Why the growing unemployment rate should worry us

When I approached a car insurance company to discuss ways to reduce my insurance cost, the manager advised me to take a study course on defensive driving, which I passed four years ago. She argued that rules and ideas on safe driving evolve over time and so the government has made it mandatory for anyone to refresh his or her knowledge of safe driving every three years to earn the cost advantage. The same is true for an economy which may seem to be on a fast-growth track but the inherent risk factors must be reviewed every now and then for safe growth.

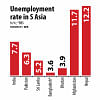

The fact is, despite satisfactory growth, Bangladesh's economy is developing a cavity in the labour market: growing unemployment. Recently, the US unemployment rate has hit 3.9 percent—lowest in the last 17 years. By contrast, the unemployment rate in Bangladesh is now possibly one of the highest particularly among the educated youth. Bangladesh's unemployment rate, which is around 4.5 percent, is not comparable with America's. Bangladesh follows the ILO definition which is quite loose and thus non-reflective of the actual situation in the market. In 2017, one BBS official made a joke on the ILO definition and assured me that a person working for an hour in the last month will no longer be regarded as unemployed. There are numerous studies where economists show how the ILO definition rarely finds anyone unemployed.

In contrast, the Bureau of Labor Statistics (BLS) in the US conducts interviews of 60,000 households every month and defines a person as unemployed if he or she doesn't have a job despite having looked for one for four weeks in a row. If the BLS definition is followed, Bangladesh's unemployment rate will definitely be above 12 percent—a mark that economists consider alarming. The US had crossed the 10-percent mark only twice in the last 70 years: during the recessions of the early 1980s and the late 2000s. The ILO definition is hiding the cavity, so we should instead follow the BLS definition to feel the real heat in the economy. If a thermometer shows a patient's body temperature as 100 degrees Fahrenheit, hiding the actual temperature above 104 degrees Fahrenheit, it is concealing the risk of death for the patient and thus misguiding the doctor.

The argument that the ILO puts to justify its loose definition of unemployment for the poor and developing nations is that the labour markets in these economies are not as developed as those in the developed nations. But that shouldn't be the reason to follow double standards. Understanding the differences in development is part of the learning and decision-making process. We don't follow different thermometers in different hospitals. Nor do we follow different definitions to measure economic growth and inflation—which are usually higher in developing countries for valid reasons such as growing opportunities in those nations.

Mere growth numbers shouldn't make us blind to the risk factors such as rising income inequality and growing agitation among the youth. Economists are now pointing to jobless growth. Yes, better technology and planned automation do reduce the number of jobs. That has been happening in the industrial sector and particularly in the garments industry at a steady rate. But that shouldn't be an excuse for jobless growth. For example, all the air trains in the Kennedy airport are unmanned. Also, once at midnight, I found no railway officer at the ticket counter at a Long Island station. Lastly, I had to buy the ticket from an automated vending machine. Since the technology boom in the late 1990s, most US companies are trying to adopt automation as much as possible, but still the US economy is adding jobs more than the number of people turn unemployed since 2010.

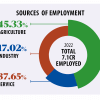

In Bangladesh, where agriculture absorbs 40 percent of workers and 85 percent of our employees are in the informal sector, addressing the issue of jobless growth should be a top priority. The recent slowdown in job creation in the private sector should be treated as a looming threat to the economy. It happened because of the beleaguered banking sector particularly over the last two years. We celebrate 17 percent profit growth in the banking sector, but the relevant ministries failed to adopt any policy that would require the bank owners to add a reasonable number of jobs to the industry.

Also, what is the point of export growth if the garment factories are hiring at a declining rate? Our vast informal sector and the pro-rich tax policy are contributing to the rising income inequality and also affecting social welfare. Before celebrating the rising growth and increasing per capita income, we should be aware that the rich are taking the greater slice of the pie day by day. Our budget allocation for social welfare and education as a share of GDP is the lowest in the region. So is the allocation for infrastructure.

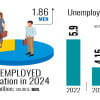

Almost 2 million jobseekers enter the market every year but the country cannot give formal jobs to even one-fourth of them. The recent quota movement can be seen as a product of the growing tension and grievances among the youth seeking jobs. Karl Marx was right to say that the unemployed will act like a "reserve army of labour". Since the country's capital market went through serious irregularities and the wrongdoers weren't often brought to justice, the banking sector is our only hope to help the private sector generate adequate jobs.

But the rising default culture, a weak central bank leadership, money laundering, and the finance ministry's excessive interference have greatly impeded the functioning of the banking sector in recent years. Concentration of bank loans in the hands of a few is another reason why job generation has slowed. The government must address these institutional factors to generate jobs at a faster pace and thus ensure safe driving on growth.

Biru Paksha Paul is an associate professor of economics at the State University of New York at Cortland. Email: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments