Why do people stash dollars under pillows?

The Bangladesh Bank (BB) governor, while addressing an event at the Bangladesh Institute of Bank Management (BIBM) on March 7, expressed deep concern about some people hoarding the US dollars under their pillows. It reminds one of the reappearance of 16th-century Gresham's law in a different form. Thomas Gresham claimed that bad money drives good money out of circulation. Many high-income families in Bangladesh seem to have stashed more dollars in their homemade portfolios by getting rid of taka in exchange.

People during the barter age used to satisfy their needs by exchanging goods without using any kind of money as a medium of exchange. The limitations of the barter system led people to devise some common items—such as salt, stones, metals, silver, gold and the like—to use as facilitators of commodity transactions. In England, currencies like silver and gold coins were in circulation in the 16th century. Queen Elizabeth I noticed that only silver coins stayed in circulation while gold coins suddenly disappeared. Worried, the queen summoned her financial agent Sir Thomas Gresham to figure out why it had happened. Gresham hypothesised that coins with two different intrinsic values cannot coexist; less-valued coins will remain in the market while people will hide high-valued coins for the future. Some people's practice of holding dollars is a new form of Gresham's law because the US dollar's market value is adequately higher than the BB-assigned value, creating some scopes for profit-making. People work for self-interest, as economist Adam Smith affirmed.

While the BB governor seemed to have disapproved of this hoarding practice, the responsibility falls on the central bank's wrong policy of sticking to the unjust, non-market price of the dollar, the market value of which outweighs its stipulated price of Tk 110. The market price of the US dollar is above Tk 120, and that very difference induces the speculative savers to keep dollars under their pillows for future gains. Despite some warnings or normative calls from the government, investors will continue to possess dollars so long as it is worth doing so. For rational financial agents, economists find nothing wrong with that; wrong policy causes people to take the right actions, although society labels them as "wrong."

In early 2009, when the US economy was in a deep recession, President Barack Obama urged Americans to continue spending and not "stuff money in their mattresses." The word "mattresses" later was misused and derided by the Republicans. Michael Barone, an economist at the American Enterprise Institute, wrote an article lamenting that the Obama economy had sent Americans to their mattresses. He went that far to suggest that investors buy big mattresses, stuff money in them, and lie down to get some rest. Paul Krugman, the Nobel Memorial Prize-winning liberal economist, asserted that people increased keeping cash dollars in mattresses during the Great Depression in the 1930s. JM Keynes theorised that savings are a vice particularly during the recession when more consumption is required to jumpstart the economy. While President Obama's call in the line of Keynesian economics was right, people paid little attention to that call. And the same will be true for the incumbent Bangladesh Bank governor's call for not keeping cash dollars under pillows. People react to policies, not to pleas.

If history is any guide, people stored gold during all the bad times when investing in stocks or bonds looked bleak. Similarly, some Bangladeshis find holding on to dollars not only profitable for now, but for so long as the central bank's dollar price remains starkly undervalued. The governor asserted that BB would not align the dollar's price with the kerb market just because the market is small. That is not correct—nor is it a good logic. The kerb market is just the tip of the iceberg. No matter how big or small the market is, its signals are worth honouring since they originate from the interaction of demand and supply. The nation is paying the price in both inflation and the dollar crisis simply because Bangladeshi policymakers remained stubbornly defiant to the market signals in determining both interest and exchange rates.

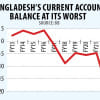

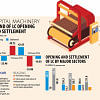

That did not happen for Sri Lanka and India, who have largely stabilised their foreign exchange reserves. The Reserve Bank of India (RBI) governor does not have any concerns as to whether Indians are stuffing dollars under their pillows since the dollar is not undervalued by the whooping magnitude as it is in Bangladesh. Per the World Bank data of 2022, India's economy is 7.43 times bigger than that of Bangladesh. But India's forex reserves are 24 times bigger than Bangladesh's gross reserves, warranting an efficient management of reserves in the latter country by ascertaining the right value of the US dollar. No sideline treatments or medicines will work to restore a healthy volume of reserves unless the dollar price mostly reflects the kerb market.

Bangladesh's inflation is now 9.7 percent, while it is 3.1 percent in the US, creating an inflation differential of 6.6 percent. It endorses depreciating pressures on the taka by more than six percent annually to keep the real effective exchange rate close to the index value of 100. The taka's depreciation against the US dollar will increase remittances and export earnings by improving export competitiveness. As the Fed chair Jerome Powell testified to Congress on March 6 and did not promise any rate cut soon, the economy signals a strong dollar globally. The inflation-led pressures on Bangladesh's taka and BB's undervaluation of the dollar are jointly encouraging clever investors and savers to keep on raising the altitude of pillows by stuffing more dollars under them. The ballooning of pillows is likely to continue unless BB ensures fair pricing for the dollar.

Dr Birupaksha Paul is a professor of economics at the State University of New York at Cortland in the US.

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments