Leasing model behind Europe's EV drive at risk of breakdown

Low resale values for electric cars have pushed the leasing firms that drive Europe's auto market to double prices over the last three years and some are threatening to quit the business altogether if regulators force them to go electric too fast, industry executives say.

The jump in prices for electric car leases comes as cuts in subsidies for new EVs in key markets such as Germany are hitting sales and risks stalling Europe's electric transition, just when Brussels wants to step on the accelerator, the executives say.

"If we were pushed very, very hard, that everything has to be electric too soon ... my shareholders will say 'we don't want to take the risk' and we'd be out of the market," said Tim Albertsen, CEO of Ayvens AYV.PA, one of Europe's largest auto leasing firms. "Let's be honest, without us, who will take the risk?"

Ayvens, which is majority owned by French bank Societe Generale SOGN.PA, has a fleet of 3.4 million cars, of which about 10% are EVs.

Leasing companies play a pivotal role in Europe as 60% of new cars of all fuel types are leased, according to calculations by environmental group Transport & Environment based on data from market research firm Dataforce.

When it comes to EVs, the proportion is estimated to be as high as 80%.

According to data provided to Reuters by Dataforce, in the 16 European markets where it can identify fleet registrations - including Germany, Britain, France and Spain - 60% of new EVs go to corporate fleets and commercial buyers. Experts say those buyers almost exclusively use leases and about half of the remaining sales to private buyers are also leases.

In markets with no EV subsidies for private buyers, the dominance of corporates is even more pronounced. In Britain and Belgium, for example, individuals accounted for just 23% and 8% of new EV purchases respectively in 2023, Dataforce said.

The price of a lease is designed to account for the depreciation of a vehicle over the typical three-year lease period, based on estimated resale prices, or residual values.

But if second-hand prices end up being lower than anticipated when the lease ends, leasing firms take a financial hit when they get the vehicle back.

For various reasons - from Tesla's TSLA.O price cuts to concerns about charging infrastructure and battery life to the influx of more affordable Chinese EVs - second-hand electric car prices have been sliding in Europe since hitting a peak in October 2022.

According to figures provided to Reuters by data firm Autovista, resale values for EVs in Germany in early July were 24% below pre-pandemic levels and 30% lower in Britain.

That's in stark contrast to second-hand petrol models, which remained about 15% more expensive in both markets.

"People have become more accepting of used EVs, but they've got to be cheap," said Gary Cambridge, a partner at used car dealer Cambridge Motors in London. "If they're expensive, people don't want them."

PRICES MORE THAN DOUBLE

Leasing companies approached by Reuters declined to give specific details about any losses on EV contracts from the slump in residual values. Signs of the electric pain have shown up in disclosures by some rental companies.

Hertz HTZ.O has reported writedowns of about $150 million for the roughly 20,000 EVs it has been selling off at greatly reduced prices while Sixt SIXG.DE said lower residual values for EVs cut its 2023 earnings by 40 million euros ($44 million).

Bart Beckers, deputy CEO at Arval, the leasing company owned by French bank BNP Paribas BNPP.PA, said losses from low EV resale values were currently limited in number, given EVs are only a small portion of their overall portfolio.

"But the amounts are not insignificant," he told Reuters. "Like other leaders in the market ... (Arval) has been forced already to increase prices because of lower residual values."

Like Ayvens, EVs only make up about 10% of Arval's fleet of 1.7 million vehicles.

Some automakers have provided cash compensation to leasing companies for slumping EV values, industry executives say. Reuters reported in May that Tesla has offered discounts and other ways to mitigate losses to leasing companies, including Ayvens, though CEO Albertsen declined to say what they were.

But the executives say leasing companies still bear the risk for EV resale values, which is why prices have climbed.

Leasing firms approached by Reuters declined to give specifics about price rises for EVs as the subject is sensitive.

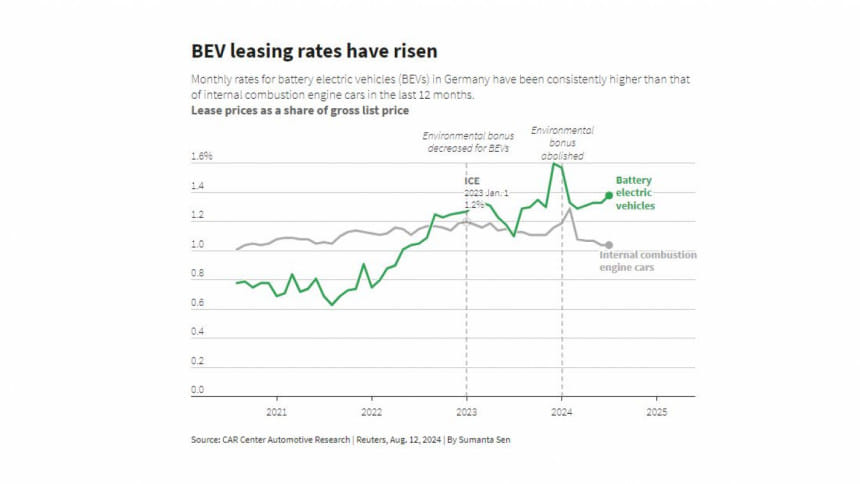

In Germany, Europe's biggest auto market, data provided to Reuters by German think-tank CAR Center Automotive Research show that EV leases have jumped in the last three years.

In August 2021, a lease for a 45,000 euro EV cost 284 euros per month, well below the 473 euros for an equivalent fossil-fuel model. Now, the cost for the EV has more than doubled to 621 euros while the fossil-fuel car has fallen to 468 euros.

German EV sales fell 16.4% in the first half of 2024 after the government abruptly axed subsidies for consumers in December and that decline has hit the overall EU trend.

Sales of fully electric vehicles in the EU rose to 14.6% of new car sales in 2023 from 6.1% in 2020 but that slipped to 14.4% in the first half as EV sales rose a tepid 1.3%.

MANDATORY SALES TARGETS?

Albertsen at Ayvens said the company was now leasing EVs for longer than combustion-engine cars to reduce resale risks.

It has also started to lease EVs out once or twice more "at a more affordable rate" and keep them in its portfolio longer, possibly up to eight years, he said.

Such is the concern about potential losses, RVI Group, a company based in Stamford, Connecticut that offers insurance guaranteeing a specific residual value for an asset, opened an office in Europe last year to field coverage queries.

Wei Fan, RVI's executive vice president for passenger vehicles, said he'd seen more requests from Europe in the past three years - all from leasing companies and banks - than in the previous 14 years worldwide.

He said he expected EV price volatility to continue for the next five to 10 years as the electrification process plays out.

Leasing firms say they are concerned, however, that an European Commission consultation on how to speed up EV adoption by corporate fleets could result in mandatory EV sales targets, as this would increase the resale risks they already face.

"The larger the share of EVs in their portfolios becomes, the bigger this problem is going to be," said Richard Knubben, director general of Leaseurope, an umbrella body in Brussels that lobbies on behalf of car leasing and rental groups.

The European Commission's "Greening corporate fleets" open public consultation, which included looking at possible measures to accelerate EV adoption, ended on July 8.

Brussels-based Transport & Environment (T&E) wants the Commission to mandate that Europe's large corporate fleets and leasing companies go 100% electric by 2030.

Stef Cornelis, T&E's electric fleets programme director, said forcing fleets to electrify would result in more used cars for consumers and speed up the EV transition.

A Commission spokesperson said the consultation was meant to identify substantive market shortcomings that warrant action but was not geared at gauging support for any kind of initiative.

The poor performance of Green and centrist parties in European elections in June has raised questions about the fate of the EU's 2035 ban on fossil-fuel cars, so it is uncertain whether the Commission would push for a 100% mandate.

But leasing companies are taking the threat seriously.

Leaseurope said an EV mandate would significantly damage leasing companies and Arval's Beckers says that, at a minimum, it would have to raise future lease rates further.

"Simply put, prices would go up," he said. "That would discourage corporate fleets from continuing to lease."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments