It's all about institutions

Anyone who visits Dhaka for the first time may be excused for thinking that Bangladesh is a rich country with millions of automobiles. After experiencing the never-ending traffic jam, the visitor will start to believe, falsely, that everyone in Dhaka has a car. But if you look closely, you will realise that it is primarily an institutional problem. Given the population size, the number of pending legal litigations, (almost three million) in the courts, is one of the highest in the world, fuelling injustice and delaying investment—two things that hamper growth. This is an institutional problem.

Private universities are mushrooming everywhere while our higher education quality is one of the worst in South Asia. This is also an institutional problem. How can a nation improve labour productivity, technology, and knowledge to accelerate growth when educational institutions have poor quality control? When a resource-hungry nation's bureaucracy cannot even use funds already allocated for infrastructure projects, nothing else can be blamed for this incapacity other than institutional deficiency.

Institutions are defined not only as organisations or agencies; they refer to rules, regulations, cultures, customs, tradition, and social norms as well. Institutional economics—a recent field of economic study—examines the role of institutions in spurring growth and development. Institutional economists like William Nordhaus, Douglass North, Daron Acemoglu, and James Robinson emphasise upon institutions to explain the roots of poverty or prosperity.

While economists acknowledge the importance of institutions, the main debate pivots on the question of primacy: Which comes first, development or institutions? The common idea—also prevalent among Bangladeshi economists and politicians—is that first we need development and only then can we think of fixing or building institutions. And that mentality is extremely wrong, causing delays in addressing the institutional impropriety we face every day in the country.

This belief that “first we will be rich and then we will fix institutions” seems to have an element of truth, but that is a wrong way of development. No nation that follows this path can have quality growth. Africa, where this misleading concept of institutional detour is widespread, could not achieve sustainable growth. That is why Zimbabwe experienced more than 10,000 percent inflation because its past President Robert Mugabe didn't fix the central bank in the first place. And now it is beyond repair.

When politicians simply sell growth numbers as a signature of success, the intrinsic quality of growth comes into question—something economists are getting increasingly concerned about. Person A may gain weight by exercise and muscle-building. Person B may gain even more weight by eating fast food and thus generating fat. The quality of Person A's growth is better than B's although A's additional weight may be less than B's. A's growth is more sustainable, more invigorated, more energetic, and more fortified than B's. A similar concept is applicable to the Empowered Growth Index (EGI) that convinces developing nations to address long-term capacity building by improving their institutions and doing justice to human capital along with the environment.

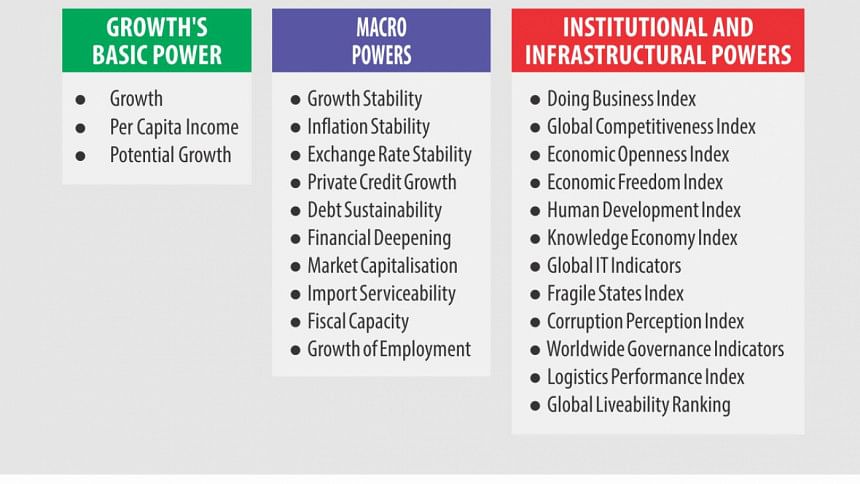

In the early 2010s, the IMF developed a concept of quality growth that includes the state of education and health along with the growth numbers. Empowered growth has a bigger umbrella which includes education, health, human development, traffic congestion, infrastructure, political stability, openness, governance, and other major institutional indicators.

Also, macro-stability indicators such as steady growth, moderate inflation, stable exchange rates, sustainable debt, employment growth, and growing fiscal capacity are what empowered growth comprises as shown in Figure 1. It is hard to quantify institutional aspects of a country, but some indices have already been developed by different global organisations and they can be used to measure the Empowered Growth Index as can be seen in Figure 1.

At the beginning of the 20th century, Argentina looked like it could graduate to being a developed country soon through industrialisation. But it didn't happen because institutions were not ready. Major institutions like the central bank or the line ministries were highly politicised and they couldn't build ample infrastructure and failed to control inflation resulting in eroded growth and shattering Argentina's dream of becoming a developed country.

In fact, inflation torpedoed Latin America in its entirety since its central banks didn't have the guts to control money supply by displeasing the regimes. Inflation is like a fire in the neighbourhood. If the house next to yours catches fire, your response becomes mandatory. If Brazil, for example, pumps more money into circulation, Argentina has to follow suit to keep the bilateral exchange rate largely in line with its neighbour to maintain export competitiveness.

Europe and North America are the two lucky continents where institutional development took place almost simultaneously. And that is why we see similarities in the development of countries in Europe or North America. Nowadays, East Asian countries are gradually converging when it comes to the measure of lifestyle and prosperity, mainly because their institutions are becoming similar. Japan was instrumental to building South Korean institutions in the middle of the last century and that was the main recipe for making Korea as it is today.

China's transformation towards market economy and liberalisation has been one of the fastest since the late 1970s. The Chinese regime, though communist by political identity, realised that the country would never be able to reap the advantages of globalisation without opening the door and seizing the benefits of capitalism from the western world.

In China, capital formation became a worry because labour was abundant in the world's most populous country. The regime realised that mainly labour-driven growth would not be enough, that institutional changes are warranted to build capital, and that private investors must be engaged in capital formation to transform China into a manufacturing paradise of the world. The stock market model, which China once hated, later became a boon to them.

The visionary leadership of Deng Xiaoping made it happen. He visited Wall Street in New York and spoke in favour of replicating the model in China. Many opposed, but Deng's resolute stance won the battle. Now, China's capital markets are among the giants of the globe. A stock trader whom I met in Beijing vowed to beat Wall Street one day. The change in institutions in the first place has given China a ground speed for empowered growth.

In India, the institution of “License Raj” that required seeking licenses and permits from the bureaucracy crippled the economy. The nation scooped up only around three percent growth on average for three decades since the country was locked in the tentacles of the License Raj in the mid-1950s. The government realised that existing institutions have done more harm than good. The 40-year-old License Raj system was dismantled in weeks in the early 1990s, and India embarked upon massive reforms of liberalisation to accelerate growth. New institutions empowered India's growth which ultimately reached as high as seven to eight percent on average. The country transformed into a global giant within two decades of the major institutional change.

Koreans in both the north and the south share the same culture and values. But differences in institutions made their fortunes starkly different. South Korea's success vindicates that governments are primarily responsible for building institutions in their respective countries. When Turkey was turning into a fundamentalist country—and even many Indians at that time launched movements to restore caliphates in Turkey—Kemal Ataturk emerged as the saviour and turned the nation's path towards modern institutions that now define how Turkey is different from Syria, Iraq or Iran.

Good institutions are the precondition for better living conditions and lifestyle. This entails a vibrant parliament that debates national interests, an efficient judiciary along with a smart law enforcement body, a quality education system, a fair and competitive public recruitment authority, a strong anti-corruption commission, an independent central bank, a rules-complying transport sector, and a brave media. It is all about institutions that can foster good quality growth that is empowered. Growth that isn't inclusive isn't strong or sustainable.

Good institutions inspire people to be engaged in nation-building and this attitude makes growth inclusive—since it does not only involve the few super rich but also people who were previously left behind. In Singapore, I met a few Bangladeshi businessmen who once dared to open up a shop in their vicinity, and they now start businesses swimmingly because institutions are streamlined making them business-friendly. Singapore became independent only six years before us, but we now risk lagging behind them by 60 years if our institutions are not fixed. The adage that goes “Honesty is the best policy” is what we should follow in the beginning years of our life, not after we become bank defaulters.

In the year of independence in 1965, the Singaporean leader Lee Kuan Yew promised to build institutions and make the most modern rules so growth becomes naturally empowered. Singapore ranked second in the Doing Business Index 2018—a measure that reflects how advanced the country's institutions are—whereas Bangladesh ranked 177th out of a total of 190 countries. The list of the top 20 business-friendly nations, where a good number of Bangladeshis have migrated, include countries like New Zealand, Singapore, Denmark, Korea, Hong Kong, US, UK, Norway, Sweden, Australia, Taiwan, Canada and Germany. Law and order and good institutions in these countries enabled Bangladeshi migrants to excel in education and business in a free and fair manner—something that they couldn't do in their homeland without resorting to corruption or political lobbying.

For instance, why do we see Bangladeshi drivers to be so disciplined overseas whereas their behaviour is quite the opposite when they drive in Dhaka? Because of differences in institutions. The failure to understand the fundamental gaps of institutions makes us think in a certain way. For example, hundreds of people are killed on the road every year by bus or truck drivers—most of who have no formal training or licenses—and we label these manmade losses of lives as “accidents” or an “act of God.” When lawbreakers gradually become the majority, politicians convince people to accept bad rules as the norm of institutions, because expanding the vote bank becomes the number one goal even if that means destroying long-term welfare.

So how do we get rid of this vicious cycle of short-term gains? The government no doubt has some tough decisions to make. If the government is sincerely committed to enforcing the law, people will comply with it sooner. A change in voter IDs, for example, has transformed our attitude entirely. We are now accustomed to using the ID whenever we sign a contract. Removing street hawkers and vendors is politically expensive in the short run, but we can't expect prospective entrepreneurs to buy or rent shops in commercial buildings as long as more profit can be earned by staying on the streets.

And herein the question of empowered growth arises. Letting economic agents maximise profits in a damaging way will raise a country's economic growth temporarily by making growth qualitatively poor. Only empowered growth can make Bangladesh's dream of becoming a developed nation by the middle of the century come true.

Biru Paksha Paul is associate professor of economics at SUNY Cortland. He is the author of the forthcoming book Empowering Economic Growth for Bangladesh: Institutions, Macro Policies, and Investment Strategies (UPL). Email: [email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments