Hurdles to investment

WHAT is the one thing that can help Bangladesh to achieve the 7 percent economic growth rate that it is so desperate for? We know that Bangladesh has been successful in attaining 6 percent plus growth rate even during the US recession and the Eurozone Debt Crisis, when most economies crumbled.

Since 1970s, the Gross Domestic Product has grown at a steady rate. GDP has grown at an average rate of 3.7 percent during the 1980s, 4.8 percent during the 1990s and 6.3 percent between the Fiscal Year 2010 and 2014.

One of the key determinants behind this growth rate has been the accumulation of capital (i.e., investment). The regulatory environment for business in a country can have a direct impact on this. A list of cumbersome procedures and bureaucracy can act as a deterrent to private investment. Whereas, if a country is able to look after investors' interests and simplify setting up of businesses and its transactions, it will help to encourage investment.

In Bangladesh, investment in FY 2014 was reported to be 28.7 percent but has it been good enough? If Bangladesh is to attain middle-income status by 2021, it is crucial that it increases its investment to GDP ratio. Countries with middle income status have investment to GDP proportions ranging from 35 to 40 percent.

It is particularly important for a country like Bangladesh to increase its investment-GDP ratio. One important reason is because Bangladesh is currently experiencing a demographic dividend and each year 2 million people are entering the job market. Without adequate investment, the economy would be unable to absorb the new people joining the labor force.

Private investment in Bangladesh had started to rise since the early 1990s which occurred due to a number of factors including trade liberalisation, privatisation, and fiscal incentives among many others. However for the last five years, it seemed to have lost its momentum as it has been hovering at 21 percent of the GDP.

Now let us take a look at the Foreign Direct Investments in the country. In 2013, Bangladesh managed to rake in only $1.5 billion FDI as compared to India ($28 billion), Malaysia ($11.5 billion), Indonesia ($23 billion), Vietnam ($9 billion) and China ($347 billion). We know that on the upside, Bangladesh has the advantage of cheaper labour over its comparators and a large market size. But despite the positives, the country is raking up only a fraction of FDI compared to its neighbors.

So what are the constraints to investment and why is Bangladesh not being able to bring in as much FDI as its neighbours?

Two reports can help us to gain an insight into the matter; these are The Global Competitiveness Index (GCI) and Doing Business (DB) indicators.

The Global Competitiveness Index (GCI) is an indicator of investment climate which bases competitiveness on 12 components such as macroeconomic environment, education, health, infrastructure, goods and labour market efficiency, market size and the like.

From the GCI, we can see that countries like India, China, Vietnam, Indonesia and Sri Lanka are more competitive than Bangladesh. Though Bangladesh has made some progress in recent years, the comparator countries have improved at a higher pace.

In the recent Doing Business (DB) report, Bangladesh ranks 173 out of 189 countries, with Singapore getting the best ranking and Eritrea getting the worst at 189th.

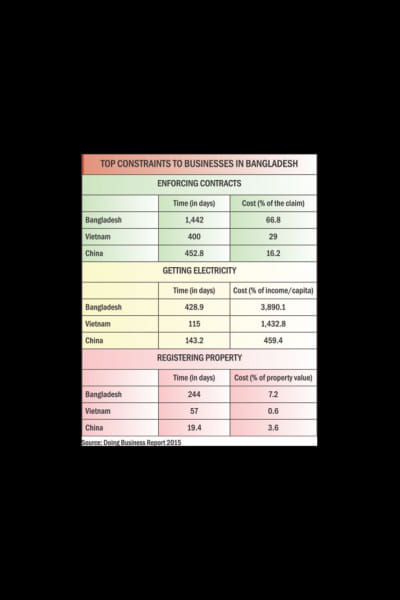

The DB report covers 10 regulatory areas that affect business decisions. In Bangladesh, the three biggest constraints to investment are enforcing contracts, getting electricity and registering property.

It takes Bangladesh 1,442 days to enforce a contract and the financial cost of enforcement is 67 percent of the claim. Whereas it takes only 400 days in Vietnam and 453 days in China and the financial cost are 29 percent and 16 percent respectively. The time lag acts as a deterrent to investment and must be improved in order to increase investments, especially FDI.

In acquiring electricity, it takes Bangladesh 429 days, which is much higher than Vietnam (115 days) and China (143) days. The relative cost of getting electricity measured as percentage of per capita GDP is much higher in Bangladesh relative to its comparators. The high cost is an indication of inadequate supply of electricity respective to demand. Domestic investors in many cases are able to use personal connections to cut through the time slag however, for foreign investors, the process remains difficult.

As far as registering property is concerned, it takes Bangladesh 244 days, whereas it takes only 57 days in Vietnam and 19 days in China. High population and rapid urbanisation have led to a scarcity of land; in addition, the land market is inefficient which lowers availability of land for industrial purposes in urban areas in Bangladesh.

Bangladesh has the advantage of cheap labour and hence the ability to attract labour-intensive industries. This is why it is vital to provide an investor-friendly business environment that will help us to reap the advantages of higher investments in the country.

The writer is the head of research at The Daily Star and can be reached at [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments