A glance at two success stories

PHARMA INDUSTRY

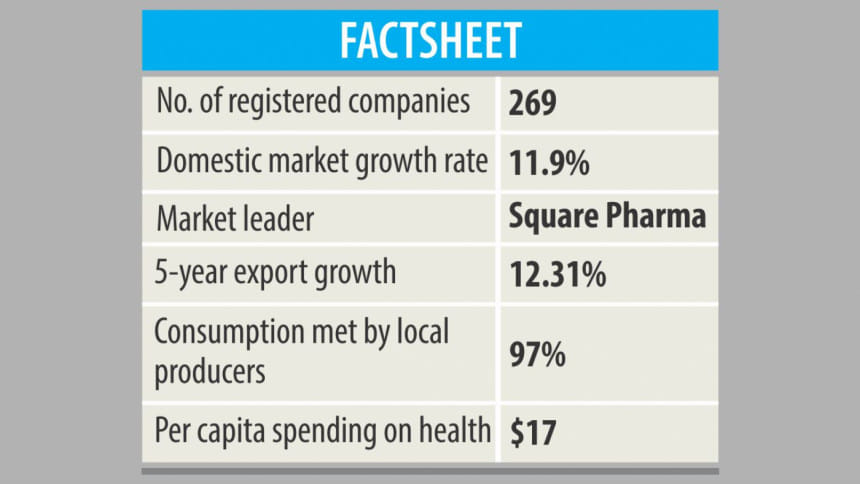

After apparels the pharmaceuticals industry has been one of the success stories of Bangladesh in the last three decades. Bangladesh had to depend largely for medicines on multinational companies and imports in the 1970s and early 80s. Now local companies meet almost 98 percent of domestic demand worth around USD 2 billion or Tk 16,000 crore.

The sector is not only catering to domestic needs, but also exporting to over 100 countries including the United States and Europe. Pharmaceutical exports were close to USD 100 million in fiscal 2016-17.

According to Latifur Rahman, chairman of Eskayef, Bangladesh's pharmaceuticals industry is going to be a major player in the global export market in the next three to five years.

Technology transfer by Novo Nordisk, which is the world leader in insulin, to a company outside Denmark is a manifestation of the country's strength.

What has driven this phenomenal growth of the industry?

Two effective policies have accelerated the growth of the sector. One was the Drug Control Ordinance 1982, which banned foreign companies from selling imported pharmaceutical products in the country.

The other was the relaxation of the World Trade Organization's agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which permitted Bangladesh to reverse engineer-patented generic drugs. The relaxation of TRIPS for least developed countries has been extended to 2032.

Bangladesh's pharmaceutical sector can grow at 15 percent for the next five years riding on the expanded domestic market as well as new export frontiers, according to research studies.

LR Global, an asset management firm, in its recent report on Bangladesh's pharmaceutical sector, said that it would be unsurprising if it takes a similar route to the Indian pharmaceutical industry.

In 20 years, the neighbouring country's pharmaceutical sector grew 30 times, according to the report.

Presently, the pharma industry of Bangladesh meets 98 percent of the local demand and exports to more than 125 countries.

Greater affluence among the poorest socio-economic group and a shift in disease profile are expected to drive the growth of healthcare expenditure in Bangladesh, it said.

Bangladesh's disease profile is expected to change in two major ways: the rise of non-communicable diseases and a gradual move from acute to chronic diseases.

Also, the country's ageing population is increasing: By 2036 about 25 percent of the population will be over 50 years of age.

Besides, drug purchasing power is likely to rise with sustained growth in income as Bangladesh advances into the league of middle-income countries, according to the analysis.

The industry also has growth opportunities in the international domain—enough to emerge as the next thrust sector after garment.

“With backward integration, quality research and skilled human resources, Bangladesh's pharmaceutical industry can emerge as a world leader in producing off-patented generics medicine,” said the report.

Globally, healthcare providers are increasingly endorsing generic drugs and Bangladesh can capitalise on the trend to penetrate the markets in the US, Germany, France, the UK and Japan.

Global generics were valued at USD 168 billion in 2013, and are expected to reach USD 380 billion by 2021.

Emerging markets also hold promise for Bangladesh's exports: Their spending for pharmaceutical products stood at USD 249 billion in 2015 and is expected to reach USD 345-375 billion by 2020.

The report found that while most of the emerging markets in the low- and middle-income countries are dominated by multinational pharmaceutical companies, Bangladeshi companies have the capacity to penetrate these markets.

Since the beginning of the decade, the pharmaceutical industry in Bangladesh has experienced double-digit growth driven by a large consumer base, improved health consciousness and a supportive regulatory framework.

In fiscal 2015-16, the annual sales of pharmaceutical products stood at Tk 15,600 crore. This is a huge jump for the sector as the industry size was only Tk 170 crore in 1982.

Exports of pharmaceutical products registered 14.6 percent growth in 2011-2016, while the industry is expected to log in receipts of USD 90.3 million for fiscal 2016-17.

According to Rizvi Ul Kabir, director for marketing of Beximco Pharmaceuticals, the pharmaceutical sector is the most successful sector in Bangladesh and it did not compromise on quality to get to its current position.

In line with the growth of the market, everybody has invested in quality, lab equipment and human resources to raise the standard to international level, which enabled local firms to enter developed and highly regulated markets, he said.

BICYCLE INDUSTRY

Bangladesh is the second largest non-European Union exporter of bicycles to the EU and the eighth largest exporter overall. Bicycles are the largest export item of Bangladesh's engineering sector, making up about 12 percent of the country's total engineering exports. According to a recent World Bank blog post, Bangladesh has an opportunity to diversify its exports beyond readymade garments.

High anti-dumping duty (48.5 percent) imposed by the EU against China and duty-free export benefits have been helping Bangladesh export to European countries.

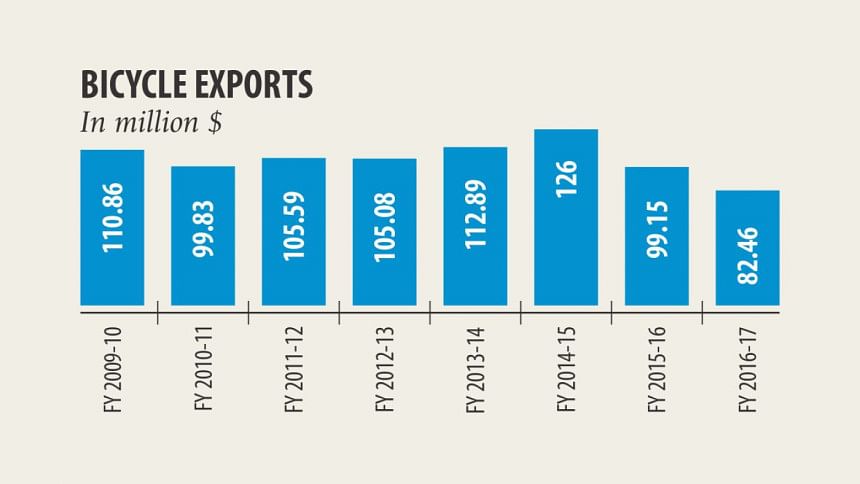

The global bicycle market is expected to grow to USD 35 billion by 2022, up from nearly USD 30 billion now. Yet, the country's export is not that high in terms of value. Rather, bicycle exports from Bangladesh have been declining for the last several years, mainly due to the rise of electric bikes (e-bike).

“The bicycle market has seen a squeeze worldwide in recent years due to the growing use of e-bikes,” said Lutful Bari, director, operations of Meghna Group which has three bicycle and parts factories.

Bari said Bangladesh is still in a good position in the European market because of trade benefits and anti-dumping duty on Chinese bicycles.

The EU trade rules allow Bangladesh and Cambodia to export bicycles, parts and accessories to the EU's 28 member states without the regular 14 percent duty on complete bicycles and 4.7 percent duty on imported parts and accessories.

Bangladeshi bicycle exporters estimate that without anti-dumping duties, Chinese bicycles could cost at least 10-20 percent less than Bangladeshi bicycles in European markets. And Chinese exporters can ship bicycles to the EU market with a lead time that's 35-50 percent shorter.

According to government data, Bangladesh exported bicycles worth USD 111 million in 2009-10, which came down to USD 82.46 million in 2016-17. The government has set an export target for the current fiscal year at USD 85 million and the first seven months' export receipts show that the target may be achieved.

Meghna Group is the market leader in bicycle exports with its three factories. Alita Bangladesh in Chittagong Export Processing Zone and Fire Fox in the port city have also been exporting bicycles for over a decade. Rangpur Metal Industries, a concern of Pran-RFL Group, entered the market in 2014 and began exporting bicycles in 2015.

Industry insiders said Bangladesh exports lower and middle-end bicycles that cost USD 120-150 per piece.

“We are exporting our bicycles to 10 countries, all European nations,” said Kamruzzaman Kamal, director, marketing of Pran-RFL Group.

In addition to export, both Meghna and Pran have been selling bicycles in the local market to cater to the growing demand of the younger population. But dumping of Chinese bicycles has become a threat for local manufacturers.

Meghna has built up a strong backward linkage industry for making finished bicycles for the local market. But indiscriminate duty structure has made the situation very difficult for local makers, they said.

“We need protection to survive,” said Bari of Meghna.

Some unscrupulous businessmen import bicycles from China in the name of parts to avoid taxes.

Kamal said they have to import a few items, such as brakes, to make finished bicycles, but the average duty on this item is a whopping 55 percent that pushes up the cost.

The price of Pran's bicycles is somewhere between Tk 3,000 and Tk 70,000 a piece.

Sajjadur Rahman is Business Editor at The Daily Star.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments