Sustainability is no longer optional— it is imperative

Mashrur Arefin, Managing Director & CEO, City Bank

As part of its broader sustainability commitment, City Bank has also pledged to plant one tree for every Green Savings Account opened. In 2024 alone, the bank recorded 20,001 accounts—reflecting strong customer interest and growing public engagement in green banking.

The Daily Star (TDS): What role do you see banks playing in promoting environmental sustainability in Bangladesh?

Mashrur Arefin (MA): In the context of climate change and green growth, banks in Bangladesh have been playing a pivotal role as catalysts for sustainable development. They are channelling financial resources into projects aimed at reducing environmental impact, enhancing climate resilience, promoting renewable energy, improving food security, and empowering women.

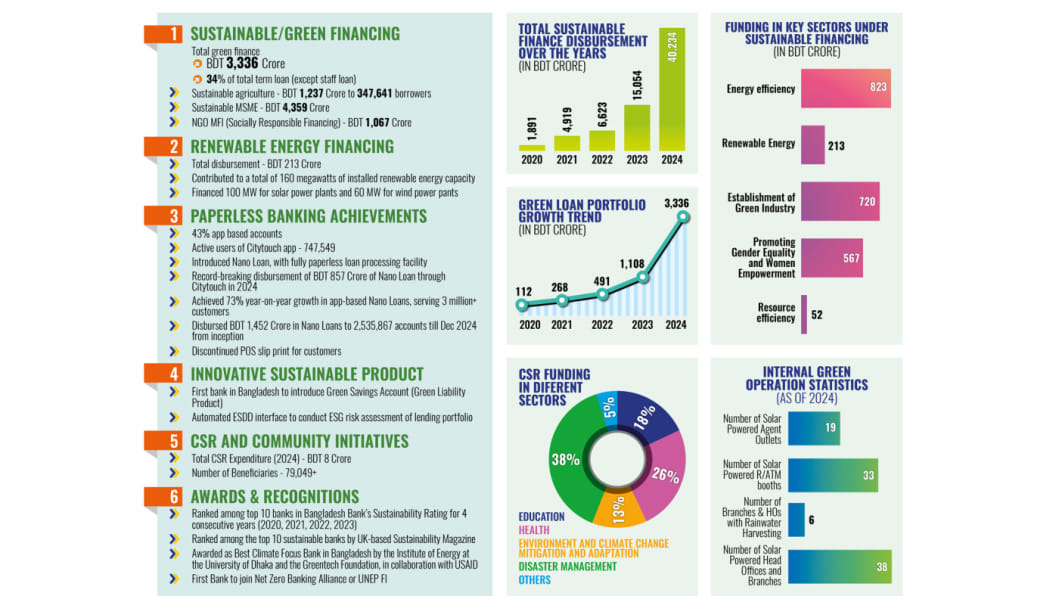

In 2024 alone, the banking sector collectively disbursed BDT 30,653.78 crore in Green Finance and BDT 459,483.82 crore in Sustainable Finance. Among the leading contributors, City Bank disbursed BDT 3,336 crore in Green Finance, supporting initiatives such as greenhouse gas (GHG) emission reduction, renewable energy-based project development, pollution prevention (including waste management), green building construction, and others.

Additionally, the bank disbursed BDT 40,234 crore in Sustainable Finance, which was directed towards sustainable agriculture, support for MSMEs, women's empowerment, and other socially responsible sectors.

The banking industry is also actively supporting green initiatives such as rooftop solar installations, construction of green buildings, procurement of energy-efficient machinery, water use efficiency, recycling, and waste management through low-cost green loans with only a 5% interest rate, backed by refinance schemes from the central bank.

As financial intermediaries, banks are aligning with the national agenda to meet Nationally Determined Contribution (NDC) targets, promote green economic growth, and transition towards a climate-resilient and sustainable economy.

TDS: Can you highlight any specific green finance initiatives, sustainable investment strategies, or eco-friendly banking practices your institution has adopted recently?

MA: City Bank has taken several proactive steps to promote green finance and sustainability across different sectors, aligning with Bangladesh's broader climate and green growth goals.

i. Joining the Net-Zero Banking Alliance of the United Nations Environment Programme (UNEP FI):

City Bank became the first bank in Bangladesh to join the United Nations Environment Programme Finance Initiative's (UNEP FI) Net-Zero Banking Alliance (NZBA), marking a significant milestone in the country's banking sector. Through this commitment, the bank aims to reduce greenhouse gas (GHG) emissions from both its internal operations and lending portfolios.

As part of this initiative, City Bank conducted a comprehensive assessment of GHG emissions associated with its internal activities and financed emissions from its lending portfolio. With support from Deloitte, the bank set science-based emission reduction targets and publicly disclosed them—demonstrating transparency and leadership in climate action.

ii. Introducing the Green Savings Account:

Recognising the gap in green liability products within Bangladesh's banking sector, City Bank launched the pioneering Green Savings Account in February 2024. This innovative product ensures that all deposited funds are exclusively allocated to environmentally sustainable projects, fully aligned with Bangladesh Bank's Green Finance Taxonomy.

iii. Advancing Paperless Financial Products:

City Bank's Nano Loan is a fully paperless, environmentally friendly loan product designed to promote financial inclusion while reducing paper consumption. As of December 2024, over 506,000 customers have accessed this digital loan product, with a total disbursement exceeding BDT 1,452 crore across more than 2.5 million loan accounts, showcasing large-scale adoption of eco-friendly banking solutions.

TDS: How is your bank aligning its long-term corporate strategy with global environmental goals?

MA: City Bank is strategically aligning its long-term corporate objectives with national and international environmental frameworks, including the United Nations Sustainable Development Goals (SDGs), by embedding sustainability into the core of its operations and financing activities.

The bank's strong focus on sustainable and green finance is reflected in impressive year-on-year growth of 167% and 201%, respectively, between 2023 and 2024. This underscores its commitment to supporting projects that promote clean energy, emission reduction, waste management, and climate resilience.

A key highlight of this commitment is the financing of large-scale renewable energy projects, such as a 60 MW wind power plant and a 100 MW solar power plant. These initiatives directly support SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action), contributing to the nation's transition towards a low-carbon economy.

In 2024, City Bank allocated BDT 1,237.36 crore towards sustainable agriculture, benefiting 347,641 end borrowers. This support is critical to advancing SDG 1 (No Poverty) and SDG 2 (Zero Hunger), both of which are vital to Bangladesh's socio-economic development.

Sustainability is also being actively integrated into City Bank's internal operations. The bank has installed 90 solar systems across its head office, branches, sub-branches, remote ATMs, and agent outlets, reducing its own carbon footprint. Additionally, to foster environmental awareness among employees and build a culture of environmental stewardship, City Bank commemorates World Environment Day each year through a week-long series of programmes and initiatives.

TDS: As a corporate leader, what message would you like to share on World Environment Day about the responsibility of financial institutions in building a greener, more resilient future?

MA: Banks are not merely financial intermediaries—we are catalysts for sustainable growth. Climate change and environmental challenges present both risks and opportunities for our industry.

To effectively manage these risks, integrating Environmental, Social, and Governance (ESG) considerations into risk assessment is essential. At the same time, we must seize the opportunities by prioritising green finance, supporting renewable energy, and investing in innovative, eco-friendly solutions that drive both environmental progress and economic development.

Sustainability is no longer optional—it is imperative. Beyond financing, we must also foster a culture of environmental responsibility within our institutions. Adopting internal ESG practices and raising awareness among employees are critical steps. Additionally, banks can leverage CSR initiatives in collaboration with NGOs and development organisations to elevate environmental awareness within communities.

I firmly believe that by working together with our customers, partners, and regulators, we can lead with purpose and innovation to build a sustainable financial ecosystem—for the benefit of both people and the planet, today and for generations to come.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments