Strategies to increase FDI inflows

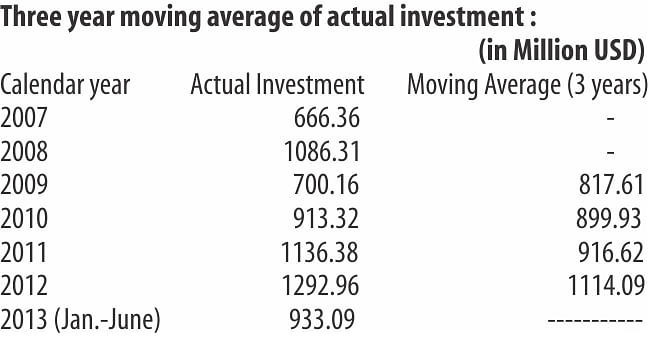

The flow of FDI in Bangladesh since 2010 has been encouraging. Actual inflows of Foreign Direct Investment (FDI) in 2011 reached the highest ever level in the history of Bangladesh at US$1,136.38 million, according to a report of UNCTAD (World Investment Report 2011). Investment friendly policy of the democratic government is largely responsible for this. The ease of doing business in Bangladesh is now widely recognised. But the red carpet that we roll out to our guests may be a little dusty yet. It is our endeavour to make it cleaner. Jim O'neill, the Goldman Sachs banker who had coined the acronym BRICS (Brazil, Russia, India, China and South Africa) has now coined “the Next 11” which includes Bangladesh, Indonesia, Mexico, Turkey and Vietnam. Bangladesh is the only least developed country of this set. It is well on its way to achieve the UN Millennium Development Goals targets. Child and Maternal Mortality is down, more children go to schools—more girls in particular. Bangladesh has done better than most of its South Asian neighbours in this area. Cafeteria approaches and innovative civil society initiatives for social transformation were born in Bangladesh (B.Lund, Bangladesh Frontier Forum, Oslo, 2012). Bangladesh has a population of 155 million which is the 7th largest in the world, a growing middle class and an emerging market. It is a multi cultural, multi religious, multi ethnic country where the different races and cultures have cohabitated for millennia. In terms of investment protection Bangladesh shares the 24th position with Norway. Thus where the development community has laid the foundation for progress it is the business community that can be catalysts for projecting a much better image of Bangladesh as a destination for trade and investment.

The main challenges facing FDI in Bangladesh are:

* Investment climate

* Infrastructural inadequacy

* Economic and political governance

* Accountability and access to information

* Steps towards ending resources crunch.

* Multilayered and dysfunctional bureaucracy

* Knowledge deficiency

* Lack of matching inputs in the sphere of production

* Political economy of governance

Investment climate:

Significant improvement has taken place since this government came to power in 2009. We can still go further.

Bangladesh is an open market based economy and private sector is the major engine of growth.

The risk factors of FDI are minimum in Bangladesh. The effort is on to further reduce these. Bangladesh is a high profit destination for the FDI. Proven export competiveness, strategic locations, regional and global access to information highway are its other advantages. It is a multi party parliamentary democracy where freedom and justice are of utmost importance

Bangladesh is the 27th best investment destination in the world, according to MIGA.

Bangladesh has scored higher than the average rating of around 100 developing countries in the CPIA of the World Bank that assesses four broad areas including economic & public sector management. The areas are a) economic management, b) structural policies, c) policies for social inclusion and d) public sector management and institutions

Bangladesh scores 3.5 out of a maximum 6 points where developing countries average point is 3.3 (BD score 0.2% higher)

Basic requirements for sound investment are a) good macroeconomic statistics, b) accurate financial statements, c) stable regulatory framework and d) clear understanding of corporate governance structure. Bangladesh possesses all of the above at the present time and the quality of macroeconomic statistics is improving gradually. All these are under an umbrella of sound macroeconomic fundamentals.

Bangladesh has created equal access to knowledge (Digital Bangladesh).

Ease of doing business indicators that include, starting a Business, Dealing with Construction Permits, Getting Electricity, Registering Property, Getting Credit, Protecting Investors, Paying Taxes, Trading Across Borders, Enforcing Contracts, Resolving Insolvency given the economic realities of the country showed marked improvements. An investment project can be incorporated in less than a month and all formalities completed. Investors have access to foreign loans and credits and other services at no additional costs.

Democracy and strong democratic institutions:

* Local government institutions with adequate strength and jurisdiction. Elections have been held and functions devolved to local tiers of government recently.

More stable and developed markets have a web of intricate regulations and other constraints which limit investment opportunities. Growing markets, with innovative entrepreneurs, offer greater business opportunities vis-a-vis old markets with stagnant demand and high taxes.

Under such situational contexts movement of capital to emerging markets like the ones represented by countries of south Asia is likely to be more profitable with no added risks.

Existing slacks in the economy of Bangladesh offer enormous opportunities of high return and low risk investments in infrastructures, utilities, manufacturing and consumer goods industries.

Large and lumpy investments against this backdrop would not be inflationary and should expand the productive capacity of the economy offering a variety of new goods and services which would further promote sustained economic growth and social development

For a substantial increase in economic growth of the county (currently at 6%) the aggregate domestic investment must reach the level of 30% of GDP. Attempts are on to reach this level. Innovative entrepreneurship is somewhat weak now and needs a huge face uplift.

Infrastructural inadequacy

Removal of major impediment in physical infrastructure including utilities, economic and legal infrastructure, and better enforceability of laws and regulation clearly would attract more FDI.

FDI is the function of the following 4 (four) composite variables:

1. Macro variables

2. Firm/Corporate level variables

3. Policy Variables

4. Risks and Uncertainties

The state of Bangladesh can try and improve all of these vis-à-vis their existing level of performance.

The challenges in regulatory infrastructure include improving the taxation, customs, L/C, Banking related matters.

The overall environment of Doing Business in Bangladesh has to be structurally made easier, cost effective and investment friendly. This is a high priority concern of the Board of Investment.

Sectors:

The high priority sectors are Infrastructure projects (Power Generation, Gas and Oil Exploration, Industrial Parks, High-tech Parks, Expressways, Roads, Ports, Bridges, etc.), Composite Textiles and Ready Made Garments with backward linkages, Steel and Engineering, Infocomm Services (IT and IT enabled services), Textile and other Industrial Machinery and Parts thereof, Frozen Shrimp, Frozen Fish for export, Finished Leather and Leather goods, Home Appliances, Telecommunication equipment, Semi-Conductor, Fresh Fruits & Vegetables, Cooked/Semi Cooked Food items, Canned Juice, Dairy and Poultry, Livestock and Fisheries, Automobile, Central Effluent Treatment Plants in Industrial Areas, Paper from green jute and Allied Products, Hotel & Motel, Manufacturing of bicycle and two wheeler for export, Jute products, Tourism, Shipbuilding and New forms of social capital with mass transit networks, urban sewerage system, river reclamation, forestry and clean energy projects.

What needs to be done:

* We should put in place an investment regime which is credible and predictable. There should not be frequent changes in policies and regulations.

* New conduits of bringing FDI have been created. The PPP (Public Private Partnership) and Special Economic Zones, for lumpy investment with high externalities.

* Inter and Intra agency coordination (those agencies that get involved in FDI processing) need to be strong and cohesive. Presently they are not. Their investment orientation is also very inadequate.

* Improvement in Banking, Customs, Immigration and other service delivery regulatory agencies is a must for increasing FDI.

* The foreign investors are particularly wary of frequent changes in different govt. policies. To the extent possible this should be avoided.

* Physical and regulatory infrastructure need to be provided to the extent practically possible for the investors to ease doing business.

Law and order:

* Proper role playing of the police administration, particularly those handling the members of the public.

* Effectiveness of the control is to be taken into consideration. These can be structural, sectoral, and legal-juridical.

National Economic Management:

* Effectiveness of the government in reducing/eliminating inefficiency/corruption/payola/rent seeking practice in the government machinery in particular and society in general.

* Capacity need to be created to distribute services fairly, efficiently and equitably.

* Capacity to utilize the tax payer's money for their welfare by ensuring 'value for money'.

* Accountability (through parliamentary means, budgetary process, judicial review, appointment of Ombudsman, etc.).

* Size of the government/how effective it is in reducing/eliminating corruption and delivering goods and services.

* Capacity to maximize interactions with stake holders at sub-national and local levels of government

* Capacity to focus on deprived, marginalized and powerless classes like women, children and the poor.

Foreign direct investment of high quality and diversity can help achieve all of these.

The author is Executive Chairman, Board of Investment (BOI).

Views expressed are personal and do not necessarily represent those of the government or BOI.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments