Forcing internet giants to pay tax

Like any other country in the world, digital advertising is the primary source of revenue for online news publishers (including those which are running both print and online version) in Bangladesh. Although advertisers still largely depend on conventional media (newspaper and television) for advertising, their products, with the growth of the digital market in Bangladesh, different brands and advertising agencies, have enhanced their presence through increased spending on digital advertising. While making direct advertising in local online platforms, both the advertiser and the publisher are complying with the country's laws and policies. By the end of each fiscal year, both online publishers and advertisers take account of their profit and loss account and pay applicable taxes to the government. Interestingly, when the same advertiser is advertising through Facebook Audience Network (FAN) or Google Display Network's (GDN) programmatic advertising platforms, it is making direct payment to these internet giants through an international payment gateway (credit card). Google then places ads in its search and display networks while Facebook displays these ads through FAN and a bunch of other apps. An online publisher being a part of GDN or FAN, gets a portion of money an advertiser is paying to these internet giants.

From the technological point of view, this sounds like a very efficient and hassle-free advertising system. The advertisers too, find it comfortable to go for such programmatic advertising as it costs much less compared to conventional advertising. But when it comes to financial transparency and compliance with the country's laws, policies and culture, we get a very blurry picture. These internet giants are doing business in Bangladesh without maintaining any registered office and operating without any kind of accountability. They are enjoying huge sums of digital revenue without paying any taxes to local regulators.

As Google and Facebook do not disclose the revenues earned from Bangladesh, an online publisher remains in the dark about the advertising deals between an advertiser and them. The publisher never knows the percentage of the revenue it is getting from the deal. Nobody except these internet giants know the volume of financial transactions that are taking place every day.

In a bid to make the publishing platforms dependant on them as well as make them non-competitive, both Google and Facebook are pricing at a much lower rate. As a result of this unfair and unhealthy business practice, local publishers are increasingly becoming vulnerable and fighting for survival. Having no office in Bangladesh, Google and Facebook have so far been able to stay beyond the jurisdiction of local laws. They have also created a monopoly in digital advertising.

According to a research study by Visual Capitalist, digital advertising will surpass television advertising (Chart: The Slow Death of Traditional Media, Jeff Desjardins, October 7, 2016) and will become the largest ad market in existence.

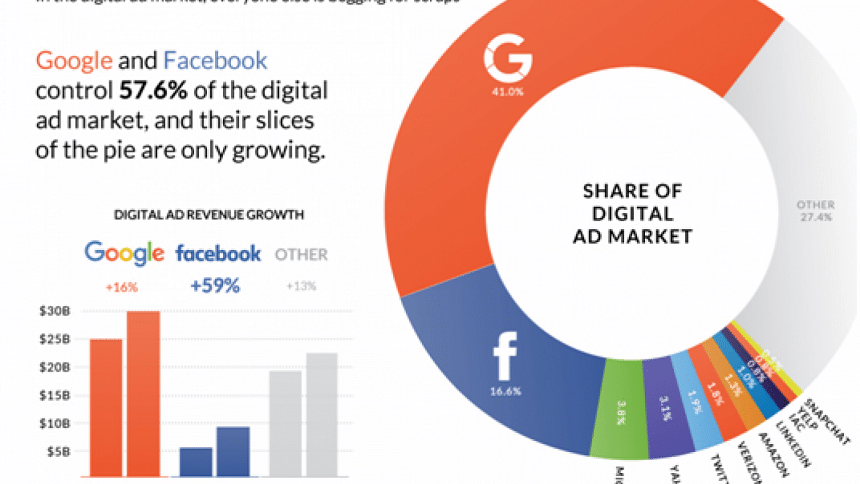

The growth may open up a bright future for online publishers. But taking into account the present scenario, the dominance of Google and Facebook, the online publishers will have no choice but to make an unconditional surrender. At present these two companies control 57.06 percent (The Dominance of Google and Facebook in One Chart, Jeff Desjardins, December 9, 2016) of the digital ad market and their slices of the pie are only growing. A rough estimate shows that more than half of each dollar (USD 0.60) that an advertiser spent on digital advertising goes to Google and Facebook. Facebook ran faster than all in terms of digital ad growth—in the first quarter of 2016 the social media company witnessed 57 percent growth to USD 5.2 billion from USD 3.3 billion (Facebook Revenue Soars on Ad Growth, Washington Post, April 28, 2016). The growth slowed down a little in the second quarter of 2017 to more than 50 percent but total revenue rose 44.8 percent to USD 9.32 billion in the second quarter of the same year (Facebook shares hit record high as mobile ad sales soar, Reuters, July 27, 2017). Facebook has more than two billion active users. It has been squeezing more ads into its News Feed. This lopsided growth and the digital monetisation strategy of internet giants are two big threats to the media stalwarts around the world including Bangladesh.

If the influence of Google and Facebook continues to grow at this pace and regulators let them get away without giving a fair share of their income to the regulators and publishers, we will be digging our own grave. It will further enhance market monopoly; the country will continue to lose a huge sum in tax revenue, outflow of foreign currency (to Singapore and Ireland) will rise; local publishers will be deprived of a fair price for their contents (German court refers publishers' case vs Google to European court, Reuters, May 9, 2017); and growth of local digital business market will be restricted, thus limiting new employment opportunities.

Both Google and Facebook are registered in California and are subjected to Federal Tax Law. However, both the companies have been very successful in remaining beyond tax net in most countries of the world. In January 2015, Google made a deal with Her Majesty's Revenue and Customs (HMRC) under which it paid £130 million in tax which was due for more than ten years. While Chancellor George Osborne termed the agreement as a "major success", the opposition widely criticised the deal as it let Google get away with millions of pounds in tax (Google paid £36 million in tax on UK revenues of £1 billion, reports show, The Independent (UK), March 31, 2017). During the deal, it was found that the vast majority of the profits associated with sales to UK (and non-US) were diverted to Bermuda, where Google has zero employees with almost zero taxation.

In 2012 (Facebook caught in controversy over earnings exported to Cayman Islands, The Guardian, December 5, 2013), company filing revealed that Facebook diverted an estimated £645m earned in the UK and other overseas markets to the Cayman Islands which have been a tax exempted destination historically. The social network company runs a subsidiary in Ireland through which it collects advertising revenue from around the world. Although Facebook earned £1.5bn in 2012, the Irish government collected just £4.4m in tax. To avoid tax and shelter much of its money, Facebook runs a complex web of subsidiaries known as "double Irish" (Double Irish With A Dutch Sandwich, Investopedia), employed by a number of American multinationals.

In June this year, South-East Asia's biggest economy Indonesia made Google reach an agreement under which it would pay the Indonesian government an undisclosed amount of tax for 2016. There are possibilities that the company will be slapped with USD 400 million for 2015 alone.

Forcing Google and Facebook to pay tax will be a hard nut to crack. But the Bangladesh government can learn from UK, Irish and Indonesian experiences and strategies. There are ample examples that governments in many countries are waking up and clamping down on corporate tax avoidance. It is a unique opportunity for the Bangladesh government to ramp up its tax collection efforts. To start with, the government can conduct a comprehensive research study to understand the nature and volume of online transactions by these internet giants. This will serve a fourfold objective; 1) establish financial transparency in online transactions, 2) bring the internet giants under the tax net, 3) meet budget deficit and 4) finance ambitious infrastructure projects.

Meer Ahsan Habib is a communication for development professional.

Email: [email protected]

Comments