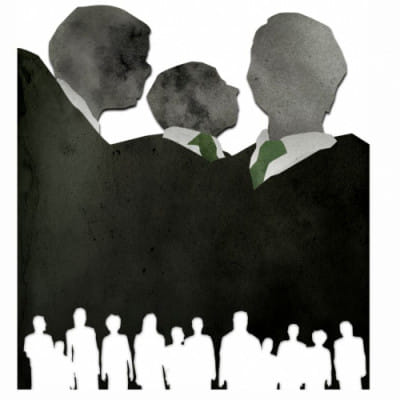

The rise of the super rich

A recent report that says Bangladesh has had the highest rise in its ultra wealthy population, surpassing any other country in the world, may have taken many by surprise. The growth rate, calculated by Wealth-X, a global financial intelligence and data company, stands at a solid 17.3 percent. Despite our queries, the company hasn't revealed how many ultra-rich—those who own at least USD 30 million or BDT 25 billion—we have amongst us, but it measured the change in their number over the last five years in "compound annual growth rate," which gives us some hints in comparison to the average annual growth rate.

To put it in context, if Bangladesh had 100 super rich in 2012, for example, the number should stand at 219-220 by 2017. In other words, the number of super-rich more than doubled in our country in just five years.

On the face of it, this may just be a normal trend. The top 10 countries that have registered the highest growth are mostly developing nations such as Vietnam, Kenya and India except for three developed countries, namely Ireland, Israel and the United States. In plain sight, such a pattern plays into the notion that growth of countries stagnates after they become rich. Upon closer inspection, however, such a staggering growth in the number of ultra-wealthy people—especially when we are a least developed country—signals that our system is heavily exploitative.

One must view the rise of the super-rich in the context of the poorest 10 percent in Bangladesh having their share of the national income being halved in just eight years from 2 percent to 1.01 percent with wealth and income inequality widening.

There are many ultra-rich who have made their fortunes out of the readymade garment industry, for instance, which is considered to be the country's economic lifeline and accounts for more than 80 percent of its entire export earnings. But, when the government decided to fix a meagre BDT 8,000 as the minimum wage for garment workers, the disparity couldn't be more contrasting.

The economy marked an impressive growth of 7.3 percent last year, but it is evident that the wealth it creates isn't fairly distributed. As the poor become poorer, the benefit of growth seems to be disproportionately reaped by a few hundred—or maybe a thousand or a few more—individuals. Also, the number of jobs added to the economy in recent years has been far from sufficient for the growing youth population, which gave rise to that curious economic jargon: "jobless growth."

Contrary to popular belief, the growing number of people getting rich does not necessarily mean that the economy is getting stronger because only a few of them reinvest their money. More recent data suggests an alarming rate of capital outflow through what experts term "over-invoicing" of imports.

According to Bangladesh Bank's data, the import cost is so inflated that the country has witnessed the highest trade deficit—the difference between the import cost and export earnings—in its history, amounting to BDT 800 billion, in the first seven months of this fiscal year. Some people, as the data implies, may be shifting their wealth abroad.

Over the years, capital outflow has been so tremendous that, according to Global Financial Integrity Report 2017, Bangladesh topped the list of least-developed countries in terms of "illicit financial flows". In 2014 alone, Bangladeshis laundered USD 9.11 billion to foreign countries. At the end of 2016, the amount of money Bangladeshis deposited with Swiss Banks stood at USD 683 million—near equivalent to the amount deposited by Indians.

What's more, many of these super rich aren't really "self-made" as they may like to call themselves. "In developing countries across Asia and Africa, those who accumulate wealth do so under the state auspices. Those who receive favourable treatment from the state or maintain close connections with the state machinery are able to make a fortune," Fahmida Khatun, Executive Director at the Centre for Policy Dialogue (CPD), said in an interview with the BBC.

Her arguments are supported by the fact that successive governments have provided rich businessmen, industry owners and investors with massive patronage in the name of "incentives"—such as low-cost electricity and gas supply, condoning extremely low wage and poor safety for workers, little regulation and tax breaks—while neglecting our foreign workers, who remit billions of dollars each year, and doing for the small and medium-sized enterprises.

What's so revealing about this rise of the super-rich is that it has debunked the myth of "trickle-down" effect—an economic theory, which justifies huge tax breaks for the rich, in which the poorest somehow benefit as a result of the wealth increase of the richest.

This "patronage" has often crossed a legitimate limit. Almost every few months the public comes to know of a grand loan default scheme, often involving powerful individuals swindling banks—mostly state-owned—out of billions of taka through shady means. The government has not only failed to take anyone to task for these scandals but has also funnelled taxpayers' money to rescue the banks in question.

The energy sector, especially quick rental power plants, has also become a breeding ground for the rich. One of the two reported near-billionaires of the country has made money primarily in the power and energy industry. While quick rental power plants have helped to reduce the power shortage substantially, it's hardly transparent when legal indemnity is provided to all deals that have awarded certain companies the exclusive rights to build such plants.

And, then there's this sudden infrastructure boom, which the government proudly calls "development," that may have made some people very rich. While some earned it in legitimate ways by, for example, cashing in on the increasing demand of construction materials, many big contractors may have followed a common strategy: time overruns, which can double, triple and even quadruple the initial budget by extending the deadline of the project. The fact that the cost of road construction in Bangladesh is highest in the world, despite the availability of abundant low-cost workers, speaks volumes. What's more absurd is that it's almost a given that the contractors' ridiculous demands to increase budget midway through the project will be accepted without thorough investigation.

The so-called development mantra may have helped grow the economy, but there's now overwhelming evidence to suggest that crony capitalism has allowed the rich to exploit this economic progress to become richer, while depriving the poor of their fair share.

Nazmul Ahasan is a member of the editorial team at The Daily Star.

Comments