Primary energy supply challenges for power

Power Secretary led a high level government delegation to Malaysia on 16 December 2013 to sign an MoU for carrying out works for formation of a joint venture (JV) company between Bangladesh Power Development Board (BPDB) and Malaysian State Owned power company Tenaga National Bhd. to develop a coal fired power plant of 1,200 MW capacity in Moheshkhali in Cox's Bazaar district of Bangladesh.

A Chinese company delegation was due to visit Bangladesh in December 2013 to sign a separate MoU with BPDB for developing a 1,320 MW coal fired power plant in Anwara Upazila, Chittagong district. The China Hudian Hong Kong (CHDHK) company and BPDB will form a dedicated JV company for implementation of the power plant project with loan supports from Chinese banks.

The Matarbari, (Moheshkhali) 1,200 MW coal fired power plant is expected to be implemented by BPDB with Japanese financial assistance. Japan Bank of International Cooperation (JBIC) intended to provide around US$ 2 billion loan to Bangladesh to install the base load power plant and associated facilities. A feasibility study for the 1,200 MW coal fired power plant is planned to commence soon as a follow up of BPDB's pre-feasibly study carried out earlier for selecting coal fired power plants at Sangu (south), Anwara, Matarbari and Moheshkhali areas of greater Chittagong district. BPDB projects to develop Moheshkhali island of Cox's Bazaar district as a coal fired power plant hub with 8,000 MW power generation capacities.

Earlier BPDB and Indian NTPC formed a JV company to develop 1,320 MW Rampal, Bagerhat coal fired power plant. Prime Ministers of Bangladesh and India officially inaugurated the Rampal power plant project development works on 5 October 2013. BPDB has been carrying out land development works for the project site 14 km off the Sunderbans mangrove forest area inviting a lot of concerns and protests from environmental groups. Reports suggest that Orion Group has taken some land development and coal sourcing initiatives for power plant development. It has been negotiating with a large Korean company to build partnership for their coal fired power plant development projects. S Alam Group has signed an MOU with Chinese Shandong Electric Power Construction Corporation (SEPCOIII) for developing a 1,320 MW coal fired power plant in Chittagong.

BPDB earlier signed 3 IPP contracts for coal fired power generation with Orion groups for 1,200 MW (522 MW plant at Mawa, Munshiganj, 300 MW plants at Labanchara, Khulna and at Anwara, Chittagong) on June 2012. As per the contract, the PDB agreed to buy per kilowatt hour (each unit) electricity at 5.8497 US cents (Tk 4.095) from Mawa plant while tariff for the Chittagong plant was set at 5.4214 US cents (Tk 3.795) and tariff for Khulna plant at 5.4071 US cents (Tk 3.785) respectively. Orion Group was to mobilize US$ 1.4 billion for development of the said three coal fired power plants, arrange coal import and develop necessary infrastructure within 45 months for Mawa plant and within 36 months for the remaining two plants. In addition Cabinet Committee on government purchase approved on 29 September 2013 five coal fired power plants on Built Own Operate (BOO) basis. As per the government decision Orion Group was given the green signal for building three coal-based ones in Dhaka and Chittagong with a maximum generation capacity of 1,400 MW, and the tariff was set Tk 6.69 to Tk 6.76/kW. Two other coal-based plants were permitted to set up by a joint venture of S Alam Steel Ltd, S Alam Super Edible Oil Ltd, S Alam Cement Ltd and HTG Development Group Co Ltd in Chittagong and Barisal. Generation capacity of these two plants are agreed to be a maximum of 1,100 MW and with an approved tariff rate of Tk 6.60 and Tk 6.79/kW.

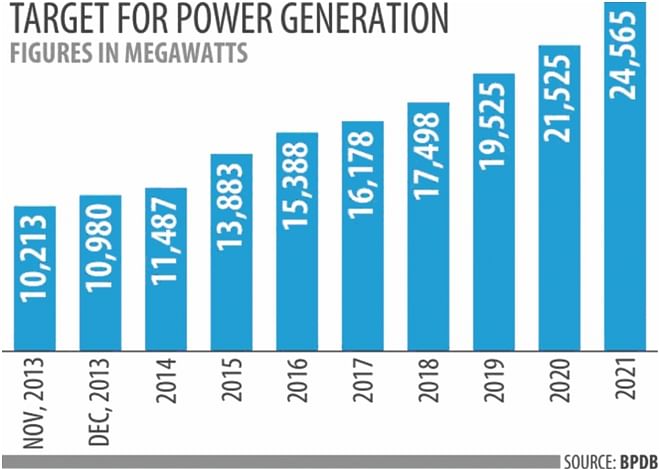

In the meantime the Finance Minister of the government on 18 November 2013 unveiled a plan to boost electricity generation capacity by 141 percent by 2021. Finance Minister AMA Muhit at a program organized by BPDB stated that the government initially set out to achieve 20,000 megawatt power generation capacity by 2021, but revised it upwards to 24,000MW following achievement of 10,000MW generation capacity recently.

BPDB experts believe that the optimistic revised target of power generation could be attained if a sustainable supply of primary fuel can be ensured and adequate financing for the power generation facilities development are unhindered. Also BPDB hopes that the private sector participation, demand side management, energy efficiency improvement program and regional cooperation on cross-border power trade would also help in generation of 24,000MW of power by 2021.

The government has successfully arranged to upgrade the power generation capacity to 9,713 MW and additional 500 MW power import from India through Baharampur Bheramara interconnector has helped to achieve 10,123 MW capacity within its current five years tenure. This capacity development has almost secured the existing demand for electricity in the country. The admirable success of power generation capacity enhancement has temporarily comforted the government for addressing the severe crisis for power and helped industrial and business growth in the country. But a significant part of the power generation increase has been achieved by costly liquid fuel based power plant development and the nation has to pay higher rates of power tariff for getting power supply. If the base load power generation capacity will not improve with comparatively cheaper fuels like coal and gas, the upward power tariff adjustment will continue in future with increased liquid fuel import bills. Therefore, sector specialists apprehend that the growing gaps for primary fuel supply for power generation will make the power generation capacity achievement unsustainable unless urgent coordinated initiatives are taken.

Already the several existing gas based power projects suffer from gas supply shortages. More gas based power plants in the pipeline are unsure whether they will get gas supply for generation of power in future. The import coal based power plants construction plans are at the very early stages and their success are significantly dependant on the coal import facilities development. The engineers working with the coal fired power plant development projects both in public and private sectors in the country do not expect significant addition of power from the coal fired power generation earlier than 2020. On the other hand, the producing gas fields in the country have been enjoying their peak production levels now.

Gas sector experts believe that from 2016 the gas production in the country will gradually start to decline. Already the power sector of the country suffers from gas supply shortages. Presently demand for gas reached 2,800 mmcfd (nearly 1 trillion cubic feet annually) and 60% of the produced gas has been consumed by power sector alone.

The gas demand for power generation at present has reached nearly 1,200 mmcfd and Petrobangla can supply maximum 900 mmcfd for the power plants. In addition there are 1,800 MW capacity (installed) captive generators which accounts for approximately 300 mmcfd gas requirements. Unfortunately, majority of the captive power generators are not energy efficient and there are scopes for improvement in energy use in these plants.

Government did not put a lot of attention to this aspect earlier but now in the backdrop of primary fuel shortages conversion of the captive power units for co-generation units (using the generated heat energy in the process of power generation for alternative productive purposes like heating water requiring for an industrial plants). Also, the public sector gas fired single cycle inefficient power plants if converted to combined cycle power plants, power generation can be enhanced approximately 1.5 times using the same amount of fuel gas.

Unfortunately the initiatives for conversion of the power plants to energy efficient plants both for resource conservation and rational use of resources have been progressing slowly.

The 25 discovered gas fields in the country cumulatively possess approximately 27 trillion cubic feet (Tcf) of gas (proven and probable) of which 11 plus Tcf has been used. The Gas Sector Master Plan projected that the gas demand will reach 7,400 mmcf a day by 2025. If no major gas fields are discovered and the gas dependency in the country as commercial primary fuel will continue, it is feared that the existing recoverable reserve of natural gas will be depleted within next one decade.

The present trend of exploration activities promises no immediate breakthrough in the new gas sources development from virgin fields. Experts observe that there was no major gas discovery for last 14 years in the country. Therefore, urgent initiatives are needed for extensive exploration endeavors for gas including with the involvements of IOCs and with capacity enhancement of local exploration company BAPEX.

Also, the government's intended shift for 50% coal based electricity development needs concrete action plans and their implementations, both for securing investments and for infrastructure developments. So far, coal based power development has been circling around import based coal fired power plant development. There is no initiative taken for domestic coal development in the country despite the fact that Bangladesh has discovered more than 3 billion tonnes coal resources in five coal fields in the Dinajpur and Rangpur districts. Only a small underground coal mine built in the Barapukuria basin produced for last eight years approximately 5.5 million tonnes costly coal.

The leased area for Barapukuria mine has 390 million tonnes good quality coal in-situ and major part of the reserve will have to be untouched by the existing mining methods. The Barapukuria mine mouth power plant with installed capacity of 250 MW has become the only coal fired power plant in the country operating since 2005 with the coal supplied from the mine next door. The coal fired power plant now has the de-rated capacity of nearly 160 MW. Government plans for adding a third unit plant in the power plant complex. But the sole supply source of coal for the plants remains as a risk factor for the coal fired power plant expansion plan. Already the Barapukuria coal mine has several instances of unscheduled shutdown of coal productions, mainly for technical reasons and operational difficulties.

Funding for coal mining and coal fired power development has been a challenge and with growing pressures from global movements favouring low carbon development the challenges have been multiplied. The Guardian on 20 November 2013 reported that the British Energy Secretary Ed Davis favoured that no British tax payers money would be used for development of coal fired power plants in future in the developing countries. The United Kingdom and China jointly funded approximately 57% coal mine development projects in the world. UK has provided approximately US$ 500 million during last 7 years through different development banks for coal development project funds in the developing countries. Therefore, UK's negative stands for fund supports for developing countries for coal mine and coal fired power project development will make investment funds costlier. It is interesting to note that coal fired power plants produced 39% of UK's electricity in 2012, up from 29% in 2011. Developing countries like Bangladesh needs to enhance its commercial energy development as energy supply security at an affordable cost as the energy supply security will stimulate economic developments and poverty alleviation. Per capita electrical energy generation in Bangladesh is still very low in the SAARC region and beyond, only 321 kWh compared to 616 kWh in India, 457 kWh in Pakistan, and 449 kWh in Sri Lanka.

The governments' plan for 20,000 MW coal fired power generation within 2030 will require approximately 60 million tonnes of coal supply security. The Power System Master Plan 2010 envisaged for 11,250 MW power generations from domestic sources of coal and the balance from import coal. 11,250 MW power generation will require approximately supply security of 33 million tonnes of domestic coal which no way can be met by underground mining in Bangladesh. For large scale open pit coal mine development initiatives, there are social and environmental challenges including ground water management challenges. Without decisive stands and facilitating roles of the government no local coal development projects will progress in the country. India, the third largest coal producer of the world and the major coal importer, struggles to keep the cost of power generation within the limits of consumers' affordability due to growing pressures for importing coal. In a recent move the West Bengal state government has decided not to import coal from international market from 2014-2015 financial year, to keep electricity generation cost within the affordable limits of the consumers. The import coal based power industry will now look into Indian domestic coal mine sources. As per the Anadabazar Patrika report dated 16 December 2013, West Bengal consumes on average 20 million tonnes coal for power generation. During the current fiscal year West Bengal intended to import almost 50% of its required coal from international market.

On the contrary Bangladesh having no experience for large scale coal import puts its thrust to develop coal fired power based on import coal. Unfortunately, the required volume of coal import for the projected 9,000 MW import coal based power generation will not be possible without deep sea port facilities and inland water rout development. A single Rampal power plant will require 4.72 million tonnes of coal import and supply to the power plant annually has emerged as a major challenge for BPDB. Therefore, coal fired power generation targets with import coal may be jeopardized. Power plant construction if not synchronized with fuel supply arrangements will only create uncertainties in power generation. As several initiatives are reported for coal based power development in the country, the government urgently needs to decide for the appropriate 'land zone' for coal mine and power plants development. The existing practices of haphazard developments will only increase cost of the energy and power project development which will ultimately trickle down to the common people.

For large scale investment in energy sector in Bangladesh the investors will primarily look into the domestic investment climate, its risks and returns. As per published reports, the Bangladesh Bank has revised down the country's GDP growth outlook for the current fiscal year due to the severe political unrest following similar projections by development partners. Both the parties in power and in the opposition have little differences in economic development philosophy for the country but seldom they discuss their policies for energy sector development, especially how they will meet the growing demands for energy at an affordable cost if elected for running the government. Election manifestos are such documents which inform people what the parties will try to do if elected. The 10th national election manifesto will hardly reach the voters for reasons known to all. Let us hope that the 11th national election manifesto of competing political parties will make people informed about their long term and urgent priority policies in energy sector developments.

The writer is a Mining Engineer.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments