Balancing faith and commerce during Ramadan

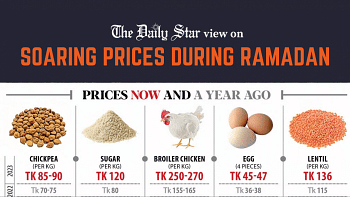

As Bangladesh recovers from the intensity of its recent elections, the arrival of Ramadan sheds new light on its economic woes. This holy month, historically a time of spiritual meditation and fellowship, today emphasises the complicated dance between consumer demand and market stability in a country attempting to reconcile ancient values with modern economic realities. The vibrant streets of Dhaka, pulsating with the spirit of Ramadan, present a contrasting story. On the one hand, increased consumer spending in the market and retail sectors reflects the month's cultural significance. On the other hand, rising prices for critical necessities cast a pall over the festivities, providing substantial hardship for regular Bangladeshi families.

Consider the small-scale spice dealers in Old Dhaka, who experience increased demand during Ramadan. Last year, a combination of import restrictions and higher tariffs caused an almost 30 percent spike in the price of basic spices. The merchants, torn between retaining consumer loyalty and managing rising expenses, exemplify the more significant economic issue. In another case, a prominent Dhaka eatery famed for its iftar dishes faced a similar conundrum. The rising cost of ingredients caused them to hike menu prices, resulting in a decrease in repeat consumers. This pattern is repeated throughout industries, from street vendors to substantial retail outlets, all facing comparable issues.

The government's role in this circumstance is critical. Previous patterns in Bangladesh have demonstrated that, without regulatory monitoring, the cost of essential items can increase during Ramadan, putting excessive burden on consumers. However, government intervention in market dynamics is a tricky issue. The solution is not heavy-handed control but deliberate measures that ensure fair pricing without disturbing the fundamental dynamics of the free market. For example, a government-led programme to subsidise crucial ingredients during Ramadan can drastically reduce costs for businesses and consumers. This move would help stabilise prices and uphold the spirit of Ramadan, which is one of charity and community.

The private sector plays a complementary role. Adopting tactics from nations like Malaysia—where "Ramadan bazaar" discounts are widespread—can serve as a roadmap. Local businesses should create special Ramadan pricing or discounts that reflect the month's spirit while being affordable. Furthermore, large firms could participate in corporate social responsibility (CSR) programmes, such as funding community iftars, to assist needy individuals. This method not only helps to keep prices stable but also promotes communal unity.

However, some contend that the market should be allowed to self-regulate. They claim that government intervention may cause long-term market distortions. While this stance has merit in many economic contexts, Bangladesh's specific socioeconomic environment, mainly during Ramadan, necessitates a more nuanced approach. There may need to be more than a hands-off policy to handle consumers' urgent challenges during this time.

Looking beyond Ramadan, the methods implemented during this time may have far-reaching consequences for the Bangladesh economy. Effective market management during Ramadan can serve as a model for resolving similar difficulties in the future. It can also improve the general resilience of the economy, particularly in areas such as Ramadan-based essentials/foods and services, which are critical to Bangladesh's economic growth. To solve these difficulties, I suggest the following: i) Use targeted subsidies or price caps on critical commodities during Ramadan to avoid excessive price increases; ii) Encourage private-public collaborations that offer customers and businesses special discounts or loyalty programmes; iii) Increase market surveillance to ensure price conformity and avoid hoarding or false shortages; and iv) Encourage community-driven activities, such as local food banks or charity drives, to help people most affected by price increases.

Thus, the call to action is clear—a team effort is required. Policymakers, industry leaders, and consumer advocates must collaborate to develop and implement measures that balance market stability and customer welfare. This intentional effort guarantees an equal Ramadan and sets a precedent for managing economic issues during culturally significant seasons. As Bangladesh navigates challenging financial waters, the lessons learned during Ramadan will be critical. They can influence future policy and the entire fabric of the country's economic and cultural landscape. The question now is not whether intervention is required but rather how it may be done most effectively in the best interests of all stakeholders.

Finally, the strategy for addressing economic issues during Ramadan in Bangladesh must be varied and inclusive. Bangladesh can sustain the spirit of Ramadan by combining strategic government policies, good corporate practices, and consumer awareness.

Dr Mohammad Shahidul Islam is an assistant professor of marketing at Brac Business School, Brac University. He can be reached at [email protected]

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments