Establishing bancassurance as a cornerstone of financial inclusion

Farzanah Chowdhury

Chartered Insurer (ACII, UK), Managing Director & CEO, Green Delta Insurance

The Daily Star (TDS): How would you assess the current state of bancassurance in Bangladesh? What key trends are shaping the market at present?

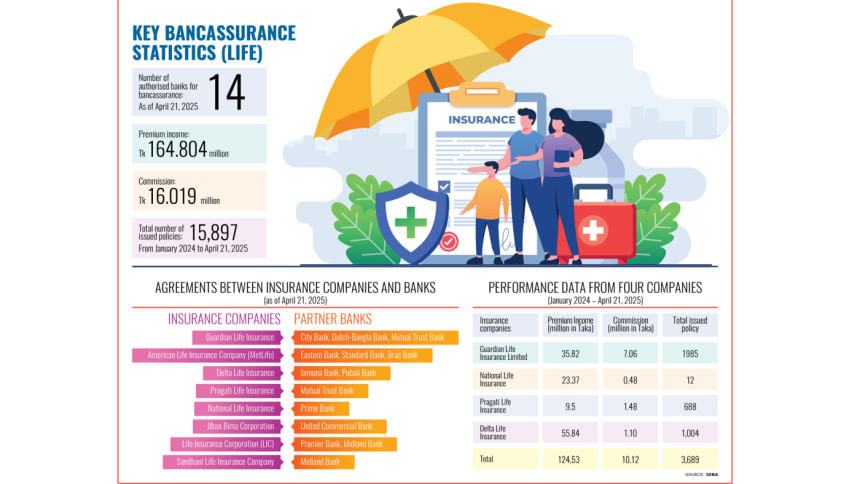

Farzanah Chowdhury (FC): Bancassurance in Bangladesh is in its early but rapidly developing phase. Initial challenges included low consumer awareness and a traditional preference for direct insurance channels. However, rising financial inclusion and growing trust in banking institutions have significantly boosted adoption. The market is now shifting from urban saturation to expansion into district towns and rural areas, leveraging the extensive branch networks of banks.

Key trends shaping the sector include digitalisation, customer education, and the development of tailored insurance products, with a strong focus on technology integration and transparency. However, regulatory limitations—such as caps on the number of eligible banks per insurer—and operational inefficiencies remain hurdles. Our existing bancassurance partnerships also exhibit limited branch-level penetration, with services yet to be operationalised across the entire network of our partner banks.

Despite these challenges, industry optimism is high, with expectations for sustained growth as bancassurance becomes a mainstream distribution channel.

TDS: What forms of partnership does your organisation maintain with banks that offer insurance products to customers?

FC: Green Delta Insurance has formal bancassurance agreements with leading banks, including BRAC Bank, Eastern Bank Limited (EBL), and Mutual Trust Bank (MTB). These partnerships allow customers to purchase a wide range of non-life insurance products directly through the banks' branch networks, SME units, and agent banking platforms.

To ensure smooth operations, certified bancassurance officers are stationed at partner bank locations. These professionals, trained and approved by the Insurance Development and Regulatory Authority (IDRA), assist customers with product selection, sales, and support. The collaboration is designed to bundle insurance with banking products, enhance accessibility, and drive financial inclusion across Bangladesh.

TDS: How do you ensure that the insurance products distributed through bancassurance align with customers' financial goals and risk profiles?

FC: Green Delta Insurance works closely with partner banks to co-design insurance products that match the specific needs and risk profiles of their customer base. The company emphasises needs-based selling, with bancassurance officers trained to assess individual requirements and recommend appropriate coverage.

To ensure continuous improvement, we regularly conduct customer satisfaction surveys and maintain feedback loops to refine our product offerings. Transparency and compliance are prioritised, with clear policy disclosures and strict adherence to IDRA guidelines to ensure customers fully understand the terms, benefits, and risks before making a purchase.

TDS: What are your future plans for expanding bancassurance operations in collaboration with banks across Bangladesh?

FC: At Green Delta Insurance, we aim to expand our bancassurance footprint by partnering with more banks—especially those with strong rural and SME outreach—to serve underserved markets. This, of course, is subject to IDRA's approval and modification of existing guidelines.

As an insurance company, we have invested significantly in digital integration to streamline policy issuance, premium payments, and claims processing. Future initiatives include developing more customised, data-driven insurance products and using analytics to better understand customer segments. Going forward, we also plan to enhance training for bancassurance officers and launch joint marketing campaigns with banks to increase awareness and build trust.

Our long-term vision is to establish bancassurance as a cornerstone of financial inclusion, offering risk mitigation solutions to Bangladesh's emerging middle class and rural populations

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments