Reliance Insurance: The reliable insurer

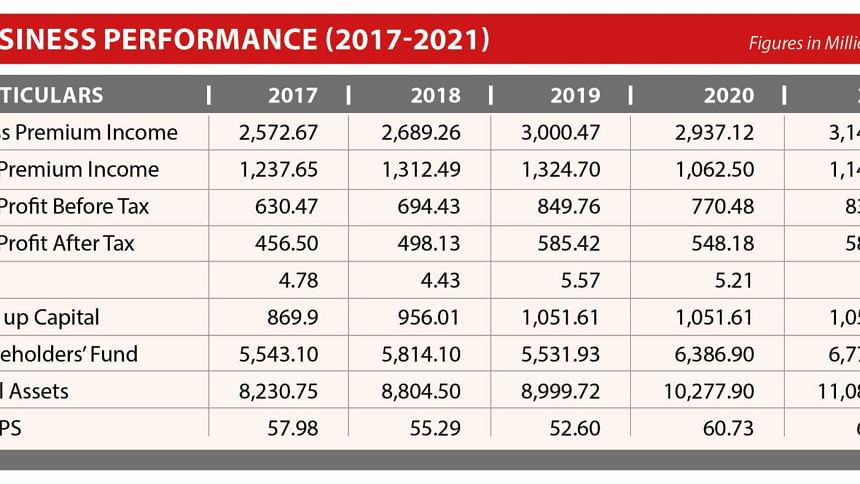

Being a leading first generation private sector non-life insurance company in Bangladesh, Reliance Insurance Limited was incorporated in 1988. The company was subsequently listed with Dhaka and Chittagong Stock Exchanges in 1995. Reliance transacts all classes of non-life insurance business and its turnover was BDT 3,140.35 million in 2021. The Company carries its insurance activities through thirty-two branches across the country. Reliance received a Surveillance Rating of "AAA (Triple A)" (Stable outlook) from CRISL based on its sound financial performance and claim paying ability. Reliance has an authorized capital of BDT 2,000 million and paid-up capital of BDT 1,051.61 million. Shares of the company are traded in both Dhaka Stock Exchange and Chittagong Stock Exchange and are listed in the "A" category. The company has a total market capitalization of approximately BDT 9,202 million as at December 31, 2021.

"We want to continue healthy business practices with ethical values, towards our clients providing the finest services; as well as ensuring better communication with all regulators and stakeholders."

In 34 years of its operations, Reliance's business growth has been consistently impressive over the years. From a few million Taka at the start up stage, the Gross Premium of the Company is now over BDT 3.00 billion in 2021. The Shareholders equity has also grown impressively to BDT 6.77 billion in 2021. With this outstanding performance, Reliance Insurance Limited has indeed set a new benchmark in the Insurance industry of Bangladesh.

The company is flexible and responsive, in their approach towards satisfying clients by providing them with what they want, when they want it in accordance with their needs. Reliance Insurance has reliably been able to capture a huge portion of insurance portfolio of the leading local business conglomerates and MNC's present in Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments