Cultivating Prosperity

Agricultural loans serve as a cornerstone for rural farmers, playing a crucial role in sustaining a nation's food security and rural economy. Bangladesh, known for its remarkable growth story, is striving to elevate itself to an upper middle-income status. Given the paramount importance of agriculture and food security in this pursuit, the demand for agricultural loans remains robust, with the sector's scale steadily expanding. Nevertheless, persistent challenges continue to exist.

In FY23, the agricultural sector contributed 11.38 percent to Bangladesh's gross domestic product (GDP), as estimated by the Bangladesh Bureau of Statistics. Furthermore, data from the 2022 Labor Force Survey reveals that 45.33 percent of the nation's workforce is directly involved in agriculture. In alignment with the broader goals of the Bangladeshi government's development agenda, the Bangladesh Bank (BB) formulates the 'Agricultural and Rural Credit Policy and Programme.' This initiative is designed to ensure the smooth, timely, and hassle-free flow of funds into agricultural and rural economies, thereby directly benefiting grassroots-level farmers.

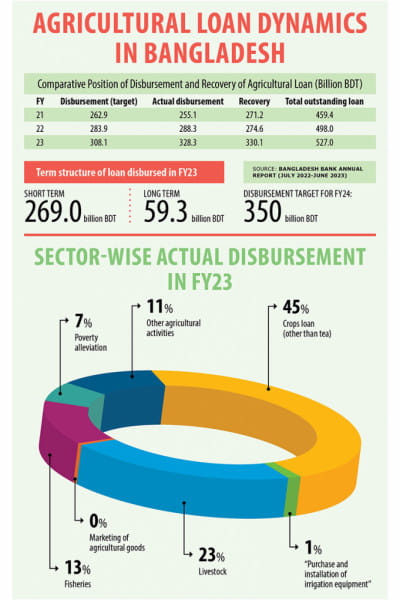

According to the Bangladesh Bank, agricultural and rural credit disbursed during FY23 amounted to BDT 328.30 billion, surpassing the target of BDT 308.11 billion by 106.55 percent. This also represents a notable increase from the amounts disbursed in FY21 (BDT 255.1 billion) and FY22 (BDT 288.3 billion), indicating a positive trend in agricultural financing. For FY24, Bangladesh Bank has set the target at BDT 350 billion, marking a 13.60% increase compared to the previous fiscal year.

The disbursement structure delineates between short-term and long-term categories following the central bank's directives. In FY23, short-term loans constituted the majority at BDT 269.0 billion, with long-term loans comprising the remaining BDT 59.3 billion, as disclosed by the Bangladesh Bank. Moreover, the recovery performance has been commendable, with a total of BDT 330.1 billion recovered in FY23, surpassing the recovery figures of BDT 271.2 billion in FY21 and BDT 274.6 billion in FY22. These statistics underscore the inherently secure nature of agricultural loans.

Despite the excellent recovery figures, the BBS survey (2017) reveals that out of the 27,480,054 households surveyed, only 10,157,553 households (36.96%) availed agricultural credit. Notably, NGOs are the primary sources of loans for households, with 63.28% of households obtaining loans from this sector, followed by banks (26.03%), Mahajans or local lenders (3.67%), relatives (3.75%), and other sources (3.27%). These statistics underscore the need for greater accessibility to agricultural loans from banks, particularly for genuine farmers who require them most.

"In general, our banking sector shows little interest in extending loans to farmers, considering them inherently risky. Instead, loans predominantly flow towards sectors indirectly linked to agriculture, such as local agribusiness or general enterprises involved in processing or marketing agricultural products," opines Hossain Zillur Rahman, Executive Chairman of PPRC. He emphasizes the vital role of farmers in securing the nation's food supply and urges improved accessibility to banking services tailored to their needs.

Rahman notes bankers' perception of agricultural loans as risky due to the absence of personal connections, contrasting with their familiarity with industrial and corporate borrowers. He also questions NGOs' effectiveness in reaching farmers at the grassroots level, citing various barriers farmers face, such as social and bureaucratic hurdles, and often high loan processing costs.

However, the prospects for agricultural loans through banks are on the rise due to guidance from the central bank.

Two specialized banks, Bangladesh Krishi Bank (BKB) and Rajshahi Krishi Unnayan Bank (RAKUB), along with six state-owned commercial banks (SCBs), play a pivotal role in disbursing agricultural and rural credit. The contributions of foreign and private commercial banks are also crucial in this aspect.

In order to promote direct lending to farmers, the Bangladesh Bank has mandated that banks disburse a minimum of 50% of their total loans through their own channels.

"Bangladesh Bank has modified the policy tool and instructed all banks to disburse at least 50% of the agri loan disbursement target using their own distribution network. Though the industry is behind the expected direct lending to farmers by banks, things are improving. All banks are trying to take different measures to scale up agri lending," shares Sanjib Kumar Dey, Head of SME & Agri Banking, Mutual Trust Bank.

"Agricultural loans, though small and labor-intensive, pose challenges due to limited branch coverage. However, ours has proactively embraced this sector, surpassing targets since inception," emphasizes Ahsan Jamil Hossain, VP and Head of SME and Agricultural Loans at Midland Bank. He underlines their commitment to disbursing loans directly to the grassroots level through branches, NGOs, and intermediaries.

"Network challenges hinder loan disbursement in agricultural areas with limited bank branches. However, Dhaka Bank has opened 1,500 farmers' accounts via the EzyBank app, allowing for quick loan processing within seven days and application processing within 15 days," notes Md. Katebur Rahman, Senior VP and Head of the Agriculture Banking Unit at Dhaka Bank.

"We mainly disburse agricultural loans to farmers through NGO linkages, however, we finance farmers through our own channel via our branches as well. We have designed two agricultural products called EBL Krishi Rin and EBL Projukti for disbursing loans through our own sources," shares M. Khorshed Anowar, Deputy Managing Director & Head of Retail & SME Banking at Eastern Bank.

"Two noteworthy initiatives are underway: one in Patgram, Lalmamirhat, supporting corn farmers, and another in Laxmipur, aiding soybean farmers. Through a network spanning 136 branches and collaborating with numerous prominent NGOs, we distribute agricultural loans to empower these communities," says M. Shahidul Islam, Senior Vice President at NCC Bank.

"Many banks prioritize corporate clients, with fewer focusing on small and medium-sized enterprises (SMEs). However, at our bank, SMEs are our main focus. We directly disburse loans for dairy, poultry, and fisheries ventures, while also channeling support to farmers through NGO partnerships," mentions Syed Abdul Momen, Deputy Managing Director & Head of SME Banking at BRAC Bank.

"Previously, reliance on NGO financing was predominant, but in the last three years, this dependency has been decreasing. Our initiatives have been accompanied by the establishment of numerous sub-branches and agent outlets across the country, mostly in rural areas, with the primary objective of integrating unbanked marginal farmers into the formal banking system. Notably, more than 27,000 marginal and landless farmers are now benefiting, compared to the previous number of 150 (excluding NGO financing)," shares Iftekhar Enam Awal, Head of Business, Corporate, and SME at AB Bank.

"We are providing collateral-free loans with small amounts, and we are also focusing on leveraging our agent banking network to reach our farmers in the most remote areas, pushing forward the adoption of digital or phone applications, and partnering with tech-based agri-companies to facilitate the loan application process for farmers," adds Nazeem A. Choudhury, Deputy Managing Director – Consumer Banking at Prime Bank.

"Our bank has exceeded the central bank's target, disbursing loans through 300 stations nationwide. With 40% facilitated via agent banking across 500 agent points, alongside 163 branches and 40 sub-branches, our network is robust for agricultural loan disbursement," notes Kamrul Mehedi, Head of SME at City Bank.

"Our bank is nearing its agricultural loan disbursement target across NGOs, branches, and our agent banking network. Leveraging the extensive networks and experience of NGOs in agricultural loans, we aim to further enhance performance in this sector," shares Shaminoor Rahman, Head of SMR at Bank Asia.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments