation's two main political parties fought over general elections.

This time the country lost $2.2 billion (approximately Tk 17,150 crore) or 1 percentage point of gross domestic product (GDP) due to prolonged political turmoil, said the World Bank in its "Bangladesh Development Update Report 2015" launched at its Dhaka office yesterday.

The amount is more than two-thirds of the estimated cost of constructing the 6.15 km-long Padma bridge, which the WB declined to finance over corruption allegations.

"Without political turmoil [GDP] growth could have been 6.6 percent," said the report.

The WB now projects the GDP growth at 5.6 percent for the current fiscal year, down from 6.01 percent in the previous fiscal year.

In its 2014 update report, the Washington-based multilateral lender said Bangladesh economy suffered a loss of $1.4 billion because of election-related political unrest, which had forced the WB to lower the GDP forecast to 5.4 percent for 2013-14.

In this year's report, the WB, however, predicts that Bangladesh's GDP would grow by 6.3 percent and 6.7 percent in the next two fiscal years.

Johannes Zutt, WB country director for Bangladesh, launched the report while Dr Zahid Hussain, WB lead economist, made a presentation on the findings of the report.

The report was prepared taking into account the developments, near and medium-term outlook and challenges in the first three months of this year.

The WB said job-friendly growth appeared to be gaining momentum in Bangladesh in 2014 until the resurgence of political turmoil since January 2015. The supply chain across the country was severely disrupted dampening growth prospects.

The report said the unrest this time came soon after the dry winter season began, when the largest and highly input-intensive rice crop (boro) was being planted, tourism was supposed to peak, inter-district transport was in full swing and construction activities reached their height.

"In short, the unrest occurred during the part of the year when the country's within-year business cycle peaks."

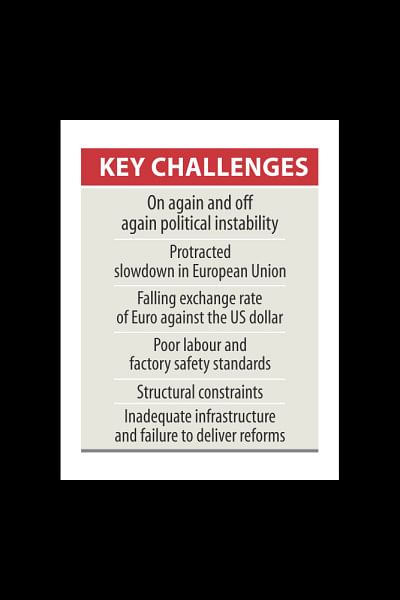

On recent developments, the WB said Bangladesh economy's resilience continues to be tested by faltering political stability, weak global markets and structural constraints, which are inhibiting the country's income growth and progress on shared prosperity. Political turmoil in particular is taking a heavy toll on the economy.

According to the report, economic growth in the first half of FY'15 benefited from sustained political stability throughout 2014.

Capacity utilisation improved, and it is evident from sharp recoveries in imports of industrial raw materials and intermediate inputs. Activities in the domestic market-based industries expanded faster than in 2013.

Agricultural growth followed its normal path aided by benign weather, reasonable smooth functioning of input markets and improved farm-gate prices. Remittances also picked up due to worker outflows to the Gulf countries.

A windfall resulting from the declining international oil price is benefiting the government by saving its funds meant for subsidising fuel oil imports. Government borrowing from the banking system has not been needed so far because of a steep rise in non-bank borrowing, particularly from savings certificates.

Bangladesh also performed well in containing inflation due to favourable international commodity price movements and sound macroeconomic management. The 12-monythly-moving average inflation decelerated from 7.6 percent in February 2014 t0 6.8 percent in February this year.

However, exports lost momentum because of a limping global economy and transition in the garment industry involving a significant number of factory closures. The depreciation of the euro against the dollar -- over 17 percent in 2014 -- is eating up exporters' price competitiveness. Tax revenue growth has also been weaker than the targets.

Despite the emergence of a $1.3 billion deficit in the current account in the first seven months of the current fiscal year, the surplus in the overall balance of payments has been sustained, leading to continued accumulation of official foreign exchange reserves to prevent nominal exchange rate appreciation, it said.

Yet, the economy continued to face several key challenges. Of those, the WB found political uncertainty as the biggest challenge followed by growing infrastructure deficit and a de-facto onerous regulatory regime.

Replying to a query on the need for the government to take $500 million budgetary support from the WB, Zahid Hussain said it is not only for meeting the financial needs but also for carrying out reforms.

"Moreover, IDA [international development assistance] loan is a very low-cost fund," he said.

Johannes Zutt said the WB's funding depends on Bangladesh's reforms. "We are thinking what we can do."

The WB country director said Bangladesh can tap into regional IDA funds and also try for IBRD (International Bank for Reconstruction and Development) funds.

The country didn't tap into IBRD loans in the past, added Johannes Zutt.

The interest rate for a low-cost IDA loan is around 1 percent, while for an IBRD loan it is up to 4.5 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments