Prioritising Green Finance for a Low-Carbon Future

M. Shamsul Arefin, Managing Director, NCC Bank

The Daily Star (TDS): What role do you see banks playing in promoting environmental sustainability in Bangladesh?

M. Shamsul Arefin (MSA): Banks and financial institutions in Bangladesh are playing a progressively vital role in promoting environmental sustainability, particularly in the face of climate change and the pursuit of green growth. One of the cornerstone developments has been the implementation of the Environmental and Social Risk Management (ESRM) Guidelines issued by Bangladesh Bank, which began in 2011. This pioneering effort set a global precedent by integrating environmental considerations into the credit decision-making process.

The ESRM framework includes detailed procedures for transaction screening, escalation mechanisms, covenant integration, corrective action planning, and exclusions based on environmental and social risks. These policies ensure that banks are not only compliant but also proactive in mitigating environmental and societal risks, aligning with both local and international best practices.

Furthermore, recent regulatory initiatives such as the Sustainability and Climate-related Financial Disclosure Guideline emphasise the importance of transparency and accountability. The principle of "We cannot mitigate what we cannot measure" underpins this guideline, encouraging banks to quantify and report emissions arising from both operations and financing activities. This development fosters a culture of environmental consciousness and enables more informed, strategic action toward carbon reduction.

Together, initiatives in green finance, climate finance, sustainable finance, and carbon accounting form a cohesive roadmap towards a greener Bangladesh. These collective efforts represent a transformational shift in the banking sector's commitment to environmental sustainability.

TDS: Can you highlight any specific green finance initiatives, sustainable investment strategies, or eco-friendly banking practices your institution has adopted recently?

MSA: At NCC Bank, environmental sustainability is a strategic priority embedded in our corporate DNA. Both our Board of Directors and management are deeply committed to integrating sustainable practices into our operations and financing activities.

We are proud to be among the few Bangladeshi banks currently implementing the Sustainability and Climate-related Financial Disclosures, with technical support from the JIM Impact Model. Moreover, NCC Bank has recently become a signatory to the Partnership for Carbon Accounting Financials (PCAF), a global alliance dedicated to standardising the measurement and disclosure of greenhouse gas (GHG) emissions financed by financial institutions. This affiliation marks a significant step in aligning with global benchmarks and fostering transparency in climate-related disclosures.

To reduce our carbon footprint, we have discontinued paper receipts at all ATMs and are actively expanding our digital infrastructure. Our flagship digital platform, NCC Icon, provides seamless corporate online banking capabilities. Simultaneously, our mobile application offers convenient and sustainable digital banking services for retail customers and SMEs. We've also implemented green PIN systems to reduce paper usage.

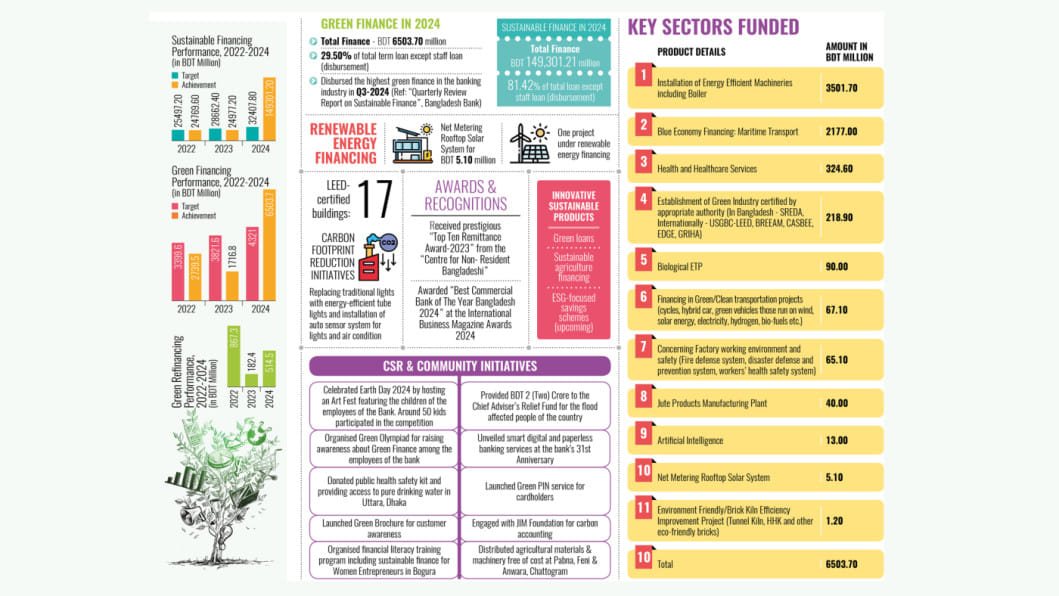

Green finance has become a high priority at NCC Bank. We are offering green finance products across all branches and sub-branches, supporting projects in renewable energy, energy efficiency, green buildings, and more. Through customer engagement sessions, awareness campaigns, and personalised consultations, we are promoting the benefits and accessibility of green financing—helping to reshape market perceptions and catalyse broader adoption.

TDS: How is your bank aligning its long-term corporate strategy with global environmental goals, such as the Sustainable Development Goals (SDGs) or Bangladesh's national climate priorities?

MSA: NCC Bank is strongly aligned with both the United Nations Sustainable Development Goals (SDGs) and Bangladesh's national climate strategies. We contribute to key climate-related SDGs, including: SDG 6: Clean Water and Sanitation; SDG 7: Affordable and Clean Energy; SDG 11: Sustainable Cities and Communities; and SDG 13: Climate Action.

Our financed portfolio supports a range of sustainable initiatives such as renewable energy projects, energy-efficient machinery, effluent treatment plants, environmentally friendly brick kilns, green infrastructure, and blue economy initiatives. Under our CSR programmes, we have contributed to safe drinking water projects and expanded banking services to rural and underserved regions, promoting financial inclusivity and access.

Looking ahead, NCC Bank is working on setting carbon goals integrated with our strategic roadmap. We are preparing to publish our first Annual Sustainability Report in 2025, based on 2024 data, which will detail our progress and future commitments toward a sustainable, low-carbon economy. Our approach to green finance is being solidified through dedicated strategies, capacity building, and an unwavering focus on impact.

TDS: As a corporate leader, what message would you like to share on World Environment Day about the responsibility of financial institutions in building a greener, more resilient future?

MSA: I urge every corporate and individual stakeholder to recognise that restoring our planet is a shared responsibility—one that must be rooted in long-term strategies and meaningful action. It is imperative that national level SMART carbon goals—Specific, Measurable, Achievable, Relevant, and Time-bound—be established, understood, and implemented across all sectors.

Financial institutions have a unique role to play. We must embrace our capacity as enablers of change by channelling finance into green projects, embedding sustainability into core operations, and fostering environmental awareness through education and outreach. Incentivising sustainable behaviour through rewards can accelerate this transition.

There are already commendable efforts by the government, Bangladesh Bank, and several banks and financial institutions to promote climate-responsive financial practices. It is essential that banks leverage these platforms, broaden green financing portfolios, and take a proactive stance on sustainable corporate social responsibility.

We also advocate for the integration of environmental education into school banking programmes, ensuring that future generations grow up with a deep respect for sustainability and ecological stewardship.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments