Women making their mark

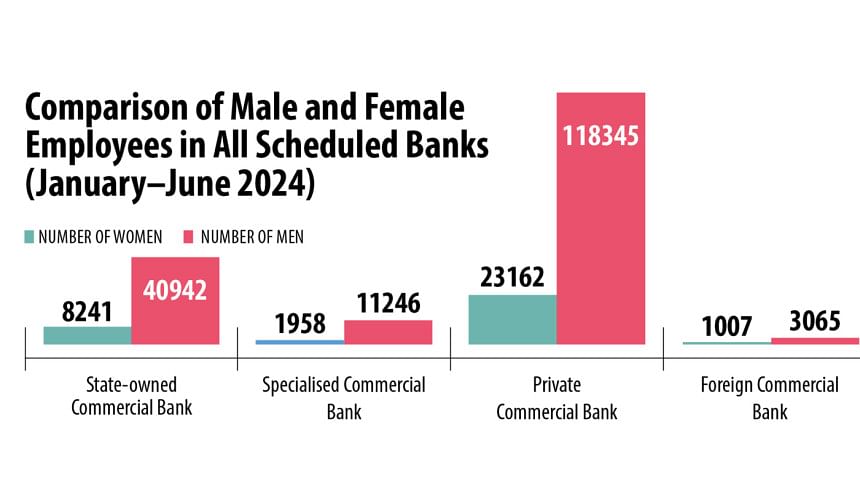

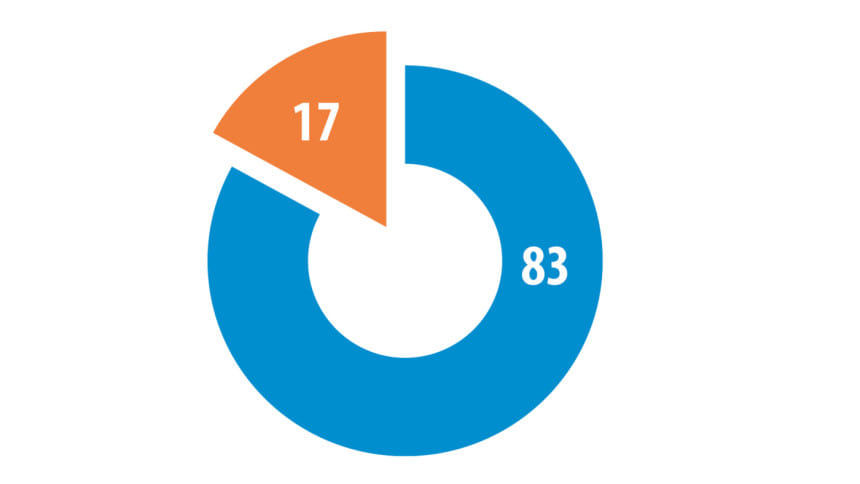

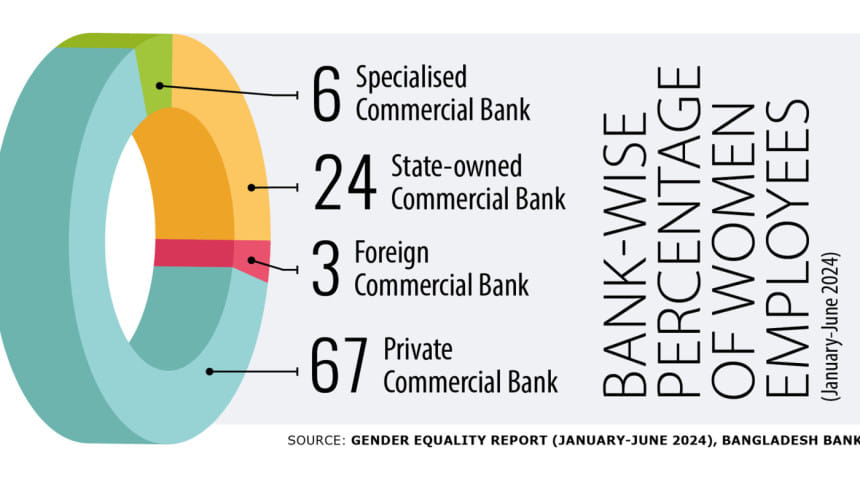

The gender gap in the banking sector has been a persistent challenge, but encouraging developments indicate a shift towards greater inclusivity. Women currently make up 16.53% of the banking workforce in Bangladesh, with a noticeable presence at entry and mid-level positions. However, their representation at leadership levels remains low. Despite this, banks are actively working to address these disparities and create a more gender-balanced industry.

A significant factor driving this change is the banking sector's commitment to gender-friendly policies. According to Bangladesh Bank's Gender Equality report (Jan–June 2024), most banks now offer maternity leave, sexual harassment prevention policies, and gender equality training. Additionally, over 65% of banks have daycare centers, and 85% provide transport facilities for female employees, ensuring a more supportive work environment.

The importance of increasing women's participation in banking extends beyond workforce inclusivity. Bank insiders emphasize that a higher representation of female staff can enhance financial inclusion, especially for women in rural and remote areas who feel more comfortable seeking assistance from female bankers.

"Women's presence at the entry level has increased, but their participation in decision-making roles remains minimal," notes Lila Rashid, former Executive Director of Bangladesh Bank. While women make up 17.19% of early-career positions, their numbers decline significantly at senior levels, with just 9.38% representation. Encouragingly, foreign banks have set a benchmark, employing 27.73% women, the highest proportion among all banking categories.

One major concern is the disconnect between university-level gender ratios and recruitment patterns in banking. Despite an almost equal male-to-female ratio in higher education, women constitute only 22% of annual entry-level hires in banks. Factors such as unconscious biases in recruitment and limited postgraduate representation contribute to this disparity.

Fahria Haque, Head of Women Banking at City Bank, highlights this challenge: "Unconscious biases often limit women's entry into demanding roles. Many recruiters still question their ability to handle high-pressure positions."

Family responsibilities and organizational limitations also play a role in restricting women's career progression. Nighat Mumtaz, Senior Vice President and Head of Sustainable Banking at NCC Bank, explains, "Women are often perceived as unable to handle business-related roles requiring frequent travel. Additionally, a lack of family support forces many women to leave their jobs." She also points out the need for daycare facilities beyond head offices to support working mothers.

To foster lasting change, banking leaders emphasize the need for proactive gender-inclusive policies. Lila Rashid suggests that banks must address why women stagnate in their careers and ensure policies supporting women's professional growth are actively implemented. Increasing female representation in decision-making roles will not only strengthen gender balance but also contribute to a more inclusive financial sector.

As the industry progresses, these steps indicate a promising future where women in banking can rise to leadership positions, breaking long-standing barriers and contributing significantly to the financial landscape of Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments