Bangladesh needs a new investment regime

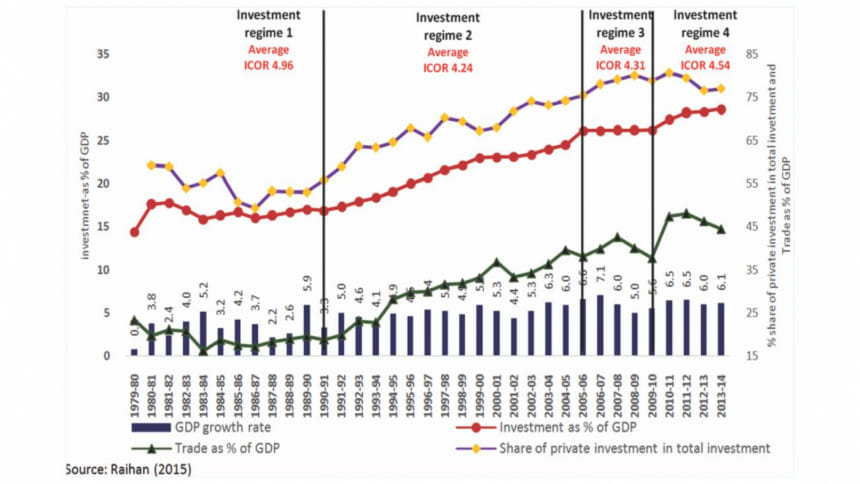

Looking at the trend in the investment-GDP ratio since 1979-80, we can suggest four different investment regimes in Bangladesh. The first regime (1979-80 to 1989-90) is characterised by low level of investment-GDP ratio with an annual average of 16.5 percent. This regime generated large fluctuations in GDP growth rates and the annual average GDP growth rate was only 3.5 percent. The second regime (1990-91 to 2004-05) saw a steady rise in investment-GDP ratio with an annual average of 21 percent. This regime yielded an annual average GDP growth rate of 5 percent. The third regime (2005-06 to 2008-09) experienced a higher but virtually flat investment-GDP ratio of 26.2 percent and a resultant rise in annual average GDP growth rate to 6.2 percent. Finally, the fourth regime is the current one (2009-10 to 2013-14) with a rise in annual average investment-GDP ratio to 28.2 percent, with 6.3 percent annual average GDP growth rate.

These four investment regimes can be tagged with different economic and political environments in Bangladesh. One economic indicator is the degree of openness. During the first regime, the economy was highly protected as is manifested by a very low level of trade-GDP ratio. However, since the second regime, through different economic reform measures, the economy became more and more trade-oriented, as the trade-GDP ratio experienced a steady rise over the years since then. The third regime, however, experienced a rise in the trade-GDP ratio at the beginning and then a fall. The striking feature of the fourth regime is that, the recent years are experiencing a gradual fall in the trade-GDP ratio, which is a matter of concern. This is also linked to sluggishness in economic reforms in recent years.

On the political front, the sluggish and low level of investment during the first regime was accompanied by a military dictatorship. The second regime of the steady rise in investment was under the regime of 'parliamentary democracies' with high prevalence of 'contested politics'. The third regime of stagnant investment was associated with a 'military backed' caretaker government with complete absence of 'contested politics'. And finally, the fourth regime has been a regime of 'parliamentary democracies' with a low level of 'contested politics'.

One very important aspect of these investment regimes is the trend in private sector participation in the economic growth process. If we look at the trend in the share of private investment in total investment, the first regime was characterised by a low and declining share of private investment. However, during the second regime, large contribution to the rise in investment came from the rise in private investment and its share in total investment. During the third investment regime, the share increased in the initial years and then fell in the later years. However, under the fourth regime, with the fact that the investment-GDP ratio has become somehow stagnant in the recent years, the share of private investment in total investment has fallen with the rise in the share of public investment, which is essentially unsustainable.

One very striking feature is that in the recent two investment regimes, the productivity of investment has fallen. One way of measuring the productivity of investment is the Incremental Capital-Output Ratio (ICOR), which is the 'ratio of investment as percent of GDP' to 'GDP growth rate'. The higher the ICOR, the lower the productivity of investment. During the first regime, the annual average ICOR was as high as close to 5. However, during the second regime it came down to 4.24. The third regime saw a rise to 4.31. But, alarmingly, the fourth investment regime has an average ICOR of 4.54. This suggests that in recent years, there have been noticeable rises in the inefficiencies in the economic institutions and resultant falls in the returns to investment. This is clearly manifested by the fact that though during the third and fourth investment regimes, the annual average GDP growth rates have been little over 6 percent, the investment-GDP ratio in the fourth regime was 2 percentage points higher than that of the third regime, indicating that the economy is now needing more resources to generate the same level of GDP growth rate! This also points to the alarming fact that a mere rise in investment-GDP ratio would not ensure higher GDP growth rate in the future.

There is no denying the fact that economic diversification is very important for economic growth process to be sustainable. It is important to mention that as against the first investment regime, the second investment regime was able to generate some essential diversifications of the economy through significant expansion of some non-agricultural sectors. One such example is the growth of the export-oriented readymade garment sector. However, in the later investment regimes, there has not been much progress in further diversification of the economy in general and the export basket in particular. There remain large policy induced and supply side constraints, inhibiting further diversification of the economy.

All these suggest that there is a need for a new investment regime in Bangladesh. This new investment regime calls for some substantial policy and institutional reforms aiming at considerable rise in private investment and its efficiency.

What is needed are: (i) a new paradigm of macro, trade and investment policies aiming at economic diversification, (ii) reducing the cost of borrowing through financial sector institutional reforms, (iii) reform of the economic institutions tuned to further growth acceleration and growth maintenance, (iv) stability in the political institutions and presence of higher degree of 'contested politics', (v) efficient public investment in social and physical infrastructure, facilitating further private investment, (vi) attracting large FDIs, with emphasis on regional cooperation in South Asia, and (vii) improving the overall governance of the macroeconomic policy environment.

The writer is Professor, Department of Economics, University of Dhaka, Bangladesh, and Executive Director, South Asian Network on Economic Modeling (SANEM).

Email: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments