A budget divorced from reality

Self-contradictory is what best describes Finance Minister AHM Mustafa Kamal's fifth budget, and the last of the Awami League-led government's current term.

Take, for instance, the title of his budget speech: Towards Smart Bangladesh Sustaining the Development Achievements in a Decade and a Half. It speaks of transforming the nation into a smart one by 2041 and yet there are measures that would impede the process.

He proposes increasing the customs duty and value-added taxes for an array of essential software like databases, operating systems, anti-virus, word processor, spreadsheet and so on from 5 percent to 25 percent on the excuse of protecting the local ICT industry.

But, there is no local firm building such software. Besides, literacy in such tools is vital for the fourth industrial revolution. Which begs the question: why make the enablers of Smart Bangladesh prohibitively expensive?

This wasn't the only own goal from Kamal. He also raised the VAT for locally manufactured and assembled mobile phones, including the cheaper devices mostly used by the poor and low-income people.

Mobile phones are no longer a luxury product, and at a time of elevated inflation, this demographic will simply choose to forego their planned phone purchase.

In fact, in Kamal's world, inflation does not exist.

Inflation averaged 8.85 percent in the first 10 months of this fiscal year and way above the fiscal 2022-23 budgetary target of 5.6 percent.

The poor and the low-income are barely making it through, skipping meals or consuming the bare minimum.

So dire is the problem that a recent survey of the Bangladesh Institute of Development Studies found that 51 percent of Dhaka's total poor as of 2022 were new.

And yet, Kamal did not find it in his heart to make room in his budget to provide such people, who form the majority, with some sort of assistance.

If the trend continues, the impressive poverty alleviation over the decades, which has made Bangladesh the toast of the development world, would unravel spectacularly.

Actually, his social safety net budget is nothing to write home about. It is smaller than the current year's both in proportion to the overall budget and GDP. He increased the allowances by Tk 50 to Tk 100, which, in this time of high inflation, is not of much help.

He could have easily accommodated some sort of support for those being overwhelmed by the spiralling price level by doing away with the cash incentive for remittance, which has proven to be ineffective in luring in remittance in the presence of multiple exchange rates, and garment exports.

In fact, eliminating the cash support for exporters is the need of the hour to increase competitiveness given the impending graduation from the least-developed country bracket, which would see the duty benefits in the main export markets disappear.

Other than the odd mention of LDC graduation, the budget has no concrete steps in preparation for the post-LDC world.

In his quest to boost tax revenue collection, he heaped the burden on the middle-class amid the cost of living crisis while extending charity to the wealthy.

The imposition of the minimum tax of Tk 2,000 for those below the taxable income floor of Tk 3.5 lakh but have TINs and file returns, while keeping the income tax intact for the wealthy is simply pouring salt in the wounds of the less well-off.

Another baffling move of Kamal, like the hike in import cost for software, is the hike in customs duty for escalators and lifts to protect the domestic industry.

Given the need to build high-rise buildings to accommodate the growing population, lifts are not a luxury. But it is a costly exercise to purchase, install and service lifts.

What the duty hike would achieve is sending those with a very finite budget towards sub-standard and unreliable locally-manufactured lifts that would need replacing in a few years.

How does it help anyone other than the two sprawling conglomerates that have ventured into lift manufacturing?

In fact, his budget speech was bordering on schizophrenia.

In his desperate attempt to restrict the budget deficit to within the International Monetary Fund's bounds, he showed an abnormally high revenue collection target peppered with baffling tax cuts or hikes.

The target will remain unmet by a country mile, given the slowdown in the economy and the import curbs to safeguard the fast-shrinking dollar stockpile.

And, what is more damning is he did not take any definitive step towards addressing the elephant in the room, as in previous years: corruption in the tax administration that could be dealt with through automation.

Neither did he mention anything about reforming the VAT and income tax laws to make compliance more compelling.

His plan to increase the National Board of Revenue collection target by an improbable portion is simply wishy-washy.

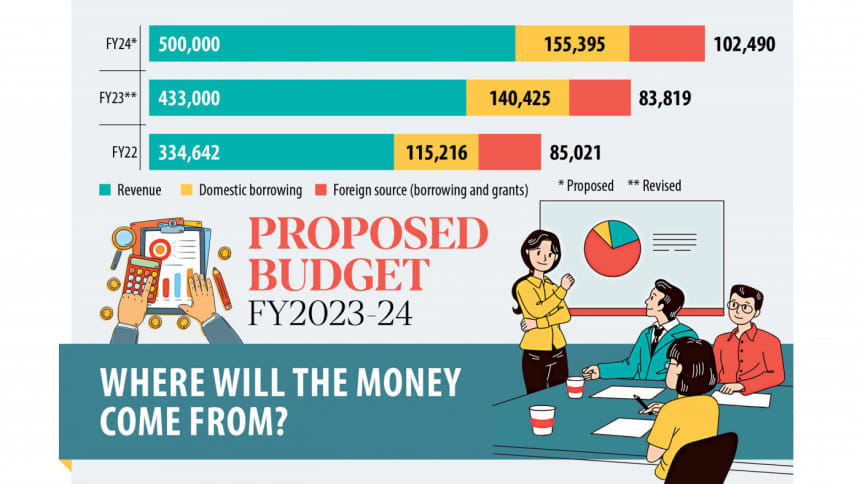

A large part of the budget would be funded with record bank borrowing and assistance from development partners.

The problem with bank borrowing is it crowds out private sector investment. And yet, he has forecasted that private sector investment would hit an all-time peak of 27.83 percent of GDP in the upcoming fiscal year.

Budget support from development partners is not a guarantee, so should he decide to borrow from the central bank during the course of the fiscal year to plug the holes in the books, it would be catastrophic, as it would fan the inflationary fire further.

Admittedly, there are some encouraging reforms in the budget, but those have less to do with Kamal and more to do with the shackles of the IMF's loan programme.

One such reform is the much-delayed automated pricing system for the energy sector to reduce the subsidy burden.

And yet, Kamal would be increasing the power subsidy in the next fiscal year. How the additional subsidy would be used has not been articulated. Would it be going towards the extravagant capacity charges?

Similarly, Kamal did not stick to all of the IMF's prescriptions: social spending -- which includes expenditure on health, education and safety net -- did not increase.

The Ukraine war has taught us the fallacy of depending on imports for subsistence, and the budget failed to provide anything to encourage local growers to ramp up the production of kitchen essentials.

In summary, this is a budget divorced from reality. Let's hope the reality becomes rosier over the next 12 months such that the budget becomes less injurious for the economy and the common people.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments