Elections and the economy

An interesting theory regarding pre-election periods is the theory of "opportunistic political business cycle," by which incumbent politicians cause temporary economic expansions before the elections. Even so, there is no reliable empirical evidence for the presence of an opportunistic political business cycle. Two countervailing electoral cycles affect economic outcomes. A robust opportunistic period is in the private consumption of nondurables and government spending. Also, there is a reverse electoral investment cycle in costly-to-undo investments, which decline in the pre-election period. Politicians often manoeuvre budgetary spending and other policy instruments. Even though, these measures do not always lead to a real change in outcomes such as gross domestic product (GDP).

There are arguments saying that there exists an additional electoral business cycle that explains the absence of evidence for opportunistic cycles. This alternative theory suggests that as elections approach, the macroeconomic performance plummets, particularly in the countries with lower levels of political and economic development.

The impulse to use economic policies and resources for political gain often becomes appealing by politicians even in advanced countries. The incumbent politicians (and also opposition parties) mainly focus on influencing the voters with promises and worry about the costs and consequences later. These costs and implications can be huge with the post-election economic aftershocks.

The huge amount of money dumped on elections by campaigns and outside groups are snowballing in most countries. Some studies show that in most advanced countries, campaign spending does not substantially improve the chances to win an election. However, in most developing countries, campaign spending has a significant impact on the votes.

We sometimes come across electoral models that predict that a strong economy favours the party in power and that a weak economy causes it to lose the elections. However, it may not be true always. The US economy is in pretty good shape now, but some polls show that the Republicans may not be able to lead the congressional elections in November. But these predictors could be wrong as they were in the 2016 elections.

So what about developing countries? In the election years, ahead of Lok Sabha elections, the Indian economy usually slows down even if the government intervention turns opportunistic. Increased government spending fuels inflation rather than stimulating growth. In Pakistan in the run-up to the last general elections, economic woes worsened. In Nepal also, usually, there is a slowdown in economic activity in the election years. The situation in the Philippines is somewhat different. In this country, the election spending usually boosts GDP growth by two to three percentage points. During election seasons, some of the money stashed away abroad is brought back to fund election campaigns.

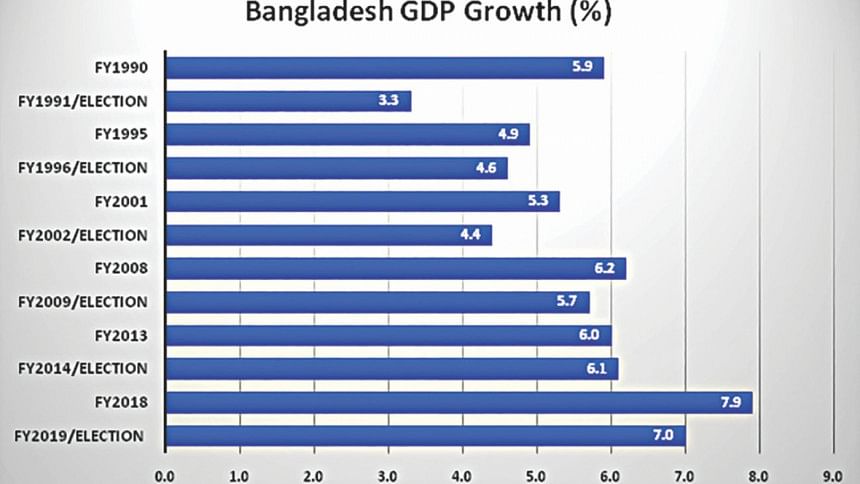

In Bangladesh, as we see in the chart, GDP growth fell in all elections years since FY1991 (except in FY2014). Political turmoil did not have any effect on investment which increased in election years (except in FY1991). Political uncertainty, strikes, and violence disrupted capacity utilisation which reduced the GDP growth in election years. In FY2009, there was no violence and strikes, but political uncertainty reduced growth. In FY2014, GDP growth rose slightly by 0.1 percentage point despite political disruption and violence. Why didn't the political turmoil affect the GDP growth in FY2014? Exceptional performance in agriculture in FY2014 compensated the election-induced lower growth in the industry. In the second half of FY2004, domestic demand bounced as the economy recovered.

We are expecting a general election in a few months. Although the macroeconomic fundamentals of the country remain strong, the economy is facing several downside risks including election-related political uncertainty. As in other similar countries, the money power matters in our elections. The election campaign funding is a tricky matter. It is substantially higher than the legal limit. There are no reliable estimates of the fund spent by the parties or candidates in election campaigns. It is believed that huge funds, mostly unaccounted for, go to campaign process. Election campaign spending by the candidates and other groups is likely to rise sharply if the election is competitive. The election-related costs, including for campaigns, polls management, and development, and current spending, are likely to inject plenty of money, estimated at 0.35 percent of GDP, into the economy in FY2019. Some parts of these spending may have a minor positive impact on the GDP.

Inflation may speed up because of the election-related private spending and expansionary fiscal policy. Despite a rebound in exports and remittances, the external balance remains under immense pressures because of a sharp rise in imports and lack of flexibility in exchange rate management. It is hard to prove if the capital flight is taking place ahead of the elections. However, the recent surge in imports points out the possibility of capital flights through trade mis-invoicing. The reports of the Global Financial Integrity show substantial illegal capital flights take place from Bangladesh through trade mis-invoicing. It is also possible that some people will bring back some laundered money to fund election campaigns.

With the elections approaching, the government has delayed some vital reforms. These include implementing the new VAT, raising interest rates on saving certificates, restructuring the banking sector and revising the energy prices. In the lead-up to the general elections, the government kept on approving a large number of development projects to compensate the sluggish private investment. These projects are unlikely to have any significant investment effect in the election year because of implementing delays. ADP implementation remained poor in the first quarter of FY2019.

World Bank has projected a seven percent GDP growth in FY2019 compared with 7.9 percent in FY2018. If there is a post-election bounce in business confidence and domestic demand, GDP growth in FY2019 is likely to exceed 7.5 percent.

Rezaul Karim Khan is an economist.

Email: [email protected]

Comments