Start-ups: By the young and the brave

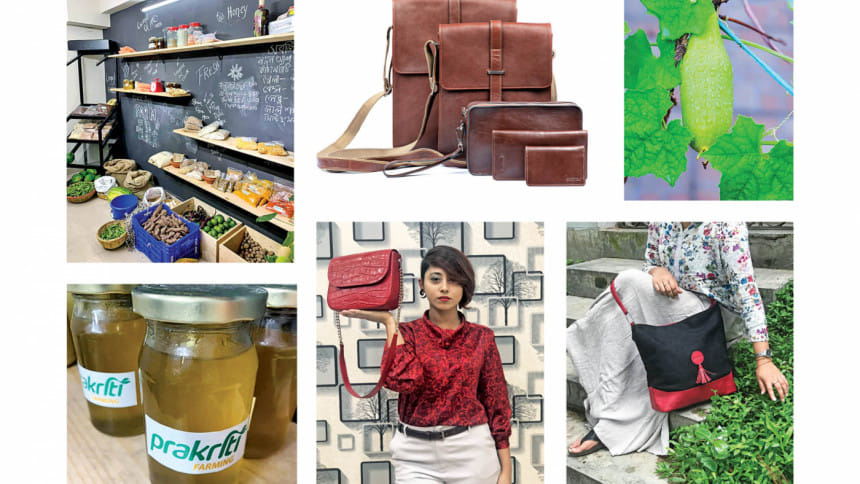

Shiny leather bags stacked on storage racks, waiting to be exported thousands of miles across the seas; that's perhaps an everyday scenario for Taslima Miji, someone who had a very humble beginning with her start-up, Gootipa.

Miji's journey began in 2016. Despite failing to be successful in a tech venture, she did not lose hope and instead, attempted to try something new, where she could prove her prowess as an entrepreneur, and leather goods seemed to be the perfect solution.

"I travelled far and wide only to discover that Bangladeshi leather had huge potential, and a market all over the world — it was simply underutilised, and I wanted to make the best of this opportunity," said Miji.

And so, her journey as a start-up entrepreneur began.

"I started everything from scratch, the idea generation, the need assessment, even the pitch —everything," revealed the entrepreneur. "My thought process from the very beginning was to be able to stand on my own two feet first and establish the company, before proving to the rest of the world that it was worth something," Miji added.

Taslima Miji began by outsourcing leather shoes from elsewhere before selling it. While doing so, she realised the need for local leather in the national context. She felt that niche groups are always on the lookout for quality, local products.

Based on that very belief, she started her footwear factory in 2017. It was easier said than done. After several try-outs, Miji faced a significant loss in the venture. At the same time, the overhead costs were on a steady rise.

"Luckily, this is also the time when I tried diversification by manufacturing bags, and this provided me some breathing space, as bags don't need to be made in batches like shoes," Miji explained.

To add to the hard times, an angel investor wanted to leave Miji's company with returns on investment (ROI). She luckily managed to skirt the disaster because during an exhibition at the Dhaka International Trade Fair (DITF), she met a Dutch buyer who was quite taken aback by her story of entrepreneurship, sustainability, and environment friendly approach to business, and more importantly, respected her more so as an aspiring woman entrepreneur, fighting against all odds to survive in a male-dominated business environment.

"I was very lucky to have been able to meet them at the right time. But the process was quite lengthy; they tried out my products first on a trial basis, just to check the feasibility. Later, after successfully acing the process, I was made to do an intensive one-year program under the Dutch Government on various subjects like entrepreneurship, business administration, financial management to sourcing, and long-term sustainability. As a result of all this, I was able to establish my brand Gootipa with a strong foothold in the local market, and I also began a white labelling company, Leatherina, through which, I began manufacturing export-oriented leather goods for international sales," revealed Miji.

On the front, it seems to be the perfect rags to riches story of a struggling entrepreneur, but what one does not notice is the struggle underneath, the resilience, the debt crunch, investment partner backouts, factory closes, the expanding overhead costs, and debilitating frustrations.

"I have survived through all of these because I was adamant and I had a strong understanding of my business. My strength, efforts and time has been spent efficiently on building the business first, and then looking out for investors. This is where most entrepreneurs go wrong, in an attempt to get financial grant, they forget to build a strong model that can actually hold on to the grant or weather-out tough times.

"My advice to all future start-ups is that they must build their company first, and level it with a strong foothold; there should be passion and a structured business plan behind every new beginning. Once that is established, the investors will eventually come in, one does not have to run after them; they will find you. Just keep on doing your work diligently," expressed the entrepreneur.

Ashna Afroze, another start-up entrepreneur in the emerging ecosystem of Bangladesh, carousing in the struggle to find appropriate investors for her start-up, Prakriti Farming, also spoke about her journey. Being an entrepreneur in the organic agricultural sector, she agreed to the fact that networking is essentially the best way to gather investments in her field of business. However, according to the budding entrepreneur, networking also takes a lot of time and pressure, especially on an entrepreneur still struggling to juggle between the finances and management of the HR policies.

"I have been attached to Light Castle Partners, an incubator firm, for quite a while now and thanks to them, I have been able to receive quite a lot of mentorship trainings from reputed organisations like World Bank, IFC, etc.," acknowledged Afroze.

She also confessed to actively looking for an investor, and also acknowledged the fact that she needed someone who would equally value her company and have a matching mind-set. Otherwise, she was very sceptical about any form of investment, at all.

"I don't want my investors to pull out their money whenever they want to, instead of rolling it back into the business. They must maintain their investment in the business for the long haul, otherwise it is pointless," said Afroze.

Referring to the case of Pathao, she said, "That's what happened to the famous ride-hailing company of Bangladesh — the bubble suddenly burst!" she remarked. "I really don't want that to happen — but I also need investments to expand the company further."

When asked whether she got any help from the government sector, Afroze was a bit sceptical.

"If you search startup.bd.idea you will find information by the ICT sector, where you can enlist yourself and they will eventually help you get acquainted to the start-up ecosystem. But it would have been easier if these opportunities were largely advertised in the newspapers, or on a wider media, maybe a conclusive hotline, a point to point communication link, could be developed for the idea generators!

"Why not a separate segment for traditional businesses likes mine? Currently, the start-up ecosystem is more geared towards tech-based companies. I do realise the fact that these tech companies are certainly the future, but we also need investment to survive. Don't we?" she said.

These were two different viewpoints to the start-up ecosystem in the country. Syed Tahmim Islam, Managing Director and CEO of Axilweb, a software based company in Bangladesh that exports IT based solutions to companies abroad, also added to the perspective by sharing his start-up narrative.

"From the very beginning, our strategy was to depend on bootstrapping and perfecting our products. We never hoped for intense diversification or profit hunting. Instead, we simply concentrated on our two SBU's and its development. Ultimately, our clients, being satisfied with our products and services, referred us to others, and in the process, helping to get foreign investors interested."

Islam was clear from the very beginning that external investments were not a necessity, and should only be explored when there was no alternative. According to the start-up magnate, getting more heads involved only diluted the intensity of a project and made it unnecessarily complicated.

Taslima Miji, founder and owner of Gootipa Leather goods, voiced similar views, saying, "I have heard a lot of success stories regarding these companies, but what I can say from my personal experience is that it's not all hunky dory from the entrepreneur's end, even after they get an investment. The struggles are ever present and persist. The main idea is to invest back efficiently so that the company is able to profitably expand, and hence, there must be proper management of the investment and cash flow. As for the VCs and the incubator companies, my suggestion as an entrepreneur, having seen the system upfront, is that they must be dedicated to the companies they are investing in."

It was clear from these encounters that the start-up culture and the funding ecosystem was definitely more than welcome, but on the other hand, these very entrepreneurs also expected that the investors stay open, remain truthful, and actually stay invested in the business.

Without this basic openness and link between entrepreneurs and investors — this rising trend would fall, problems would remain, and the budding entrepreneurs would be unconvinced in registering, and in turn, we, as a nation, only fall back — when the rest of the world only marches forward.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments