Budget lacks tools to contain inflation

The measures taken in the proposed budget for the next fiscal year have failed to address the most difficult challenge of containing inflation, and as a result, the suffering of common people will increase further, the Centre for Policy Dialogue (CPD) said yesterday.

The government has set a target to keep the annual average inflation rate within 6 percent in the next fiscal year, but it will be difficult to do so due to the current macroeconomic situation, according to Fahmida Khatun, executive director of the think tank.

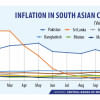

The inflation rate in Bangladesh reached 9.24 percent in April after registering a seven-month high of 9.33 per cent in March, just behind the decade high of 9.52 percent recorded in August last year.

The government has set a borrowing target of Tk 132,395 crore from the banking sources, but the question is how much will be borrowed from the central bank, Fahmida said at a press briefing on the proposed budget at the Lakeshore Hotel in Dhaka.

If the existing liquidity situation in commercial banks does not improve, the government will have no other option but to borrow from the central bank, and this will stoke inflation, she said.

The government also did not increase the allocation for social safety net programmes as expected to protect the common people from the adverse impact of high inflation, she said.

Allocation for social safety net schemes for the next fiscal year has been increased to Tk 126,272 crore from Tk 117,634 crore in the outgoing fiscal year.

This represents a hike of only 7.34 percent, which is way lower than the average rate of increase of 15.65 percent between FY10 and FY23.

The overall macroeconomic assumptions made for the upcoming fiscal year are far from reality, which is why the budgetary targets are likely to be missed by a substantial margin, Fahmida said.

"On the whole, the budget for FY24 failed to fully acknowledge the ongoing macroeconomic challenges and, therefore, offered inadequate remedial measures," she said.

Achieving other targets relating to GDP growth, export, import, remittance and foreign exchange reserves may be difficult as well given the current reality, she added.

For instance, the government set an export growth target of 12 percent for FY24 against the 5.4 percent growth achieved in the period between July and April of this fiscal year.

Import growth target has been set at 8 percent for FY24, though the country logged a negative growth rate of 12.3 percent during the first 10 months of this fiscal year.

The government has also set a GDP growth target of 7.5 percent for FY24 in contrast to 6.03 percent for this fiscal year.

The projections for these indicators appear to be overambitious when compared to the latest available figures, the CPD said.

Mustafizur Rahman, a distinguished fellow of the CPD, said when the government had unveiled the current budget in June last year, the crises in the local and global economies were already visible.

Despite the challenges, the government had set ambitious GDP growth and inflation targets, he said.

"But the projections were weak and ultimately put an adverse impact on the implementation of the current fiscal year's budget," Rahman said.

The mobilisation of internal savings should be increased, he said adding that the NBR will have to increase tax collection by 40 percent in the next fiscal year.

If tax collection target is not achieved, other areas such as deficit financing, development budget and bank borrowing will be impacted, Rahman said.

"We have been urging the government for long to form a banking commission to address the lack of corporate governance in the sector," he said.

Defaulted loans in the banking sector stood at Tk 21,000 crore in 2009 when the government came to power, but the amount has now reached Tk 131,000 crore, he added.

"Doesn't anybody have to worry about this?" he said.

Khondaker Golam Moazzem, a research director of the CPD, said the weakest side of the budget is that no effective measure was taken to tackle the inflationary pressure.

The government is focusing on collecting indirect tax rather than direct tax, which is why rich people and big businesses are the beneficiaries of the policy, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments