‘We’re at the bottom of the industrialisation ladder’

What is your opinion on the recent growth momentum demonstrated by Bangladesh? Is it sustainable?

Since the 1990s, Bangladesh has done well in terms of increasing growth. It is apparent that the modest growth that we had during the seventies and eighties has been overtaken by recent growth, especially during the last few decades. Even though the growth is sustainable, it cannot be taken for granted.

It is important to mention here that private sector investment used to be the main source of overall growth. However, since 2010, the private sector input has stagnated, not increasing much. The amount of overall growth, in relation to the level of private sector investment, is linked to the latter. We are achieving growth rates now which are not compatible with the amount of investments we are making into the economy. That is a matter of concern.

As the country moves upwards in regards to prosperity, technological innovation comes into the picture, with capital-intensive factors being essential. The incremental capital output ratio which we needed in the past to generate one unit of income is no longer applicable amidst the current scenario. For example, farmers nowadays require various equipment in order complete their tasks, which is a vast difference to common traditional methods. Thus, capital-intensity has increased in all kinds of sectors in the country. The experiences of China and Korea show that as they have increased their per capita income, their incremental capital output ratio has increased. This is because labour becomes costly, therefore substitution of labour results as a natural phenomenon, as more capital is utilised.

That is why the garments sector in Bangladesh is facing issues with labour. In order to maintain momentum of growth, and the fact that the incremental capital output ratio has to increase, much more investment on capital becomes necessary.

Three sources could give possible solutions to this problem at hand. First, the domestic private sector is the main part. Second, foreign direct investment is also there, and combined with the first, they constitute for the whole private sector (foreign and domestic). Third, public sector investment (government) is also included. However, pertaining to the third factor, it is not currently providing value for money in Bangladesh. This means the current 7 percent which the public sector is investing, is possibly seeing returns at 4 percent. Thus, translation to real investments into the economy is not occurring, and even the present administration would be aware of it. The bottom line is that we need to increase the efficiency of investment. Which means that we must increase the intensity of investment. The government sector's efficiency levels are low, which is also a concern.

Do you think Bangladesh has done as well as it should have in terms of growth? What could Bangladesh have done differently? What were the biggest mistakes? And what did we do best?

We have a higher overall potential. We certainly have done well, but we could have done better. In many ways we have done quite well compared to many other developing countries. But we have not done as well as some of the other countries that have been in similar situations to Bangladesh. So, in my view, if we could have achieved important benchmarks like investment targets, revenue goals, a successful investment climate in the country and improvement in governance, we could have actually achieved a growth of 10 percent.

Vis-a-vis such circumstances, we are struggling to even reach eight percent. Even if we do achieve eight percent, it might not end up being sustainable. Low levels of efficiency, in regards to investment, is a factor which is related to this barrier.

For a country to sustain its growth, the whole social fabric needs to be improved. Human capital, education, health, social protection, alleviation of property, and infrastructure are elements of that and investments are needed in each section. We need to mobilise our revenues significantly. Bangladesh has miserably failed in revenue mobilisation. Bangladesh's tax-to-GDP ratio has been a matter of concern in the Five-Year Plans. In fact, since the Sixth Five-Year Plan to present time, in spite of targets being set in the plans for an increase in the tax-to-GDP ratio, it has actually decreased. It now stands at 9.2 percent, which is a huge obstacle for the further development of Bangladesh. It must change in order for us to graduate to an upper middle-class nation. The government might find it tough, therefore, to maintain a credible fiscal policy. During the last 10 years, we have actually weakened our whole financial system. All the indicators show that we are well below the previous levels of 2010 in regards to the financial sector. That is not something which can provide good support for an increase in Bangladesh's growth rate. These are fundamental weaknesses we must work on.

We need huge investments in infrastructure. How is it possible to fund it if we do not have the required revenue? We cannot fund them using borrowed resources. That will create another problem. The Asian Development Bank, World Bank are fund providers for us. The biggest finances are usually being provided by them, including Japan. Every year, projects are funded by such entities. We are growing, in terms of foreign financing, albeit at a slow pace. Projects should also be implemented quicker, especially those which are being funded by foreign organisations. However, the scale of total required investments is somewhere in the range of hundreds of billions of dollars. Nobody is going to give us such amounts, even though many organisations, as mentioned before, do provide us annual payments.

Our current total annual foreign aid constitutes for about two percent of our total GDP. Our total investment required in the economy is growing quickly. The government needs to spend and invest a lot. Health, where 0.6 percent of our GDP is spent on, is something of note. In industrial countries, this percentage is usually seven, eight or even nine percent. Bangladesh spends about 2 percent of its GDP on education, which is again an indication of our nation's resource-scarceness. We must be aware of the need to use our resources efficiently. We are not getting the right quality of services, and in addition, the infrastructures which are being invested on, are of low quality. We are, thus, not getting value for money. That is an area which needs to be looked at.

What advice would you give our policymakers to improve our growth rate and make it more sustainable?

The private sector gets money from the financial sector, and that means banks for Bangladesh. As an entrepreneur, one would naturally want to invest. The investment comes from the financial sector, and it comes from depositors' money. That's what banks are there for. Another channel is the stock market. Issuance of initial public offerings (IPOs) are followed by payments of dividends to investors. The third channel is the bond market. Issuance of the bond is followed by registration in the stock exchange and the private sector, insurance companies etc. may buy those bonds, while interest is paid on the bonds and thus, capital is raised. This is how things are financed.

Bangladesh's bond market is non-existent, where not too many companies are currently active. The stock market is in deep trouble, and people do not have confidence in it. Good companies are not going there. Banks are also getting into trouble. Thus, how may one expect the momentum of growth to be sustained, which would fundamentally strengthen the financial structure of the country?

The government must focus on good governance, management and take measures to generate competition efficiency to make the banking sector and stock market healthy once again. The other factor is the revenue mobilisation issue, which I believe needs changes. To become a high-income country, we probably need a large amount of resources allocated to the public sector. The current rate of 9.2 percent, in regards to the public sector's investment to GDP, needs to be increased to about 25 percent for us to think about becoming a high-income country. It is not an easy challenge to overcome, but it is not impossible.

In Nepal, this same percentage amounts to 19 percent—India 18 percent, Germany 44 percent, United Kingdom 35 percent. Even some African countries have 20-plus percentages. So why should Bangladesh be at nine percent? There is no country in the world which can become even an upper middle-income country with this sort of domestic resource mobilisation. It is simply not possible.

VAT, direct taxes, corporate tax, personal income tax and customs duty are some of the areas where the government makes money from. The financial sector (bond market, banks, stock exchange, non-banking institutions, insurance companies) has four to five components. Insurance companies in Bangladesh are in a shambles. Banks are also in trouble. Many of the financial institutions are in the red or yellow zones, which does not mean something positive. We are in big trouble in relation to such matters.

Policymakers should have the objective of having a strong financial system.

To do that, we must acknowledge the fact that we have a weak financial system, which is getting weaker by the day. So, we must reverse it. We reverse it by not easing the conditions, but tightening them. What we have done is ease them, which is accumulating the problems. Easy conditions for loans, private bank owners' protocol (tenure, etc.), growing economy with increasing number of defaulters are not components of an efficient system. A growing economy should mean that people are paying their debts on time, because good money is being made. And so, either the economy is not growing as much or there is a moral hazard issue, which means people are just simply not paying up. That is what is happening now, with both the aforementioned elements involved.

We need to improve our regulatory governance with seriousness to improve the overall situation. The government has confirmed a fixed uniform interest rate for all kinds of deposits at (6 percent) and decreased interest rate to single-digit for borrowing (at 9 percent) from April 1. Already, the banks' deposit growth has fallen. If the interest rates are reduced to 6 percent, banks might collapse. Banks' lending to the private sector is now at nine percent, which used to be somewhere close to 22 percent. How can an economy grow at eight percent with nine percent private sector credit growth? How can an economy expand in this way? It means that fundamental changes are required.

Current policies are taking us towards unmitigated disaster. Nobody will want to lend to the SME sector now. Managing small and medium-sized loans will now be dealt as loss-making propositions. How can we think of growing our country by ignoring the whole SME sector? That would be suicidal. The money will be going away from the banks, with the recent changes in the financial sector taking affect from April. The banks' capacity to lend is about to decrease. How, then, will the private sector receive money? Who will get the small amount of money available in the banks in that kind of a scenario? The answer is influential people and powerful people. Bank owners will also trade finances between each other. What will happen to the others? More credit deprivation and wider distribution of wealth will result.

Everyone in the economic circle knows that credit is given to the high-risk borrower at a high interest rate. This is because of higher returns. And the SME sector is a high-risk sector. To increase the appetite, higher interests need to be allowed, which is not being currently implemented. This means that SMEs will, when banks refuse to provide them with loans, have to depend on other money lenders. Will it be an equitable policy for the future, keeping in mind the affects it will have on the SME sector? It seems that it is a destructive policy.

Germany, Japan are countries where most of the employment comes from the SME sector. Bangladesh is no exception to that. Repair shops, tea-stalls and regular shops are examples of SMEs. Who will agree to give such businesses 50 lakh to 1 crore taka loans under the new policies? This will destroy the financial system and also access to finance, which is very important for economic growth. The vast majority of the population will be deprived in this way. It is the most regressive distribution of resources. We must look at it from the supply-side. If the supply ceases to exist, then what would be the point of the changes taking place?

The banking system needs liquidity, supply of funds, so to speak. This policy will drive the supply away, while increasing demand, which in turn will be unmet. Financial famine is, therefore, quite possible in the coming years. My hope is that the government will fix the issues.

How far has Bangladesh come in terms of industrialisation?

The export-oriented faction of Bangladesh's industrialisation is dominated by the presence of the RMG sector. Bicycle export had made a mark, but stumbled soon. These cater to the domestic market, usually not being efficient. That is one type of industrialisation, where costs are high and the overall quality is usually low. Tariff barriers are usually put onto goods coming into Bangladesh, where high interest rates and customs duty are major obstacles. Bangladesh has one of the highest tariff protections in the world. The average effective rate of protection is at 27.5 percent, whereas, rates of other Asian countries linger at about 4 percent. We even have high protection on biscuits, an industry where we have been active, locally, for more than a hundred years.

We are at the first level of the industrial ladder. The garments sector is considered to be the very first step of industrialisation. Vietnam has now moved to the third level of industrial ladder. This is the level which includes electronics. The second level, in between, is light engineering related, manufacturing cycles being an example. Bangladesh has stumbled in the second level, where we have not been able to make much advances. We do not have anything to show for the third level. Thailand is producing 2 million units of cars every year, out of which they are selling 800,000 units domestically and exporting the rest. They also export automobile parts, on its own billion-dollar industry. Bangladesh is an import-oriented country. In our country, 30,000 new cars get registered every year. So, there is a stark difference between countries like Thailand and Indonesia and us.

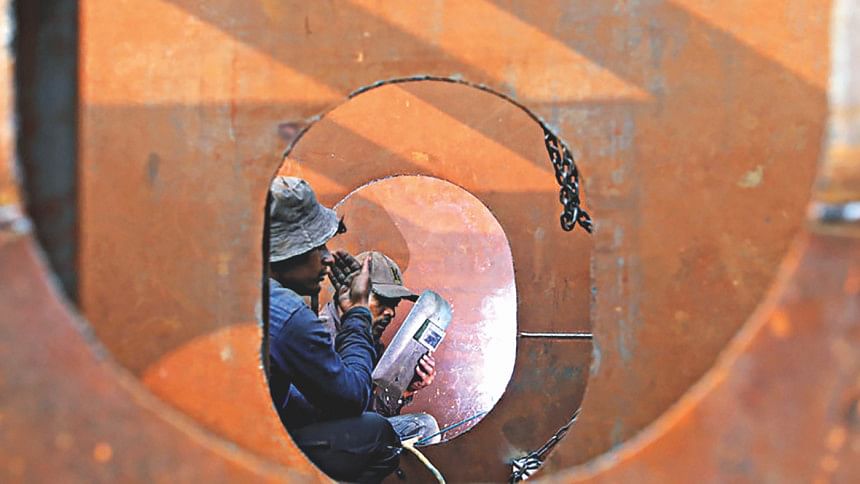

We are at the bottom of the industrialisation ladder and we have failed to move upward. We have had some flickers of success, like the ship-building industry. Historically, the RMG sector has been the industry which has been depended upon by almost all countries as the first step in the path to industrialisation. RMG was started in the United Kingdom, then moved to the United States of America. It then caught on in Eastern Asia (Japan, Korea, China) before arriving in Bangladesh. But Bangladesh has been stuck in the RMG sector for the last four decades in its path to industrialisation—we didn't move up the industrial ladder.

Have our policies for industrialisation been prudent?

Policy support has been inconsistent. The garments sector, for example, has a free trade regime, which is not the case for all such sectors in Bangladesh. There is clear discrimination. Our policies for industrialisation have been pro-import substitution. We are producing steel, instead of importing it, and that too at a high cost. The consumers are paying the price. Energy-intensive products are expensive in Bangladesh, and steel falls into that category. There is a hefty tariff on the import of steel, and so, local companies are coming into the market. If consumers could actually import the steel they would, as some international prices are actually cheaper than those of the Bangladeshi market.

Why we are not investing much more into the automobile and electronics industries is puzzling. We should look to create more jobs by increasing, to a large extent, our overall exports. The steel industry does not create many jobs, as even 10 engineers might be able to run a huge factory. It is machine-based, and there is no need for many workers. Highly-protected because of government policies, our industries are giving the wrong indicators to resource allocation. That is why our export to GDP is falling. Our industries, themselves, want the current protection they get, as they are, in effect, the policymakers.

Should policymakers be concerned at the pace at which Bangladesh's industrialisation has been happening and at the external cost that has resulted from it?

We, as analysts, are concerned. We have a land market which is distorted. Cost of living in Bangladesh is very high, higher than places like India and Pakistan. The landowners are the ones who make the real money.

In terms of cost of living, lack of infrastructure, governance, lack of democracy, it is apparent that these things have resulted from the slow pace of industrialisation in Bangladesh. People are migrating out of the country, and parents are not wanting their own children to grow up and work in Bangladesh as a result. Things like job security, in terms of ground-realities, are not strong in Bangladesh.

What are some lessons we could learn in regards to industrialisation from other countries?

We are in a region that has been the most dynamic in the world in the past 20 to 30 years. Countries like China and Vietnam have set excellent examples of development. Foreign direct investment (FDI) is highly important for us to achieve the same. Is Bangladesh FDI-friendly? No. Our records speak for themselves. Total investments from foreign entities into Bangladesh has been about USD 19 billion. Up until 2017, Myanmar had received USD 75 billion and Vietnam USD 230 billion in total foreign investments. That is how these countries developed their countries, and continue to do. We, in Bangladesh, are not investor-friendly, and this is why they do not come to us.

Bangladesh needs to address these issues. We have, at times, not treated our own companies, even ones which we once saw as success stories, properly. Grameen Phone is an example of that. We must build our infrastructure so that investors would be willing to put their money into our country. The airports of most Asian countries, including their traffic, are better than those in Bangladesh. We need to create an ecosystem which will accept FDI and, in turn, produce newer markets. Once a good foreign investor comes into the picture, an ecosystem automatically develops around him. A Bangladeshi working with such an investor may himself learn many new things and one day establish his own factory.

Samsung has now created an ecosystem in Vietnam which is worth billions of dollars. 40-50 Vietnamese companies are now supplying Samsung phones. Toyota, Nissan, Ford, Honda are all in Thailand, where they too have created a vibrant market. All parties make money, while also gaining expertise. Bangladesh must bring in much more FDI, and convince international companies to set up their factories here. Our workers must be made rich, which is not at all happening at present. Something fundamental must be done in this area.

In addition, a tariff regime which is neutral and not creating incentives only for domestic markets is of the essence. Apex recently told us that local market businesses amount for more profit for them. Tariffs have created this culture. We have to address the anti-export bias in our policy regime.

How well placed are we to growth and industrialise quickly, at a time when digitisation is changing the entire economic landscape?

The fourth industrial revolution is a global phenomenon and Bangladesh is not exempt from it. We are not ready to embrace it. We still do not seem to know what exactly we need to do in order to deal with it properly. Driverless cars, updated technologies are part and parcel of the unpredictable future. I think adaptation to technology is going to create, on its own, a sort of a "New World Order". The way East Asia has developed may not be replicated ever again. Who knows, robots might one day be working at garments factories, the industry which was one of the first in the journey towards industrialisation. Can Bangladesh produce robots? The answer, for now, is no, due to a lack of skilled workers.

We are significantly lagging in our education system, where the adaption of IT has taken longer than expected. We need to think of the access issue, in regards to education and technology. Building up of skills and the creation of jobs in technology-related areas is important in the coming days. The traditional path we have taken, till now, might not work for us in the future.

Do you believe our policymakers are doing enough to best capitalise on the global changes that are happening?

What is regrettable is that Bangladesh is only looking towards its own self, as if it was standing in front of a mirror and praising itself for the work it has done post-1971. Vietnam has gone from strength to strength over the past few decades. We, in Bangladesh, are still inward-looking. We are complacent about our achievements, being politically old-fashioned. Bad governance and maldistribution of resources has not helped our cause.

If the level of skills in our country is not increased, if lessons are not learned from other Asian countries, and if we do not change the incentive structure in Bangladesh, real changes cannot happen. We must adapt to technology, at a much faster rate, while also increasing our skills levels. Our policymakers need to look around, find the best performers, and emulate their practices onto others. There is a lot of dynamism in the private sector, but we are creating crony capitalism, a detrimental factor which might negate the long-term growth of Bangladesh. The trade associations in Bangladesh are mostly controlled by crony capitalists. The sycophancy culture needs to be broken. We must take a hard look at our own performance and how our future looks in comparison to other Asian countries.

Achieving the SDGs, creating a Digital Bangladesh, becoming a high-income country, are some of the goals Bangladesh has set for itself going into the future. The right ingredients need to be put into the cooking pot for us to actually "cook up" a bright future for ourselves. Bangladesh does not have the required resources to meet the SDG goals. We must accept the realities which are in front of us.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments