Reform and policy support for capital market

Those who say that the Bangladesh capital market has already had enough reforms and also the policy support, they are mainly outsiders; they did not have any stake in the market directly. Their observations are based on the reforms the market has undergone in the last one and a half decades and the policy support the government rendered to it from time to time. But they forget to recall that the Bangladesh capital market started its journey in 1976 from a condition of almost non-existence in an economy dominated by the state sector. To position the Bangladesh economy in a framework of market economy since the 1980's was a daunting task. As the state sector relaxed its grip on the economy, the capital market also started moving. More and more companies went public and more and more investors showed interest to invest in the stocks of listed companies.

Initially, there was no strong regulator for the market - it was the Controller of Capital Issue (CCI), normally a Joint Secretary of the government, who acted as the regulator. The Dhaka Stock Exchange, which was founded in 1956, remained dysfunctional between the period between 1971 and 1976. The Exchange was a brokers-owned and brokers-managed institution and failed to convince the policy makers the need for a vibrant capital market in the economy and the need for giving policy support for its growth and expansion. Of the 250 brokers or exchange members, as per the memorandum of the exchange, only a handful was active. They used to assemble on the exchange floor at noon and finish the trading in stocks within one hour. Only nine or so companies were able to remain listed with the exchange when it started its new journey in 1976, the other companies that were with the exchange's list since the days of Pakistan were nationalised by the Bangladesh government in 1972.

But as time passed and the economy embarked on a road to a market economy the policy makers understood the need for a capital market for the supply of long term capital to the upcoming businesses. Little by little, the policy support started coming, mostly through yearly Finance Bills, making provisions for tax relief for the companies that went public with their share sale and for the investors who invested in the listed companies' stocks. The print media – the only media available then to reach the public, initially showed a cold shoulder to the needs of the market but in later years especially since the 1990's, started covering the issues relating to it. The market saw ups and downs including booms and busts in between the periods.

But the booms and busts were not the result of normal interplay of market forces, but rather were the results of a massive manipulation of stock prices by the scam masters. The stock market saw the first of its stock scams in 1996. The scammasters manipulated the prices of stocks to such a height that ordinary investors got the idea that investing in stocks would only bring profit. The inevitable happened. The market crashed and with the crash thousands of investors were rendered pauper. The stock market scandal of 1996 brought the policy makers on the dock. They were questioned time and again by the investors and public at large for their ineptness in protecting the interest of the investing public. Though a full-fledged security regulator, named SEC, was set up in 1993, it was found to be incompetentant; sometimes looking the other way when scams were taking place.

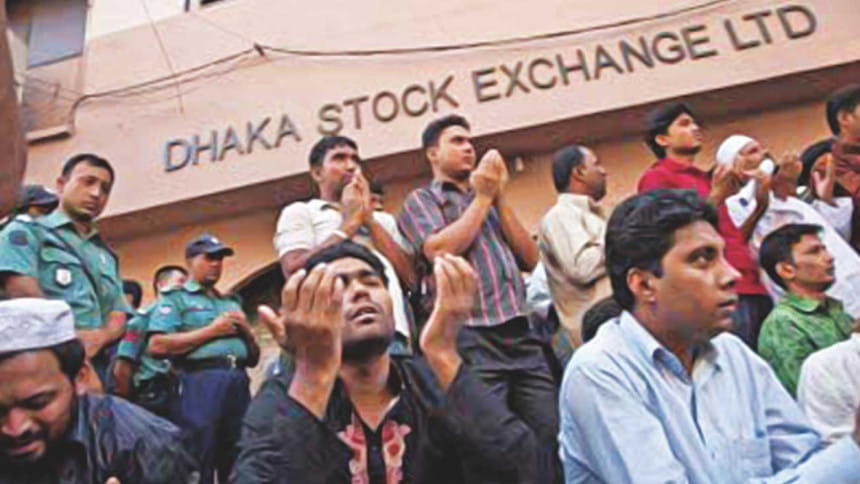

Investors after being robbed of their money left the market in large numbers and others became inactive. The stock market scam of 1996 opened the eyes and shook the conscious of the policy makers who thereafter started thinking seriously of bringing reforms in the market. In 1998,the Asian Development Bank (ADB) came up with a credit offer to the government. They madethe offer conditional on a package of reforms to be brought in the market and also in the DSE. The reforms included automation in the stocks trading system, separation of trading side from the management side of the DSE, and some other issues relating to the separation of powers in case of conflict of interest, regulations regarding mutual funds, and about the pricing of IPOs. Those reforms both in the regulatory framework of the then SEC (now BSEC) and the operational aspect of the DSE were brought about to restore confidence of the investing public who either had left the market or remained inactive after being beaten by the scam masters in 1996. At one stage, between the periodof 1997-1999, the stock prices came down to such a low in the face of massive exodus of investors that anybody could purchase stocks by more than two to three times of what he could have purchased in 1996. It took three to four more years to lure back investors to the market. But many of the old investors of 1996 never came back. The stock market created a kind of fear in their psychology. By 2002, the market to an extent regained a semblance of normality and thereafterit moved on forward. But the market moved forward at a faster rate than many other normal stock markets of the world that put it again in a condition of an impending disaster. By 2009, stock prices were built up to such a height that it was in no way sustainable. By October/November 2010, the inevitable happened - the market crashed under its own burden, the stock prices fell up to 70% from their peak prices within a month. The giddy rise of price in 2010 was also the act of manipulation by the scammasters, this time only some new scam masters were added with the old ones of 1996. But style and nature of the scams were the same - robbing the pockets of the innocent retail investors by pushing the stock prices sky high. Small investors in thousands took to the street protesting the scam but nobody cared about their protest. The only thing that was done was the forming of a committee by the government to enquire about how the stock scam happened and what could be done as remedies. The Enquiry Committee unmasked the scammasters by describing how they lay the net of robbing and in turn deplored the incompetence and inaction of the BSEC. But things stopped there. The retail investors who were robbed of their capital got neither compensation nor any other kind of justice.

The issue of the stock market and the investment in it became a scornful matter to the government. They wanted put the issues relating to the stock market under the bed in a resting condition if they could.

However, the government was too eager to availof any credit line from the multinational donor agencies, be it in the name of reforms in the capital market development or otherwise. After the painful stock scam of 2010, the ADB again came forward to help Bangladesh in carrying out the second generation or the remaining reforms in the market. Now the market is undergoing a reforms program directed by the ADB. One much desired and sought after reform is the improvement in the financial reporting carried out by the auditors. The government, though late, promised to get an act passed called the Financial Reporting Act (FRA). Under the Act, a Financial Reporting Council (FRC) will be set up and FRC will be the regulatory watchdog in the auditing industry. But the government's intention was met with opposition from the auditors lobby whose members, till now, went scot free even if they committed serious crimes in the name of auditing.

The Act relating to mergers, acquisitions and takeovers also needs to be changed. The demutualisation of the exchanges till now is a half done work. The stock market needs new products like bonds, sukuk (the Islamic bond), futures and options. A small scale commodity trading also warrants a try. New financial products and regulation relating to their trading should go hand and hand. A continuous policy support will put the Bangladesh capital market in its right place in the economy.

.................................................................

The author is a Professor of Economics University of Dhaka, Email: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments