Export diversification - Myths and realities

Export diversification has been an important policy agenda in many of the developing countries. It is commonly viewed that export diversification is a necessary condition for sustained and long-term growth of the economy and job creation. The current discourse of 'global value chain' also highlights the importance of diversification of export portfolio for effective integration with the global value chain.

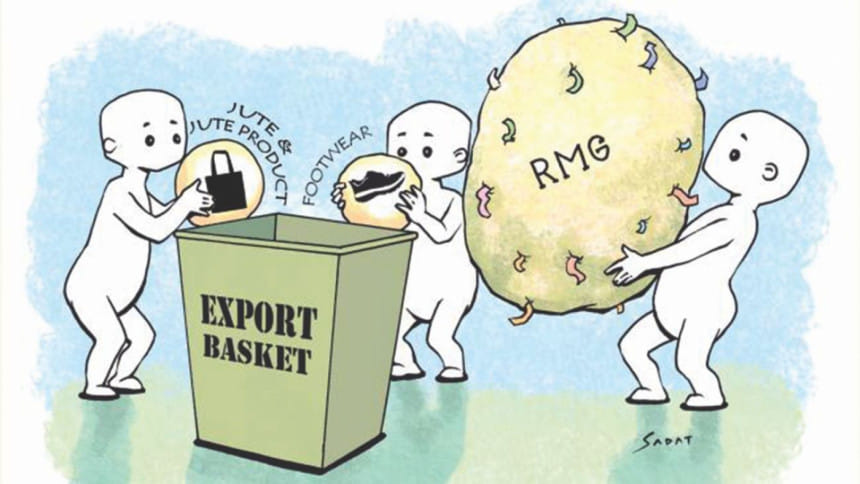

Among the developing countries, the problem of export concentration is more acute for most of the Least Developed Countries (LDCs). Many of the LDCs are still the exporters of primary products, mainly agricultural, which are not only susceptible to large volatility in the international market, but also provide limited opportunity for value addition. Few LDCs like Bangladesh and Cambodia have been able to move from agricultural exports to manufacturing exports, but still their export baskets remain highly concentrated around few low value-added manufacturing products. For many of these economies, export diversification is said to play an important role in structural transformation of their economies from producing low value-added products to high value-added products.

One strong view related to the policy for diversification of exports is its heavy emphasis on extensive tariff liberalisation with the aim of reduction in anti-export bias. The policy conclusion that emerges from this stance is for low and uniform tariffs and a seamless export-import regime that facilitates least-cost transactions at the border. Tariff liberalisation, under this view, is seen as a kind of 'auto' driver of export expansion and diversification of the export basket.

While the importance of tariff liberalisation for export promotion and diversification can't be undermined, tariff liberalisation alone isn't sufficient to trigger 'auto' large supply responses in terms of expanding export volumes and diversifying the export basket. A number of supply side constraints can prevent local producers from expanding exports, and the lack of an enabling environment can strangle entrepreneurship and innovation. Studies have indicated that most of the LDCs and a large number of other developing countries face several supply side constraints. High lead-time is an important challenge in many LDCs. Inefficiencies at ports and related internal road transportation further aggravate the problem. Amongst others, lack of investment fund and working capital, high interest rate, poor physical infrastructure, shortage of skilled workers, technological bottlenecks, lack of entrepreneurship and management skills, poor law and order situation, lack of information, invisible costs of doing business, etc. are major impediments to export prospects and export diversification. Therefore, the policy options and support measures for exports are much more difficult and involved than mere reduction of tariffs.

It is also essential to keep in mind that comparative advantage doesn't necessarily translate into competitive advantage. While many of the developing countries have comparative advantages in producing and exporting several agricultural and manufacturing products, given a domestic environment of high cost of doing business, such comparative advantages are seized to be realised. Therefore, while many of the LDCs are provided with significant market access opportunities in most of the developed countries' markets through different trade agreements and generalised system of preferences (GSP), the single major reason for their inability to take advantage of such opportunities is their supply side constraints, which undermine their competitive ability to supply to the global markets.

It is important to note that in the discourse of policy reforms for export diversification the political economy perspective is generally ignored and reform of institutions is largely overlooked. A favourable overall incentive structure through the management and distribution of 'rent' is important for the diversification of the export basket. Experiences from many developing countries show that the dominant export sector becomes the main beneficiary of different export incentives (both formal and informal) while for other sectors, such schemes appear to be less effective primarily due to various structural bottlenecks as mentioned before. In this process, the dominant export sector grabs the lion's share of the 'rent' being generated through such incentives.

This situation also raises a critical question as to whether 'rents' are needed for the promotion of other sectors. Experiences from successful countries highlight the importance of providing effective incentives to other sectors and removing structural bottlenecks in order to generate some 'rents' in those sectors. However, it should be kept in mind that while generating such 'rent' there is a need for a well-designed and effective industrial policy wherein monetary (interest rate subsidies) and fiscal incentives (reduced taxes or tax holidays) for the emerging dynamic export sectors are transparent and time-bound. In addition, industrial policy needs to address issues of education and skill development for facilitating higher capabilities for export diversification, attracting FDI and integrating with the global value chain.

Experiences from different countries that have been successful in diversifying their export portfolios also suggest that institutional reforms should be considered key to overall policy reforms targeting larger export response and export diversification. Improving the bureaucracy quality, ensuring property rights, managing corruption, ensuring contract viability through reduction of the risk of contract modification or cancellation are examples of such institutional reforms. Furthermore, reducing political uncertainties or establishing political stability and generating political capital for a diversified export basket are critically important.

The writer is Professor, Department of Economics, University of Dhaka and Executive Director, South Asian Network on Economic Modeling (SANEM).

Email: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments