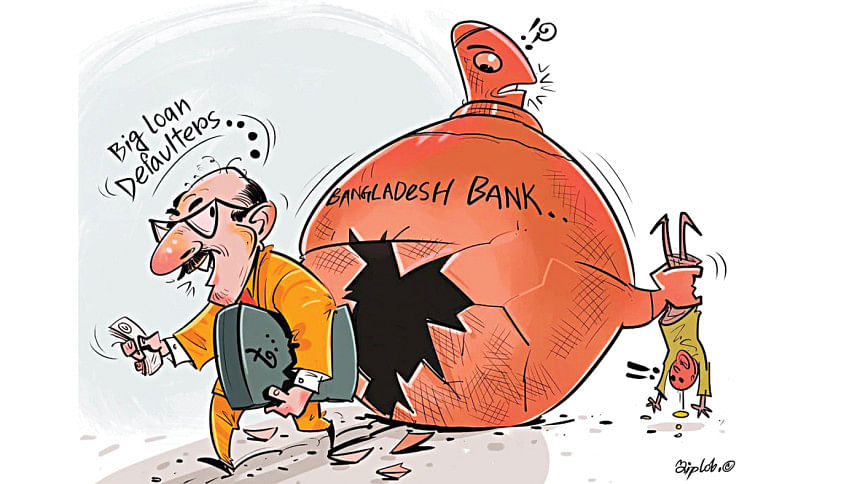

Lack of banking sector reforms will further choke the economy

Like every year, our banking sector had been in the news in 2022, and mostly for the wrong reasons. High related-party lending, soaring bad debt, new relaxed rules for repayment of NPLs (giving ample scope to the defaulters to extend their payment schedule), and increased opportunities for window dressing of accounts (new terms for loan evergreening), have been the key contributors to the swiftly deteriorating health of the country's financial sector.

The IMF and World Bank have repeatedly flagged these issues over the last few years. In 2022, the IMF had very straightforwardly mentioned to the central bank that the default loan ratio is much higher than the BB data, and that they should publish correct data. Aligning the definition of NPL according to international standards had also been recommended by the Washington-based lender.

A World Bank study released last year titled, "Country Economic Memorandum: Change of Fabric," revealed that among its structural and aspirational peers, Bangladesh's ratio of private credit to GDP is among the lowest. While between 1980 and 2020, private credit-to-GDP ratio in Bangladesh had grown eight times, from 5.8 percent in 1980 to 45.2 percent in 2020, a point to be noted here is that despite the gradual growth, since 2016, the number has stagnated at around 45 percent. The figure for Vietnam is 116 percent (2020 data), Thailand 164.71 percent (2022 data), and Cambodia 139.6 percent (2020 data).

The stagnation around 45 percent is concerning as it brings into question the banking sector's capability to cater to the needs of the private sector loan volume. The aforementioned WB study found that banks with higher NPLs are able to give out limited loans and their ability to attract deposits is also impaired.

The current condition of the financial sector should be a cause for concern for the relevant authorities, as this has exposed our economic growth aspiration to various risks. First of all, in the backdrop of the increasing load of non-performing loans – 9.36 percent of the total outstanding loans in the banking sector as of September 2022, or Tk 1.34 trillion – how much our banking sector is actually capable of expanding the private credit-to-GDP ratio, and supporting the private sector to fulfil its growth plans, have become questionable.

Moreover, we have reached such a situation where the private banks – including Islami Bank Bangladesh Ltd (IBBL), one of the largest commercial banks in the country – are having to take emergency loans from the central bank after giving big loans to their patrons. The central bank has given out a loan of Tk 40 billion to the five banks which include Union Bank, Social Islami Bank, First Security Islami Bank, and Global Islami Bank, apart from IBBL.

Islami Bank Bangladesh Ltd, First Security Islami Bank Bangladesh Limited, and Social Islami Bank Bangladesh Limited, all owned or controlled by S Alam group, have given big loans to the group and its affiliates without collateral or required documents. From IBBL alone, S Alam group borrowed Tk 30,000 crore, against the group's maximum borrowing entitlement of Tk 215 crore.

While the ACC is now investigating the issue and observers have also been appointed in some of the banks, the question remains, for how long would the greedy, irresponsible borrowers be allowed to repeatedly bilk banks and make the economy suffer for individual gains?

For the above-mentioned banks involved in the S Alam group loan incident, it had been a clear case of related-party lending. One wonders how the banks were able to approve such loans, without the intel agencies getting a whiff of what was happening?

And where did the money eventually go? Had such significant volume of money been invested in the economy, the reflections would have been obvious. Perhaps the money is invested abroad to buy properties and assets, or laundered through shady/offshore companies?

Unfortunately, this problem of a lack of corporate governance is prevalent extensively in the banking sector, where according to the WB study, directors are granted around 20 percent of the total loans in the banking sector.

These malpractices and lax enforcement of rules and regulations – many of them are no longer time befitting – are taking a toll on the national economy. Today we have reached a scenario where the country's ability to import essentials have come into question, where businesses are not being able to open letter of credit (LC) to import the much-needed raw materials to support their production lines. We have reached a situation where we are having to take a USD 4.5 billion loan from the IMF to help the vulnerable people and stabilise the economy in the wake of the economic stress the country is facing.

Had so much money not been squeezed from the banks or laundered out of the country, perhaps we would have been better positioned to overcome these ongoing challenges. Given that the banking sector is a key organ of the national economy – calling it the economy's lifeline might not be an exaggeration – its perpetual ill health is making the suffering worse for the people.

The inability of the regulators to rein in the situation over the years exposes the muscle power of the influential borrowers – read crooks and scammers – who are robing this nation of its finances and trampling on the economy to create stronger foundations for their illegally acquired wealth.

Reforms in the banking sector have become the need of the hour. Corporate governance system in the banks should be strengthened so that the owners and directors are not able to abuse their authority. More independent directors should be appointed and empowered to take unbiased and fair decisions, especially with regard to sanctioning loans. Due diligence should be given the priority, existing rules and regulations should be reviewed and brought on par with international standards to eliminate loopholes in the system, and the standardised regulations should be stringently enforced. Moreover, the financial criminals should be brought to book and the legal system should be used to punish such crimes. Existing laws should be reviewed and, if needed, reformed to mete out appropriate punishment to the financial criminals.

It is high time the concerned authorities took stock of the rapidly deteriorating scenario and implemented effective and time befitting reforms to revitalise the system.a

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments