Why Bangladesh Bank needs to be fully independent

If you ask someone from a country with a decent economy whether the central bank should be allowed to exercise independence in its policymaking, they will say that not giving independence to the central bank is like letting someone drive a car while keeping their hands tied behind their back. The question is not why, but how to give more independence to the institution.

An independent central bank is a necessity for the functioning of a state in the modern world, to act as a regulator as per the constitution of that country. Its independence is equivalent to the independence of the judiciary. An independent central bank can ensure macro-stability by maintaining a non-inflationary money supply, credible currency value, ensure responsible borrowing by the government, and private credit growth that is supportive of employment generation. No country has been able to maintain low inflation without an independent central bank. A government-controlled central bank is often used as a money-printing factory for the political party in power. The US, New Zealand, Australia, and European economies thus stand out in contrast with the inflation prone economies of Latin America and Africa.

The reason lies in the conflict between the short-term interest of political power and the long-term commitment of the central bank. Before elections, politicians long for cheap money policy that relates to greater money supply for businesses and consumers and low interest rates. It requires the central bank to print more notes without any judicious calculations. Inflation does not kick in immediately after more money is printed, and there is a time gap because of the circuitous transmission mechanism.

The extra money printed goes to businesses through private credit and consumers through wage growth. This channel creates excess demand which exceeds supply, causing price hikes in the market. When too much money chases too few goods in the market, prices go up, making high inflation inevitable. Clever politicians who seek to get re-elected see this gap – of say, three to six months – as an advantage they can use to lure voters.

If the central bank is forced to execute this plot, the incumbent is likely to get re-elected, and it does not care if inflation is higher once the party has regained office. Thus, central bank independence is essential to prevent politicians from gambling with a country's economy and damaging its macro stability just to regain power. This is the conflict of interest from which central bank independence can rescue a nation – and as an extension, from price instability and hyperinflation. Economist John Menard Keynes argued that price stability should be the single most important goal of monetary policy, whose smooth functioning cannot be ensured without central bank independence.

The Zimbabwean case is a classic example of why central bank independence is crucial. President Robert Mugabe forced the central bank to print more money whenever he wanted, or particularly before elections. He used that money to bribe civil and army officials and to satisfy his personal cravings. He lived one of the most luxurious lives among all the world leaders. Mugabe's endless spending to fulfil his personal and political ambitions eventually caused Zimbabwe to experience an unthinkable and unprecedented level of hyperinflation, ruining the economic prospects of Zimbabwe.

Of course, no ruler is expected to be so destructive in their handling of the central bank. But a government even with a partial mindset as Mugabe is enough to destroy the financial architecture of the whole country.

The British Empire created central banks in its colonies to smoothen its trade and fund wars when needed. The Bank of Calcutta – the first of its kind in undivided India – was founded in 1806 mainly to fund General Wellesley's wars against Tipu Sultan and the Marathas. Later, the Imperial Bank of India, formed in 1921, acted as the central bank until 1935 when the British government opened the Reserve Bank of India (RBI). These banks acted under the royal charter and served the special interests of the colonial rulers who never thought of giving independence to these institutions.

India won its freedom and was partitioned into two separate countries in 1947, but the institutions, including the central banks, carried over with them the legacy of colonial domination. Their finance ministries took the place of the British rulers by capturing their respective central banks, so that opportunistic money creation for political short-term gains remained under their control. The British central bank or the Bank of England (BOE) is one of the most independent central banks in the world, and it has enhanced its authority over time to adapt to the modern world. The tightening steps which Mark Carney, as the governor of BOE, undertook were often disliked by the exchequer of its finance division. But nothing could stop Carney from doing his job.

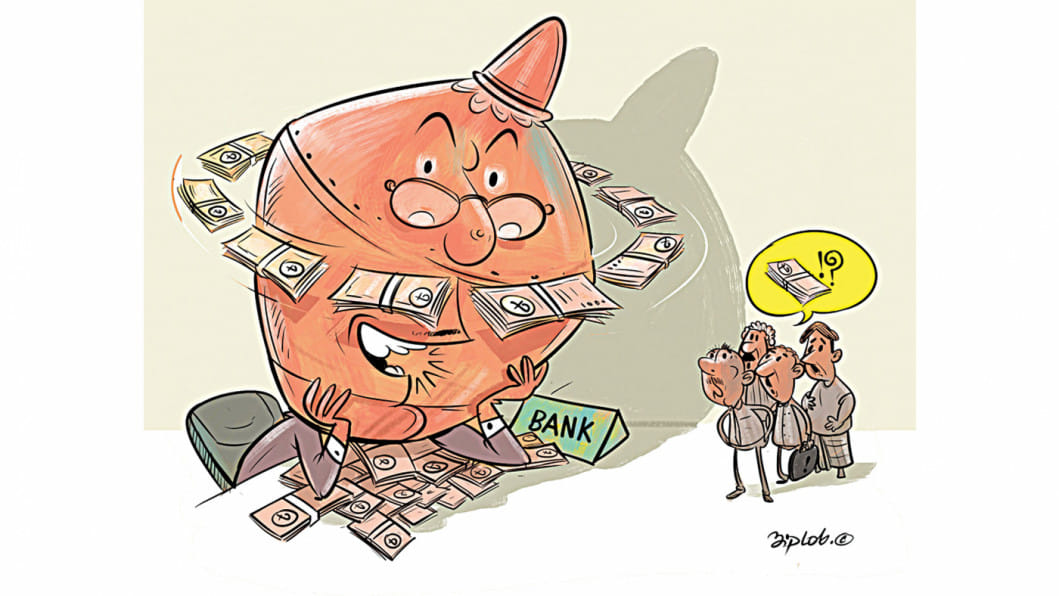

Unfortunately, the central banks of the former British colonial countries did not change much, mainly because their respective governments wanted to use them the way General Wellesley once did. And Bangladesh is not an exception, where the government, and particularly the finance ministry, use the central bank to fund government deficits. The fiscal shortfall arises from undertaking politically ambitious projects and for failing to tax the rich since it is politically unpleasant. The ministry heavily relies on the banking sector for borrowing when its tax collection is poor and inefficient. That is why the central bank is often used as a note printing factory for the government.

India, however, is different in this regard. It passed the fiscal responsibility act in 2003 – a law which forces the government to bring fiscal discipline by stopping the automatic monetisation of its fiscal deficit. Bangladesh is in desperate need of a similar law. Without it, the finance ministry will keep hiding its fiscal incapacity by increasingly borrowing from the banking channel – which economists define as "crowding out," suggesting the shying away of private investors in the face of aggressive government borrowing from the banking sector.

The Bangladesh Bank (BB) Order of 1972 describes the objectives of the institution. It includes maximising employment, ensuring price stability, and preserving the value of the country's own currency, the taka. However, it does not instruct the bank to maintain an artificially inflated value of the taka. Devaluing the taka often makes the government unpopular and hence there is political pressure on the central bank for being tardy in devaluing the currency. The penalty is huge and often damaging as we have experienced in recent months – since mid-2022, when the taka's value against the US dollar cascaded down rapidly, leading to a serious depletion of the country's foreign reserves from USD 48 billion in August to USD 34 billion in December 2022. Some sort of economic crisis will be inevitable if this trend is not checked. Central bank independence is required to ascertain a floating exchange rate regime reflecting the fair play of demand and supply in the market.

Unlike RBI, BB has lost its autonomy of fixing interest rates – the number one tool for implementing its monetary policy. The government has imposed interest-rate caps on both the lending and deposit rates since April 2020 – at 9 and 6 percent, respectively. While these rates were set during the pandemic so that investors could borrow funds at a reasonably affordable rate, the cap still persists despite the changing reality.

With the onset of Covid, inflation subsided to below 5 percent and keeping that 9 percent cap seemed practical at that time. Inflation doubled in the post-pandemic recovery period due to supply disruptions and Russia's invasion of Ukraine, requiring the central bank to raise interest rates to squeeze private credit. But that did not happen because the hands of BB are tied. BB raised its repo rate just as a perfunctory measure, but was not able to remove the caps because it had to please the politically connected wealthy borrowers, a segment of which has turned into loan defaulters – as they borrowed lots of cheap money from the banking sector.

RBI raised its policy rates five times since May 2022, while BB has not been able to do anything, portraying the crucial necessity of central bank independence. If a central bank cannot use tools like money supply or interest rates independently to serve the greater interest of the economy, it turns into a clerical office of the finance ministry, whose political priorities often compel the central bank to act in a way that is detrimental to the long-term interest of the economy's macro stability and employment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments