Removing the tax constraint to ICT revolution

Like the seed-fertiliser-water technology of the 1980s that revolutionised rice productivity and agriculture in Bangladesh, the ICT revolution touched off by the Digital Bangladesh initiative of Prime Minister Sheikh Hasina in 2009 holds the promise of lifting factor productivity and citizen welfare through the adoption of mobile technology. Bangladesh has already made good progress during the Sixth Plan. The potential benefits for the poor are particularly noteworthy. By transferring knowledge, by facilitating financial transactions, by eliminating needless intermediation in transactions, and by enhancing and speeding up access to a range of public and privately provided services, the ICT revolution is contributing to lower production and selling costs for the poor. This in turn is increasing their productivity and income, thereby contributing to poverty reduction and improvement in mass welfare.

Yet, progress has just begun. The spread of the ICT revolution requires commensurate progress with mobile technology, especially in view of very limited fixed telephone density. International comparison of availability and use of mobile technology suggests that Bangladesh still has a long way to go. This article looks at the progress made with implementing the ICT revolution in Bangladesh and identifies the constraints, challenges and reforms for moving ahead.

The global rankings of the ICT development index (IDI) done by the International Telecommunications Union show that as of calendar year 2013 Bangladesh ranks at a low of 145 out of 166 countries compared. This performance is also below other major South Asian countries except Afghanistan.

A decomposition of the IDI indicates that Bangladesh is particularly lagging in the sub-index of IDI relating to the actual use of ICT services, notwithstanding past progress. This suggests that most countries are moving faster than Bangladesh in making ICT services available to the citizens.

PROGRESS WITH ICT USE

The progress with the spread of the ICT revolution can be measured in terms of three indicators: the mobile subscriptions per 100 people; the number of internet users per 100 people; and the percent of bandwidth subscription.

Mobile phone subscriptions: Progress with expanding mobile phone subscriptions has been enormous, growing from a mere 6.3 subscriptions per 100 people in 2005 to 74.4 subscriptions per 100 people in 2013. This is a remarkable progress over an eight-year period. Yet, when this progress is compared with other countries, Bangladesh lags behind substantially. China with 1.4 billion people outperforms Bangladesh on the number of subscriptions per 100 people. Importantly, since an individual subscriber can have more than one mobile subscription, the number of unique mobile subscribers for Bangladesh is estimated at 66 million, which amounts to a coverage rate of only 42 percent of the population. Clearly, there is still a huge population that presently does not have mobile phone access.

Internet users: Starting almost fresh with only 0.24 users per 100 people in 2005, the use of internet has slowly expanded reaching about 5.75 percent of the population in 2013. This is way too low and puts Bangladesh at the near bottom of the global list of countries with a ranking of 150 out of 166.

Bandwidth subscription: South Asia in general is way behind on bandwidth subscription. They started late and continue to lag behind. Progress in Bangladesh is particularly slow. In 2005 there were no bandwidth subscribers. In 2013, the subscription level has reached a mere 1 percent of the population, whereas the average for developing world is 6.1 percent.

The upshot of the above is that Bangladesh faces a substantial challenge to increase the ICT access of its population in order to reap the fruits of the ICT revolution. The three indicators of ICT access and use are inter-linked. In view of the very low fixed telephone line penetration in Bangladesh and high cost of personal computers, mobile is the most cost-effective way of providing internet access. Indeed, presently, more than 90 percent of internet use happens through mobile phone. Similarly, mobile broadband is the most cost-effective way of expanding bandwidth subscription that provides access to life-changing education, knowledge transfer, healthcare and e-government services.

Constraints to expansion of ICT services: Research shows that the main constraint to the spread and usage of mobile phone technology is cost. The average cost of talk time and SMS for basic mobile phone is very low owing to stiff competition among providers. But high taxation has raised the cost of other higher value-added services (video and data services and related equipment). There is limited flexibility to reduce the cost of these services despite competition. Costs of smartphones and computers are high partly because of taxes. With 80 percent population living at around two times the upper poverty line, affordability of internet, smartphones and computers and related video and data services has become a serious constraint to the expansion of ICT. High taxation is also impinging on the incentives of private investors to acquire additional radio spectrum and roll out services to the unserved rural areas.

PRIVATE INVESTMENT AND TAXATION

While public investment provides the fixed infrastructure and supportive research and development expenditure, much of the supply of ICT services comes from the private sector. The private sector response to the deregulation of the ICT sector has been highly positive with considerable foreign investment. This response has been the key to the rapid expansion of mobile teledensity and mobile digital services in Bangladesh. Nevertheless, service providers have raised serious concerns regarding the level of taxation of the ITC industry. Independent research shows that these concerns are valid and require urgent policy response.

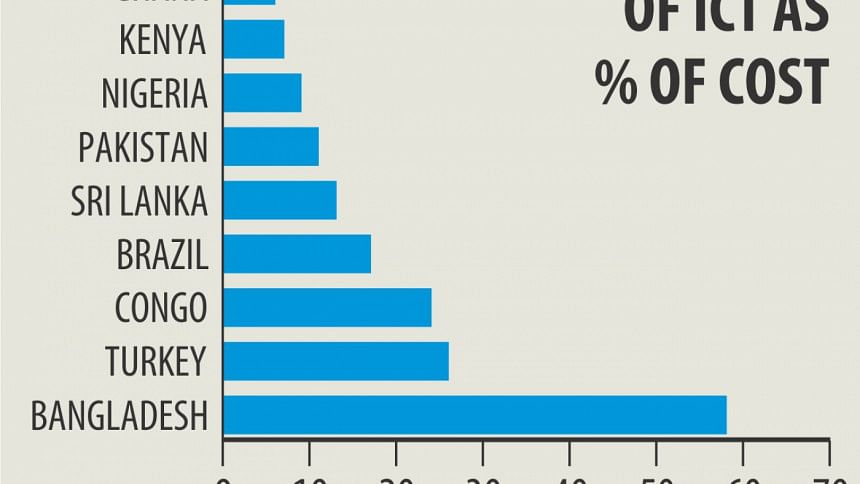

A study by Miller and Atkinson under the auspices of the International Technology Information Foundation (ITIF) covering 125 countries shows that Bangladesh has the highest rate of taxation of ICT among the 125 countries reviewed in the study. The primary basket of ICT goods and services used in the study consists of taxes and customs duties on the following: basic mobile phones, smartphones, computers and other digital products like digital cameras and digital audio devices. Taxes are computed as a percent of cost of service provided. China imposes the lowest taxation (3 percent) while Bangladesh the highest (an astounding 58 percent). The second highest taxation is in Turkey, at 26 percent. Taxes in 40 of the countries in the study are in the low range of 3-5 percent and taxes in the remaining others are mostly in the 5-20 percent range. In the global context, Bangladesh is clearly an outlier in the matter of high ICT taxation.

The Miller and Atkinson study also looks at price elasticities of demand and concludes that this elasticity is quite high for Bangladesh, which suggests that these taxes are a major reason for the low use of ICT services in Bangladesh relative to other countries. Using alternative price elasticity assumptions of demand, the study concludes that the negative effects of high ICT taxation in reducing the demand for ICT services varies from a low 52 percent (low elasticity) to 88 percent (mid-value of elasticity) and could even be as high as 167 percent. This is a very worrisome finding and raises serious concerns about the consistency of government policy for the spread of the ICT revolution. Indeed, the high taxation issue has now come to a fore and foreign investors are reluctant to further invest in new mobile network or acquire additional radio spectrum in Bangladesh in view of low profitability.

The high taxation of ICT services is clearly inconsistent with the Prime Minister's Digital Bangladesh initiative. The potential cost to the economy in terms of loss of development momentum and citizen's welfare can be substantial. As noted, Bangladesh is already lagging behind in the adoption of the ICT revolution relative to most other countries. Instead of pushing the momentum, the high taxation is constraining the growth of ICT services. This inconsistent taxation policy to the stated development objectives and the Prime Minister's initiative must be reviewed carefully and addressed speedily.

The development role of knowledge economy through ICT has just started and the returns are already being felt. The future potential is immense and the Seventh Plan will need to adopt consistent strategies and policies to take this forward. A special challenge will be to further increase the mobile tele-density and to expand internet and bandwidth connectivity through investments in network infrastructure as well as to lower access cost through reductions in ICT taxes. This will be a win-win policy because a larger subscription volume will both benefit service expansion and total tax revenues from ICT.

The author is vice chairman of the Policy Research Institute of Bangladesh. He can be reached at [email protected].

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments