Frugal living during the pandemic

#Perspective

The post-2020 world we live in is very different from the one we are all used to living. For many, it meant losing their loved ones and braving an emptier existence. For others, it is living with the scars after battling for their lives. But for the rest, it is simply a world where every move needs to be a calculative one. This is the world that have been, and continues to be, ravaged by the SARS-CoV-2, more commonly known as COVID-19 or Coronavirus.

Global outbreaks of a disease like COVID-19 are not an unprecedented event. If you were to go through history, you would find other outbreaks of diseases. You could almost say this was inevitable. However, knowing the science does not really prepare you for the reality of ghost cities around the world, where everyone is instructed to stay home to keep safe. It also does not prepare you for the damage to the economy, and by extension, your household finances and spending habits.

Cracks in the plan

Pre-pandemic life hardly ever called for keeping a count on your expenses, or the odd impulse purchases here and there for a significant section of the middle class. That all changed after the pandemic hit.

Initially, the situation was two-sided, with the upper- and middle-class remaining somewhat stable after being shifted mostly to working from home in order to curb the spread of the virus; while most of those below the poverty line, or those who live by daily wages, lost their livelihood almost overnight.

Asma, a domestic help working for a family living in Gulshan lost her job within a week of the announced lockdown back in 2020.

"My employers are concerned that since I come and go from my own house, I might unknowingly bring the virus to them. My husband is also making less money pulling a rickshaw as there are very few people on the streets," stated a concerned Asma, adding, "If I cannot find another work, we might need to go back to our village, because our options are either to starve to death, or die catching coronavirus."

Many, like Asma, had opted to retreat to their villages and try to survive.

Things for the middle class also did not stay stable for long. Soon, a multitude of issues started rearing their ugly heads. For some, it started with pay cuts at work, in order for their respective organisations to stay afloat in a depreciating economy. Others, whose families did unfortunately end up contracting COVID-19, there was the added, and rising, cost of hospitalisation and medication. And for many others, it was a complete loss of income due to being laid off.

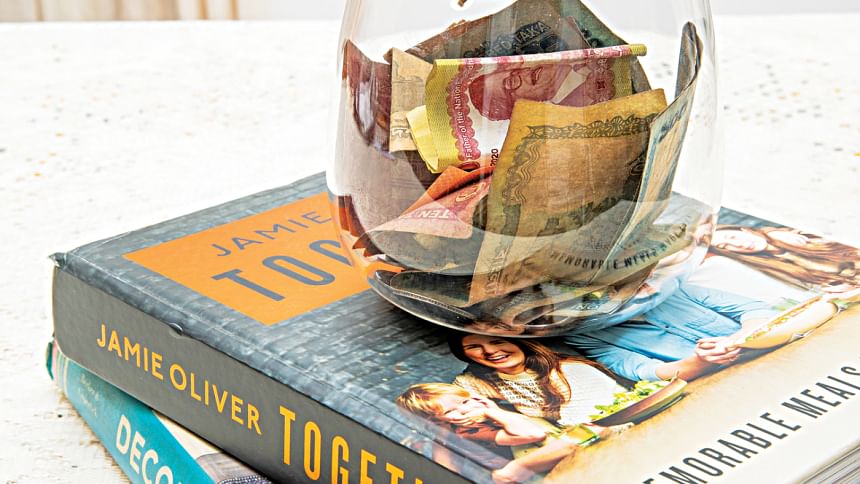

Survival of the frugalist

To survive, one needed to ditch what they knew to be normal pre-pandemic, and start embracing a more frugal lifestyle.

Every little thing needed re-evaluating as either necessity or luxury. For many in the middle and upper class, there were tonnes of expenses hiding under "necessity" that simply did not cut the mustard. These included subscriptions to things deemed "not necessary for survival" such as gym memberships, Netflix or OTT platform subscriptions, eating out or ordering food from outside, clothing, etc.

Saadi, a newly married 36-year-old working for a private firm, went through a similar routine of cancellations and evaluations.

"This pandemic made me realise how many unnecessary expenses were eating away at my pay check. After axing those, I also discovered that on top of shopping for groceries, I had a habit of buying things that made no sense in an uncertain time like this, such as buying mountains of crisps, chocolates and so on. We also realised that by skipping takeaway meals and only consuming home-cooked meals, our monthly expenses dropped significantly. We have now opened a joint-savings account and saving our leftover earnings for emergencies," remarked Saadi.

On top of just curbing unnecessary costs and re-evaluating spending, doing groceries also became a tricky venture, because when every taka matters, you want to avoid overpaying as much as possible. Many do not know this, but most super shops charge a premium for groceries and proteins compared to shopping directly at kitchen markets, and in a pandemic, every little bit counts. On top of this conundrum, there has been supply constraints with produce, making them scarcer, meaning more expensive.

Unfortunate realities

Pay cuts is another serious hurdle that many needed to tackle and integrate into a frugal spending budget.

Naima, a 31-year-old working for a private television company, had to deal with just such a reality, saying, "After a month or so of lockdowns, me and some of my colleagues had our monthly salaries cut nearly in half. This put a huge strain on me, a single woman living with my parents in Dhaka. I actually had to limit my usual grocery shopping and buy enough to make one type of food for a week, before shopping again."

An ever-harsher reality was for those who were eventually laid off by their respective organisations. Shaffat faced just such a reality. A 48-year-old father of two, who worked for a newspaper for over 20 years, was let go at the height of a raging pandemic.

"No words can describe how betrayed and heartbroken I felt. I didn't have that long before retirement. If I didn't have a saving, I could have ended up on the street," stated Shaffat.

Safe to say many others were on the same boat as Shaffat, but minus any kind of savings.

Now and forever

Things started to stabilise slowly after mass vaccinations were enabled and lockdowns were withdrawn, allowing daily wage earners to return and start work. As for the upper- and middle-class workforce, regular work resumed, to try and steer out of this battered economy. However, it will be some time before things slowly start returning to some form of equilibrium, because the fight is still not over, especially if you consider current events. Our country is currently being rocked by yet another variant, named Omicron, and infection rates are high again, putting many recovery plans in jeopardy. Until that day comes, and it will be a while, the frugal living practise should not be forsaken at any cost.

Once things do settle down, and we arrive at a new post-pandemic era, we can take all the lessons that we have learned during the pandemic about calculative and frugal living, and apply it there, because if there was one lesson we need to take into heart, it is that maintaining a saving is more important than it ever will be and these couple of years will serve as that reminder.

Photo: Sazzad Ibne Sayed

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments