Current business challenges and way forward

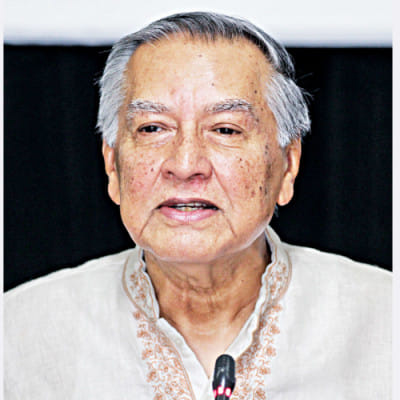

Mahfuz Anam

Editor & Publisher, The Daily Star

I'm truly honoured that all of you, such esteemed captains of industry and finance, have taken the time to be here. What brings us together today are the challenges currently facing the entire economy and how we can move forward. We aim to make this meeting as forward-looking as possible. We are all aware of many of our problems, which we have published in our newspaper and will continue to do so. However, this is an opportunity to focus on the future.

Ahsan Khan Chowdhury

Chairman & CEO, Pran RFL

I believe the most important thing is to ensure delivery. Despite all the negativity, if we don't remain positive, it will be difficult to function. There is substantial demand in Bangladesh, and as a growing country, the people are ready to contribute. If they can generate significant economic activity, they will be able to create even more demand in the future. In terms of exports, we need to focus on making Bangladesh more stable and consistent as quickly as possible to continue fulfilling our export demands. Additionally, it is essential to get all our ministries and secretariats working effectively. I feel that the critical importance of business, industry, job creation, and livelihood is being completely overlooked. If we can improve these areas, it will give the economy a much-needed boost.

Furthermore, considering agriculture's crucial role in the overall economy, we need to think deeply about maintaining the import of fertiliser and ensuring that farmers' needs are met. It's easy for anyone to boast about past achievements, but that does not help us move forward. Instead, we must focus on increasing agricultural production, which can help reduce food inflation. If we can consolidate our past learnings, agriculture will continue to thrive, as domestic demand is substantial and will only grow in the future.

Syed Nasim Manzur

Managing Director, Apex Footwear

I believe that what's most important right now is signalling where the economy is headed. For instance, we have already observed a drop in inflation; these signals need to be conveyed loudly and clearly to both the domestic and international communities because we need to recapture the narrative that Bangladesh is back in business.

Secondly, challenges on the export side include re-establishing the reliability and consistency of Bangladesh, and we require a clear communication strategy for that. I recommend setting up a task force consisting of major exporters, the government, and some of our international partners, investors, and buyers to outline this communication strategy.

Another important recommendation is to ensure safety in the five major industrial zones: Chittagong, Ashulia, Narayanganj, Gazipur, Narsingdi, and the Cumilla belt, which are the heart of our industrial manufacturing. It is crucial to emphasise that factories are national assets, even if the owners are compromised. The government must respond urgently to the situation, and this message should be delivered clearly and strongly by the advisers.

Selim R. F. Hussain

Managing Director & CEO, BRAC Bank

Our primary focus right now should be on digitalising the country. India has set an exemplary benchmark with initiatives like the Aadhaar card and India Stack, and we should learn from and replicate these models. Implementing such measures in Bangladesh would significantly reduce the cost of doing business, enhance ease, and channel money into the formal economy. Currently, approximately 15-16% of cash is outside the system, an unprecedented figure globally. By ensuring comprehensive digitalisation, we could eliminate leakage, unofficial black money, and funding in the informal sector, thereby boosting government revenue.

Additionally, wage earners' remittances, currently at $20 billion, represent only 40% of the actual volume. We need to offer greater incentives to curb hundi transactions. Developing an ecosystem for exporting manpower and enhancing our remittance sector should be a major focus.

Finally, the banking sector, the heartbeat of our economy, is under significant stress. Revitalising it will require collaborative efforts between the banking sector and the government, particularly through legal frameworks. The central bank itself should be fully digitalised, with all communication and reporting conducted electronically.

Dr. Ahsan H. Mansur

Governor, Bangladesh Bank

Bangladesh Bank (BB) does not interfere in any industry. These industries are national assets, crucial for employment, productivity, and production. It is up to relevant ministries and agencies to protect these sectors. BB has not frozen any company accounts.

We are keeping an eye on agricultural inputs and the power sector, where significant arrears have built up. While we cannot resolve these issues overnight, we are gradually addressing them.

Since my appointment, we have ceased using our forex reserves; we have not sold any dollars since last month, and this policy remains in place. We will continue to facilitate transfers through the interbank forex market, particularly to state-owned banks, which hold the majority of unsettled LCs.

A positive development is the strong remittance flow, which we hope will continue as a trend rather than a temporary situation.

A decline in exports would impact Bangladesh Bank, the economy, and dollar cash flow. Our policy aims to provide a competitive and stable exchange rate, aligned with inflation and productivity differentials, to best support the export sector.

Additionally, business associations must act responsibly, prioritise national interests over personal gains, and uphold good governance to earn respect from both the public and the government.

Syed Mahbubur Rahman

Managing Director & CEO, Mutual Trust Bank

Banking is central to Bangladesh's economy, yet weak regulatory oversight has allowed non-compliant and defaulters to flourish, exacerbating our current issues. If regulations had been enforced more rigorously, we might not be facing these challenges.

The central bank should focus on supervising compliance rather than micromanaging, while the board should concentrate on policy, leaving daily operations to management. The role of independent directors, who are supposed to protect depositors' interests, requires reform, as family members often hold these positions, compromising their objectivity.

Banks should operate independently, without relying on government bailouts—if they succeed, they succeed; if they fail, they fail. The fact that banks such as Padma Bank and Al Baraka Bank have received government bailouts underscores governance issues. Transparency and data accuracy are vital, especially since we are currently working with incorrect data, such as export figures.

Furthermore, contract enforcement must be reliable, as investors need assurance that contracts in Bangladesh are enforceable.

The Bangladesh Investment Development Authority (BIDA) is often led by senior or retired secretaries with limited business acumen; however, it should be managed by business experts.

Rizwan Dawood Shams

Managing Director, IPDC Finance

Unlike banks, Non-Banking Financial Institutions (NBFIs) are not permitted to accept government deposits, creating an uneven playing field despite serving the same customer base. This discrepancy places NBFIs at a considerable disadvantage, particularly as some banks with high levels of Non-Performing Loans (NPLs) continue to benefit from government deposits.

Regulatory provisions for CMSMEs also differ between banks and NBFIs. Given the crucial role CMSMEs play in economic growth, providing NBFIs with similar incentives as banks would encourage greater lending to this sector and foster further development.

NBFIs face additional challenges in raising funds through bond issuance due to a slow approval process from both the Bangladesh Bank and the Bangladesh Securities and Exchange Commission (BSEC). By the time approvals are granted, market dynamics often shift, complicating execution.

Mashrur Arefin

Managing Director & CEO, City Bank

Liquidity remains a significant issue, with money outside the banking system increasing from BDT 1.84 lakh crore in 2021 to BDT 2.90 lakh crore now, reflecting a loss of public trust in banks. This outflow needs to be reversed by incentivising people to deposit their money back into the system, which would help stabilise the economy. For instance, reintegrating BDT 1 lakh crore into banks could generate BDT 5.88 lakh crore in value through the money multiplier effect.

On a positive note, several banks, such as Islami Bank, have returned to positive cash flow by removing certain business influences and attracting new deposits. In the past month, many other reputable banks have also received significant new deposits, indicating a gradual restoration of trust in the banking sector. This will reduce our heavy reliance on central bank liquidity support. Confidence is expected to increase further once the central bank addresses issues such as recapitalising problem banks.

Regarding net foreign assets, the ADB and IMF have made significant promises. Once these funds arrive, money can be printed in accordance with global practices. However, the previous government failed to follow this approach, printing money without adequate net foreign asset backing.

Sohail R K Hussain

Managing Director, Bank Asia

We are all aware of the symptoms: NPLs, provision shortfalls, and capital shortfalls. To prevent these issues from recurring, we need to rethink our governance structure.

With bad loans potentially reaching around 12.5%, these figures reveal serious failures in checks and balances, including among auditors, rating agencies, the central bank, management, and internal controls. The solution lies in appointing an effective board of directors, as many problematic loans have stemmed from board and management decisions.

The banking system's challenges have damaged confidence both locally and internationally, affecting correspondent banks, foreign funds and FDI. We should learn from the policies that attract FDIs in countries like Vietnam.

A distressed asset management company is needed, and the central bank's autonomy in appointing key officials must be preserved.

Ali Reza Iftekhar

Managing Director & CEO, Eastern Bank

I was involved in drafting the Banking Company Act, aimed at promoting good governance, but it was significantly altered in parliament, with little regard for the committee's input. I suggest the governor revisit the Act and reestablish the industry's good governance recommendations.

Another issue is the definition of a "group defaulter" in the recent circular on banking governance. If one out of 20 companies defaults, how should it be handled? This definition needs to be reconsidered.

Furthermore, the formation of boards and criteria for membership is crucial. Only qualified and experienced professionals should serve on boards, focusing on policy and guideline formulation rather than making credit decisions. The effectiveness of board members is vital for the stability of the banking sector.

Dr. Ahsan H. Mansur

Given the current situation, instead of forming commissions, we will establish three action-oriented task forces. The first task force will focus on troubled banks, examining their asset quality and conducting independent audits. I also plan to hire international experts to perform forensic audit analyses of these banks. Discussions with the Asian Development Bank (ADB) are already underway, and they have committed to providing experts and financial assistance to support this initiative.

Another task force will focus on asset recovery, involving a multi- and inter-ministerial effort, including the attorney general. The third task force will be dedicated to strengthening central bank operations, reviewing banking laws, regulatory overreach issues, and central bank automation. We must ensure the central bank's independence and autonomy. We may also decide that the Financial Institutions Division is no longer necessary.

Yasir Azman

CEO, Grammenphone

The youth of our country have immense potential, and we must empower them with affordable technology and advanced connectivity solutions.

The telecom industry needs to act and innovate locally to address Bangladesh's unique challenges and regain foreign investor confidence. However, the high corporate tax rate of around 40%—compared to 25% elsewhere in Asia—remains a pressing concern.

Additionally, our licensing process is insecure and disrupts daily operations. Confusion over the roles of industry regulators and collectors has led to financial disputes, consuming the CEO's time and hindering innovation. We also face difficulties collaborating with the banking sector to promote financial inclusion and literacy for the poor. Achieving a cashless society requires strengthening both telecom and banking sectors.

Rajeev Sethi

Managing Director and CEO, Robi Axiata

Firstly, we need to urgently rethink and restructure our tax system. Currently, a customer paying for a service worth 100 Taka ends up paying 140 Taka, despite the regional tax rate being only 15%, with the lowest at 6%.

Secondly, investment restrictions are a concern. For example, I cannot lay fibre optic cables to transmit data from a tower to an international gateway. This inefficiency was evident during the recent forced internet shutdown.

Thirdly, financial mobile services (FMS) are crucial. In Kenya, the transaction value of a single mobile operator is three times the country's GDP. We should follow Kenya's lead but have faltered due to restrictive regulations.

Telecom operators should not suffer from miscommunication between the NBR and the BTRC. In any financial dispute, prioritising justice over revenue will enhance foreign investors' confidence in the country.

Erik Aas

CEO, Banglalink Digital Communications

We are owned by an international group. My shareholders have indicated a willingness to invest further if we can unlock new opportunities.

Telecom operators can support digital financial inclusion by offering mobile financial services. We have the most efficient distribution system available. All our customers have completed KYC procedures. It is not necessary to have a bank as an intermediary between the SIM card and the wallet.

Allowing mobile network operators to provide digital services can increase competition, benefit consumers.

Free access to information is essential for building a tech-driven nation. Restrictions on news, education, and entertainment through OTT platforms hinder digital growth. Encouraging access to news and education on digital platforms is crucial for creating a knowledgeable, tech-savvy society.

Syed Mohammad Kamal

Country Manager, Mastercard

Access to the internet is a fundamental human right. During the recent five or six-day blackout, payments across various sectors suffered immensely, with a 40% decline in transactions between July and August. It is crucial to send a clear message moving forward: restoring public confidence is essential to getting the digital economy back on track. Offering incentives to merchants who accept digital payments and to users who make transactions through digital platforms could enhance traceability across all commercial activities.

There is also a rumour about the removal of the 2.5% incentive for remittance payments. It is important to clarify whether this is true, as we need to encourage the flow of dollars through official channels.

Two years ago, the government mandated tax returns for credit card usage. While we have 8.5 million TIN holders, only three million are currently paying taxes. Although gradual progress toward expanding tax payments is necessary, making tax returns mandatory may be hindering the growth of digital transactions.

Raihan Shamsi

Chairman & CEO

DevoTech Technology Park

We have all heard about the ambitious $5 billion target for the IT industry. In 2013, as CEO of Accenture Bangladesh, I experienced firsthand the challenges faced by the world's leading IT services provider in the country. Although only 5% of Accenture's global revenue came from consulting and the remaining 95% from IT services, we struggled to convey this distinction to the NBR. Globally, Accenture was recognised as an IT services company in over 50 countries, but in Bangladesh, it was classified as a consulting firm, resulting in higher taxes. Back in 2013, Accenture employed 120,000 talented young professionals in India and exported $5 billion in IT services. Today, that figure has doubled to $10 billion from India alone. Although I successfully brought Accenture to Bangladesh through a plan developed with Telenor Group, the company departed three years ago.

The IT industry in Bangladesh holds immense potential. With a student-driven, pro-youth government and a large workforce, the sector has the capacity not only to create jobs but also to contribute to export diversification.

DR. Ahsan H. Mansur

We can choose to heavily tax the IT industry and stifle its growth, or we can lower taxes, allowing the industry to expand and, in turn, generate greater tax revenue in the long run. The current strategy is misguided and should be recalibrated to prioritise growth over immediate taxation. Unfortunately, the NBR seems focused on short-term revenue collection, targeting easy sources like banks and telecoms, which is a poor practice in our tax system.

On a positive note, we have been in discussions with BASIS to explore ways of providing loans at lower interest rates to new entrepreneurs. Our commitment is to support the industry from an SME perspective, ensuring that freelancers and startups have access to funds to build their companies..

Rupali Chowdhury

Managing Director, Berger Paints Bangladesh

The manufacturing sector is the largest contributor to internal revenue for the government, yet we face significant challenges across industries due to widespread labour unrest. The root causes of these issues remain unclear, and the responsible parties are unknown. Efforts to seek assistance from the police often yield no response, and while the army is willing to help prevent potential destruction, they cannot intervene directly in factory operations. This lack of support creates considerable uncertainty for multinational companies grappling with labour unrest and inadequate assistance from authorities.

The business community must unite, as discrepancies in VAT policies highlight a lack of consistency. Initially, when land was purchased, no VAT was applied, but the NBR subsequently imposed a 15 percent VAT, altering the terms and breaching the sovereign contract. While honest taxpayers fulfil their obligations, the playing field remains uneven.

Md. Miarul Haque

Director, FICCI

The logistics sector impacts everyone. We lag behind our competitors in efficiency, crucial for our country's competitiveness. NBR and customs are vital, yet our customs procedures rank among the lowest globally. To improve, we must focus on transparency and combat corruption, a major issue in the system.

Digitalisation is key. Although some reforms have been introduced, they are not fully practised, and reducing face-to-face interactions between regulators and traders is crucial to curbing corruption. The NBR should aim to increase revenue without sacrificing service quality.

Progress has been made through the National Logistics Development Policy, which proposed 62 reforms with support from the World Bank, IFC, BILS, and the private sector. Of these, 49 reforms were finalised and should be implemented immediately.

Aameir Alihussain

Managing Director, BSRM

Heavy industries are facing significant economic challenges, with many projects stalled or delayed and overall demand down by about 50 per cent. The government cannot monitor every project, and this lack of oversight has impeded progress. For instance, in our new project, funded for the first time in the private sector by JICA, 30 million dollars have been released. However, for the past two months, we have been waiting for approval from the BIDA.

The Chattogram Development Authority (CDA) and the Chattogram City Corporation (CCC) are not operating effectively. We need to expedite processes and prioritise development.

Accountability remains a critical issue. For example, we have a bank guarantee of 1.5 crore Taka from Global Islami Bank, but despite waiting for the last two years, and even after a three-party meeting with Bangladesh Bank, we have not received the cash due to ongoing delays and various excuses.

Data accuracy also requires improvement. Heavy capital industries depend on long-term forecasts, often planning four to five years ahead.

Mohsin Ahmed

CEO New Zealand Dairy Products (BD)

We are currently facing uncertain circumstances. The secretariat is not functioning effectively, and the civil bureaucracy must collaborate more efficiently with other organisations, including the police, whose morale has significantly deteriorated. Both institutions require revitalisation.

Depositors have lost confidence, so it is essential to promote a positive image.

The interim government should invest in the education sector to instil essential values in young people and help us envision a brighter future.

Sk Bashir Uddin

Managing Director, AkijBashir Group

We urgently need to reverse the regulations that have eroded depositor confidence in the bank. The law and order situation remains a serious concern.

Manufacturers are worried about fiscal measures. In export dealings, we are typically nominated by customers, forwarding companies, and shipping agencies. Currently, the nomination process is flawed, with licence values being compromised.

Many multinational banks in Bangladesh are profiting by providing credit or loans to local banks, contributing to a general lack of confidence in the financial sector. This issue must be addressed, and the cost of doing business reduced. Obtaining a conforming line of credit has become excessively expensive due to the involvement of nominated banks.

The NBR must evaluate the uniform implementation of taxes. In an open market economy, social justice can only be achieved through the consistent application of tax laws and regulations across all regions, businesses, and individuals. This is essential for addressing persistent inequality.

Resolving these issues is crucial to tackling persistent inequalities, which have been fuelled by the criminalisation of state institutions, corrupt bureaucrats, and flawed NBR policies. Effective policy-making regarding VAT, customs, and taxes is vital, as VAT is a fundamental tax.

Expanding the scope of essential industries is necessary, given the market's monopolisation.

Dr. Ahsan H. Mansur

The proposed digitalisation of NBR platforms is an initiative that has repeatedly failed. I was personally involved in at least two such unsuccessful programmes. One reason is that field-level representatives wish to maintain their power. These individuals prefer to retain control and deliberately resist digitalisation. If the government cannot address this issue, we will not achieve the necessary progress.

I suggest that three task forces be established: one for direct tax, another dedicated to VAT, and the final group focused on customs duty and trade facilitation.

Collaboration with the IMF and World Bank is essential. Automation is crucial to the entire development process.

No reform will be sustainable unless governance is properly addressed. A corrupt government will inevitably undermine the banking system once again. Without significant reform in the political process, any other reforms we implement will lack durability.

During the tenure of the last caretaker government, the concept of a regulatory reform commission was introduced but later abandoned due to bureaucratic resistance to change. We must generate a strong demand for a systematic regulatory reform in the country. South Korea's approach during the Asian financial crisis serves as a notable example: they reviewed every law, reducing the number of rules and regulations from 100% to 48%, and updated those remaining. Indonesia also underwent similar changes, resulting in a functional democracy that is projected to become one of the top five countries by GDP in the near future.

Recommendations

- Urgent measures are needed to restore business confidence, including strengthening the financial transaction system.

- Enhance security in the five key industrial belts—Chittagong, Ashulia, Narayanganj, Gazipur, Narsingdi, and Cumilla—and prioritise the smooth running of factory operations while addressing labour unrest.

- We must ensure the independence of the Bangladesh Bank.

- Establish three task forces: one for direct tax, another for VAT, and a third for customs duty and trade facilitation.

- Automation is crucial to the overall development of the financial system.

- Focus on improving ease of doing business criteria for long-term development and investment attractiveness.

- Implement the Trade Facilitation Agreement effectively to streamline business processes and reduce time delays.

- Involve key business stakeholders, including foreign investors, in reform discussions to signal that 'Bangladesh is open for business.'

- Bangladesh Bank's foreign exchange guidelines should be updated to include additional payment options.

- Ensure the Export Development Fund (EDF) is equitably accessible to all sectors, not just garment factories.

- Revisit the Banking Company Act and reimplement the good governance recommendations from the banking industry.

- Government agencies must improve coordination in their interactions with multinational corporations (MNCs).

- For NBFIs, provisions on issues such as fund collection, lending, and tax should be realigned with those for banks.

- The bulk of money outside the banking system should be brought back into the system by incentivizing people and restoring their trust.

- To achieve a cashless society, it is essential to strengthen both the telecom and banking sectors.

- Allow mobile network operators to offer digital services to boost competition, benefit consumers, and expand financial inclusion for the unbanked.

- Restructure the tax system. The NBR should adopt a more dynamic approach to revenue collection

- Transform BIDA into a dynamic entity led by business experts.

- The insurance sector needs to be revamped.

- The social security budget should be increased, with additional incentives provided to support SMEs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments