The influential theorist

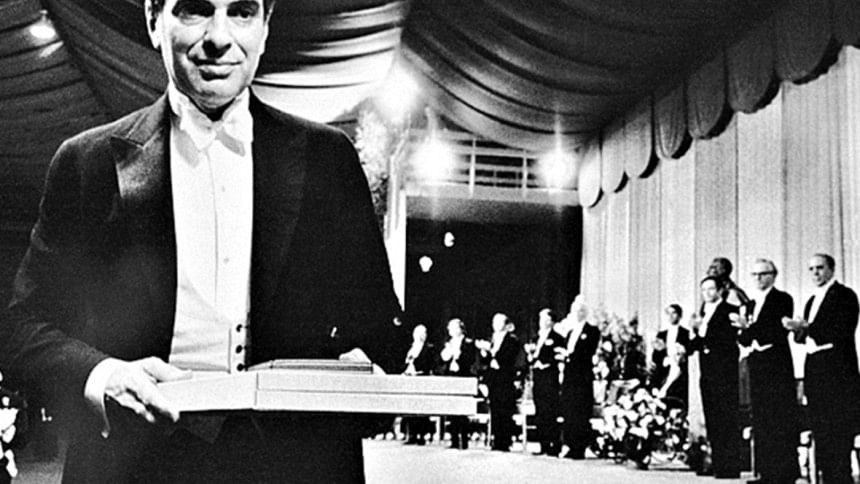

This February, the community of economists, the world over, learned of the death of an icon, Kenneth Joseph Arrow; tributes came pouring in from all corners. The youngest to date to have won the Economics Nobel in 1972, he surely was much more. At least five of his former students have gone onto win the Economics Nobel. Paul Samuelson (1915-2009, Nobel Laureate, 1970), his brother-in-law, had hailed Arrow as "the most important theorist of the 20th century in economics". Loved and revered by economists all over, Ken Arrow, however, had remained much of an unknown to the general public. Who exactly was Arrow and what did he do for mankind?

Born in New York City on August 23, 1921, Arrow grew up during the depth of the Great Depression. He majored in Mathematics from the City College of New York (now known as CUNY). He then went on to complete an MA in 1951, aged just 20, also in Mathematics from Columbia and decided to stay on for the doctorate there, this time in Economics, motivated by Harold Hotelling.

The war then interrupted and delayed Arrow's doctorate by many years (he had duly joined the military during 1942-46), but not his creativity. While on duty (research field), he published his first journal article, On the Optimal Use of Winds for Flight Planning (1943). The paper apparently dealt with how given the data, the wind forecast can be made more accurate and thus optimal flight formulas could be improved. But, his contribution was summarily dismissed by his boss: "The commanding general is well aware that the forecasts are no good. However, he needs them for planning purposes." (The Washington Post, February 21, 2017).

By the time he had finally earned his doctorate in Columbia in 1951, he had already made fundamental contributions in several areas of economic analysis including social choice, general equilibrium (GE) theory and risk-taking behaviour, and the 1972 Nobel could have in all fairness focused on any one of these fields. The actual Nobel award, however, focussed on the second of these: "… pioneering contributions to general economic equilibrium theory and welfare theory".

Although an astute topologist, few can better Arrow even in plain English. He thus summed up his work on GE analysis: "(. . .) In everyday normal experience, there is something of a balance between the amounts of goods and services that some individuals want to supply and the amounts that other, different individuals want to sell. Would-be buyers ordinarily count correctly on being able to carry out their intentions, and would-be sellers do not ordinarily find themselves producing great amounts of goods that they cannot sell. This experience of balance is indeed so widespread that it raises no intellectual disquiet among laymen; they take it so much for granted that they are not supposed to understand the mechanism by which it occurs" (Arrow, 1974).

In other words, in a state of 'general equilibrium' when all markets were in balance, only 'hard choices' (such as if one were to gain even more, others may have to be hurt in the process) remained unexplored. Such is the limit of market mechanism.

The wider academia, however, relates Arrow's name with the most seminal of his work, namely that completed as part of his doctoral thesis, Social Choice and Individual Values (Wiley, 1951). The central contribution here, known as the Arrow Possibility Theorem focussed on the following question: ". . . how can it be possible to arrive at cogent aggregative judgements about the society … given the diversity of preferences, concerns, and predicaments of the different individuals within the society? How can we find any rational basis of making such aggregative judgements as 'the society prefers this to that' or 'the society should choose this over that' or 'this is socially right'?" (Amartya Sen, Nobel Lecture, 1998.)

And, the answer? In Arrow's own words, ". . . if we exclude the possibility of interpersonal comparisons of utility, then the only methods of passing from individual tastes to social preferences which will be satisfactory and which will be defined for a wide range of sets of individual orderings [rankings] are either imposed or dictatorial" (1950). Thus the bleak conclusion is that it is impossible to construct a social ranking that respects the underlying constituent ranking of all individuals.

The third strand of scholarship that Arrow had already pioneered by 1951 lay in the foundation of a theory of behaviour under conditions of risk. His insight was anchored in Frank Ramsey's (1930) illuminating conviction that even lacking objective information about future events (say weather), rational persons (e.g. farmers) do routinely take decisions based on their own subjective belief (based possibly on 'external knowledge'). This eventually led to a complete theory of risk-averse behaviour. Simultaneously, he was led to investigate what became known as the economics of information, much of which dealt with complexities posed by the latter's incompleteness and imperfections.

Interestingly, it was left for President George Bush to acknowledge Arrow's monumental contribution to the understanding of risk and information by bestowing upon him the 2004 National Medal of Science, America's highest scientific honour.

Finally, we come to an area where a mere glimmer of Arrow's genius stands out starkly in the historicity of ideas. In a few short paragraphs in an essay dealing with the limits of the market mechanism, Arrow (1969) stressed the value, indeed the necessity, of 'social capital', as an enabling device improving upon economic efficiency. Though he did not name it as such, to my knowledge this piece happens to be the first such reference by an economist to the primacy of social capital, which sadly has gone largely unnoticed.

Before completing these words by way of a tribute, allow me to reflect on the humble nature of the man in his dealings with relative unknowns. Here, I record a letter I wrote to him in 1988 enclosing a draft paper where I extended one of his results on risk-averse behaviour in a context where the individual borrows the investment funds (instead of using his/her own savings). From the post-marks, he appeared to have replied almost the day he had received my paper, complimenting me on the derivations, but in the body of his letter, he managed to extend my analysis further by adding a few lines of algebra himself.

The last time I met Ken in person was in December 1995 in Tunis during the World Congress of International Economic Association (IEA), a weeklong event. One evening we were invited to a musical concert (actually performed by an orchestra based in Istanbul). Following the music, while walking over to a dinner arranged for the IEA Council, I caught up with Ken and asked him what he thought of the music. I prefaced by saying that to me it was striking that while all the tunes and melodies appeared very oriental, interestingly all instruments were those actually found in western classical orchestra (piano, violins, viola, cellos, harp, drums, etc). He surprised me by replying that he too was exactly thinking of that. I certainly had no clue of the evolution of Turkish music before and after the demise of the Ottoman Empire. I vaguely recall him reviewing precisely that which was most incomprehensible to me. He may have not proven any theorem on the General Possibility of Turkish Orchestral Music, but had certainly proffered quite a few solid hypotheses, not to speak of lemmas to boot.

Thank you, Ken.

The writer is Professor Emeritus, Concordia University, Montreal, Canada, and Visiting Professor, South Asian University, New Delhi, India.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments