Predictable yet unachievable

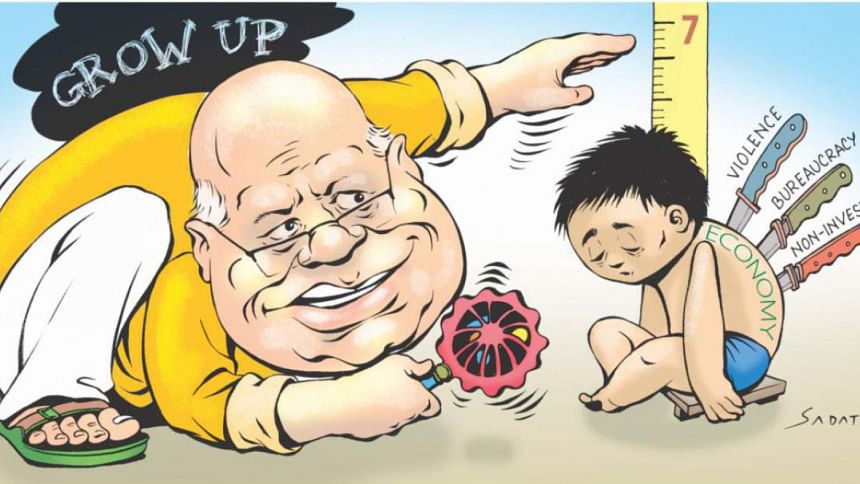

Writing on budget has become a challenge for me not only because so much has already been discussed, but there is barely anything original in the budget. The size of the budget, its proportion in the GDP, fiscal framework, budget deficit, Annual Development Programme (ADP), sectoral allocations, fiscal measures – all are so predictable. It is so obvious that based on the existing framework, there will be an increase in both expenditure and income and also allocations in most sectors. Towards the end of the fiscal year, most of these numbers will be adjusted downwards as the implementation of the budget will fall short of the target. This is the regular trajectory of the budget formulation and implementation process from which we are not going to come out anytime soon. Therefore, most of the budget analyses revolve around the realisation of the budget targets.

This year, total expenditure has been increased to 17.2 percent and revenue income to 12.1 percent of the GDP. The ADP has also been set at 32.9 percent of the total public expenditure which is higher than the revised budget of FY2015. One of the striking features of the budget is that both actual expenditure and revenue income as percentages of GDP have been declining during the last three fiscal years. For an emerging economy with a population of about 170 million, budget targets ought to be incremental. But the ambition level is not commensurate with the competence level yet.

Take the example of revenue mobilisation which is one of the biggest challenges for undertaking developmental activities in Bangladesh. The lack of fulfillment of revenue targets cannot be blamed only on the ambitious target of the National Board of Revenue or disruptions due to political turbulence. The bigger issue here is that of broadening the tax net, modernisation of the NBR, establishment of e-governance and capacity development of the concerned officials. It seems that instead of making the drive towards this direction, the Finance Ministry and the NBR prefer to target only the low-hanging fruits – chasing those who are already in the tax loop or the easier sectors. The NBR had identified several areas and sectors which are outside the tax net but we do not see any visible action to bring them into the tax circle. As personal and institutional income increases, there will be an organic increase of tax revenue. This increase can be multiplied through capturing income from new sources.

Admittedly, the tax department is not fully equipped - the number of officials is limited, proper skills are absent and full automation of the NBR is incomplete – all of this makes the task of tax officials very difficult. Therefore, political will is the key to improving revenue mobilisation. The large tax payer unit of the NBR is gradually increasing its collection. But tax evasion among the rich and powerful individuals is still a problem as much as it is among the unorganised sectors. If a resourceful person is to be punished for tax evasion or a trader is to be fined for misreporting prices, officials of the NBR must have the support and protection of the higher authority. Evasion is high in case of VAT as well. Though disposable income of a large number of people due to increased per capita income has gone up over the years, it is not reflected in the VAT collection.

The establishment of e-governance can bring great success not only in bringing taxable people in the net but also in keeping data on income and assets of people. We are yet to observe the implementation of the much hyped 'digital Bangladesh' concept in this critical area of economic management. Many countries such as the Philippines, Indonesia and Tanzania have shown success in tax payment through ICT.

Turning to sectoral allocations of the budget, quite understandably the infrastructure has received much more attention than the others as lack of it holds back the potentials of our economy. However, the social infrastructure continues to receive low priority in the budget. We may recall that we have made great achievements in health and education sectors during the MDG period. But we are going to have more ambitious targets during the post-MDG period when countries will adopt the Sustainable Development Goals for the period 2015-30 in September this year. SDGs have set goals on health and education "for all" (SDGs 3 and 4), unlike the MDGs where targets were set to achieve up to a certain level or number. If these SDGs are to be achieved, we need much more resources and effort towards these sectors.

Then comes the issue of the quality of expenditures. Ironically, in our country, big budget also means more wastage as there is low transparency and accountability of expenditures made. It is so common to make most of the expenditures on building schools and clinics instead of ensuring quality of education or health services. Unfortunately, relevant ministries and departments do not perform the overseeing role properly on the curriculum and syllabus in schools as much as they do not ensure the quality of doctors, nurses, medicine, etc. in health centres.

Thus budget exercise should also ensure the outcome of the expenditures made since numbers deceive the actual performance on the ground. To do so, the Finance Ministry has to come out of the formula based budget preparation exercise. Pro-activeness of the Finance Division to understand the impact of allocations, expenditures and fiscal measures is essential for formulating more practical and operational budget. They could think of undertaking an in-house study on how to make budget more effective and what changes could be brought in for designing a pragmatic budget framework.

The writer is Research Director at CPD, currently a Visiting Scholar at the Earth Institute, Columbia University, New York.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments