Can lower price hurt the economy?

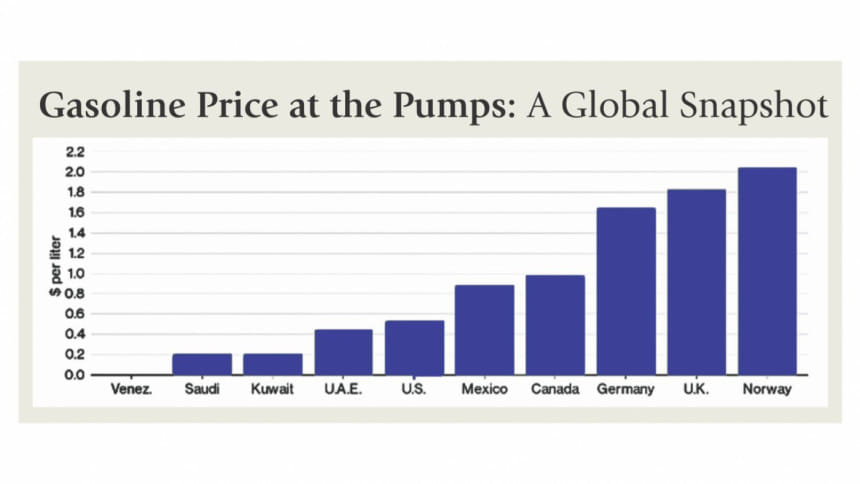

A few days ago, I filled the gas tank of my car for $15 at 1.57 a gallon (or roughly 42 cents a litre). I drive a sub-compact and since I have a long commute to work, every time I fill my tank (which is roughly twice a week), I thank the rulers of the oil-rich kingdoms of the Middle East and market forces for the extra cash in my pocket. I am not alone in this respect because the average consumer in the USA has been enjoying this bonanza since last year when prices at the pump started going down. Actually, price of crude oil has gone down by 70 percent since the summer of 2014, and is expected to stay in the range of $30-40 a barrel in the next few years. Of course, the lower price of oil in international markets have been a boon not only for the motorists, but also homeowners who use heating oil to keep their homes warm during winter, as well as other industries, such as airlines, tourism, automobiles, etc, which get a shot in the arm with lowering fuel cost. It is expected that motorists in Bangladesh will soon join the billions around the globe and partake in this once-in-a-lifetime manna from heaven, as it were.

But why is the cost of oil so low now, and since there is no such thing as a free lunch, who is paying for it? To answer the first question, the oil market is a perfect illustration of the basic economic principle of supply and demand. The current downward slide in the price of crude oil started in March 2013 when the major producers, including the OPEC countries, decided to flood the market with crude oil. Currently, there is a surplus of over 2 million barrels a day and if nothing is done to curtail this over-production, there will be continuous downward pressure on oil prices in the near future, i.e. 2016 to 2018.

The major casualties are not only the oil exporting countries such as Venezuela, Nigeria, Russia, Ecuador, and Brazil but also the US and Canadian oil industries plus the environment industry (renewables, solar, and wind). As with any market-driven price movements, some countries gain from a lower oil price regime, while some others end up losing. Whether one characterises the decision to flood the market by a few oil-producing countries as evidence of conspiracy or geopolitical saber-rattling, there is no question that the excessive supply is being caused by the entente formed by Saudi and its allies among the gulf oil-producing nations with the connivance of the US. According to estimates by the IMF, Saudi Arabia and the oil-producing allies could experience a drop of $300 billion per year in their oil revenue. So why are the Saudis taking such an enormous risk and bankrolling this endeavour? There are many possible motives for this global geo-political game. According to one theory, the Saudis foresee a weakened Russia and a pipeline through Syria as the outcome of a long drawn-out oil war. On the other hand, an American oil tycoon, T. Boone Pickens railed, "The Saudis are risking everything on their misguided attempt to destroy America's shale oil and gas industry. We have shut down thousands of rigs and shed 200,000 jobs." He goes on to shed crocodile tears for the other oil-producing countries. "New investment is non-existent and nations around the world - from the Middle East to Central America, whose economies are wholly dependent on oil exports - are on the brink of economic collapse."

One can also note that in a recent survey reported on January 26, 2016, business economists are more pessimistic about profits and sales than they were last fall and expect slower economic growth. According to a survey by the National Association of Business Economists, most of the survey participants also said that their companies plan to raise wages in the first quarter. But low oil prices are hurting bank stocks, some of which have loaned huge amounts to energy companies. Investors fear that the loans might be written off with potential losses for the bank and oil companies' stocks. So, this is something new, and an alarming twist in financial market dynamics.

One must point out that there is an extra element of uncertainty injected by the lower oil prices and higher volatility in the global commodities market. This comes at a time when a string of bad news hit the market, including downward spiralling oil and commodity prices, China's uncertain economic prospects and increased volatility in global stock prices. US stock prices have moved in recent months in the same direction as oil prices. It seems like lower oil price is dragging the financial market down.

According to Dow Jones data, since August 19 last year, oil has moved in the same direction as the Dow more than 72 percent of the time, compared to 51.98 percent for all of 2014 and more than 57 percent in 2015. "This isn't the typical relationship between the two assets. The long-term correlation between oil prices and stocks going back to 1973 has been almost zero or negative 1.1 percent. In other words, for more than 40 years, oil and stock prices have usually moved independent of each other."

Nonetheless, the overall effect of the lower oil price has been positive in the USA and net oil-importing countries. Projections vary, but according to Harvard's Bob Stavins, consumers will see an increase in disposable income, amounting to nearly $2,500 per US household annually. If we account for the income losses to US oil producers, the net gain per US household amounts to a bit more than $800 per year, with benefits accruing disproportionately to low-income households. While lower fuel cost may keep the cost of driving low and the opportunity cost of conservation high, the setback is predicted to be temporary. According to findings of analysts from Bernstein Research, "Renewable energy is a technology. In the technology sector, costs always go down. Fossil fuels are extracted. In extractive industries, costs (almost) always go up."

The writer is an economist and the author of a recent book Economics is Fun: Essays for the Masses.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments